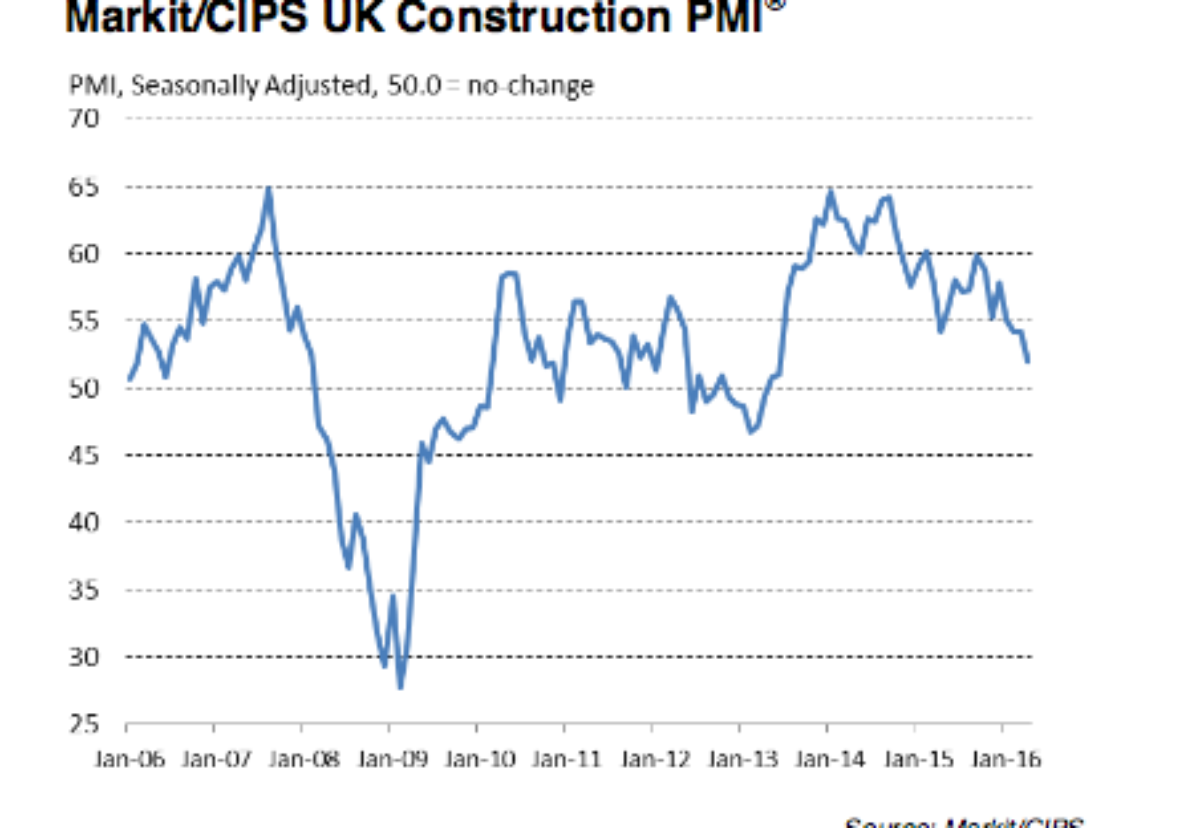

The latest Markit/CIPS UK Construction PMI index reading fell to 52 in April from 54.2 the previous month.

The index has been reading above the critical 50 mark – showing growth – for three years but April’s figure showed the slowest rise since mid 2013.

Construction companies cited a number of factors weighing on client spending, including uncertainty about the economic outlook and a general unwillingness to commit to new projects.

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, said:“Although UK construction grew marginally in April, clouds of uncertainty are hovering overhead, depressing the industry’s outlook.

“Business activity expanded at its weakest pace since June 2013, clearly pointing to a loss of momentum in the sector.

“Fears over weaker UK and global economic growth dealt a blow to confidence in the construction sector, leading to delays in new spending commitments.

“The prospect of the EU referendum and its outcome in June are likely to add to uncertainty too, with many construction firms preferring to wait and see what happens before making any decisions.

“Construction companies adopted a more cautious approach to purchasing and hiring, leading to a rise in subcontractor usage to tide them over until the outlook becomes clearer.

“The slowdown in new order growth in April suggests that though spring may be in the air, sunnier times may still be a way off for the construction sector, at least for the time being.”

Mike Chappell, Global Corporates managing director for construction at Lloyds Bank Commercial Banking, said: “Despite a backdrop of uncertainty in the wider UK trading environment, construction remains relatively stable compared to previous years, despite the drop in this data.

“The past couple of months have seen a number of the sector’s major commercial players report robust results with an upbeat outlook as the sector continues to make progress in improving margins and ensuring order books consist of sustainable work, with troublesome legacy contracts being worked through.

“Meanwhile, with the UK this week ranked among the top 10 countries in which to invest in infrastructure – aided by the current roll-call of major schemes in the pipeline – the industry should carry on performing well.

“The note of caution comes from remembering that construction’s fortunes are tied inexorably to that of the wider UK economy, though the hope is that more certainty in the second half of the year provides a boost to output levels.”

Kalpana Padhiar, construction specialist at global credit insurer Euler Hermes, said: “The new figures are likely to be a direct result of the uncertainty surrounding June’s referendum, which is having a similar impact on activity across the sector to what we saw in last year’s pre-election lull.

“The Construction Products Association has already downgraded the industry growth forecast for the third time in the last six months, and with UK and international investors holding off any decisions on new projects until July at the earliest, significant improvement in the short-term is unlikely.

“Firms should look to manage their credit books carefully.”

.png)

.gif)

MPU 300_250px.gif)