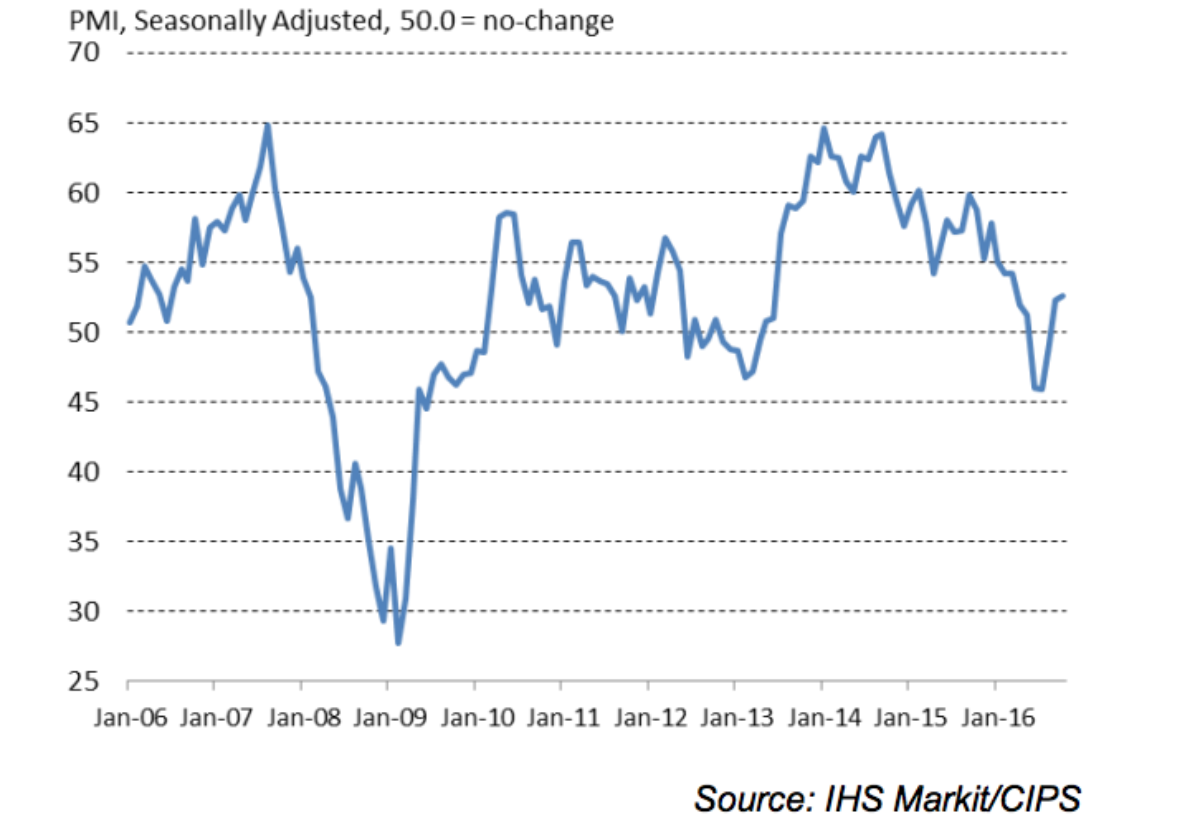

The bellweather Markit/CIPS UK Construction Purchasing Managers’ Index registered 52.6 in August, marginally down from 53.2 in September but still reflecting positive sentiment.

New order volumes also picked up across the construction sector, but the rate of growth eased since September and remained weaker than seen prior to this summer.

This contributed to a drop in business confidence regarding the year-ahead growth outlook. At the same time, input costs rose at one of the fastest rates seen over the past five years, which survey respondents widely linked to the weaker pound.

Tim Moore, senior economist at IHS Markit and author of the Markit/CIPS Construction PMI® , said: “The UK construction sector has started the fourth quarter in a positive fashion, with the latest survey data revealing a moderate rebound from the downturn seen during the summer.

“Construction growth was dependent on a solid recovery in residential work, as civil engineering and commercial building struggled for momentum in October.

“While business activity has picked up since the third quarter, the recent phase of new order growth has been the weakest for three-and-a-half years.

“Survey respondents noted that Brexit-related uncertainty and concerns about the UK economic outlook had held back investment spending.”

He added that the subdued new order intakes had contributed to a fall in construction sector business confidence.

“At the same time, a sharp pace of input price inflation added to construction firms’ anxieties about the year-ahead business outlook, with higher costs overwhelmingly linked to supplier price hikes in response to the weak pound,” said Moore.

David Noble, group chief executive officer at the Chartered Institute of Procurement & Supply, said: “A rise in input prices due to the weak pound resulted in the second-fastest increase in cost pressures since mid-2011.

“Respondents reported a squeeze on margins, while increased marketing and new projects helped counteract the continuing uncertainty surrounding the Brexit aftermath.

“Coupled with concerns around the longer-term performance of the UK economy, this dampened overall business optimism.”

.gif)