The firm is also putting aside £10m for potential safety fines following new tougher sentencing guidelines.

Closure of the overseas operations is costing £79m while the hits have been offset by income from the sale of Mouchel Consulting last October which raised £39m.

It is the latest phase of Kier’s “portfolio simplification programme” which started after the acquisition of Mouchel.

Kier said: “Since the acquisition of Mouchel in June 2015, the Group has undertaken a programme of portfolio simplification allowing it to focus on, and grow, its market leading positions in regional building, infrastructure services and housing.

“This portfolio simplification programme is nearing conclusion and, taking into account the other non-underlying items, will generate cash for the Group to enable it to focus on the future growth of its core operations”

Kier said full-year underlying profit was forecast to be in-line with expectations with construction expected to deliver a 2% margin following a strong regional building performance.

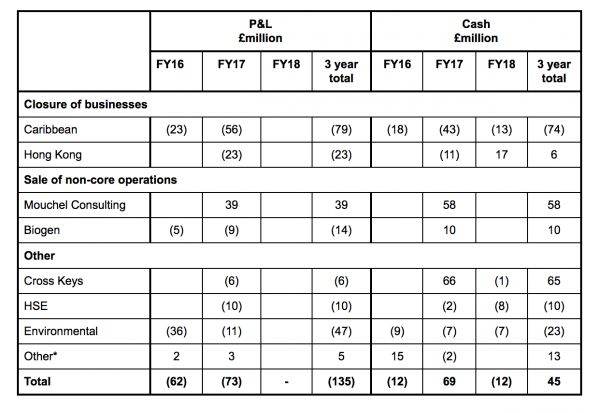

Financial effects of portfolio simplification programme and non-underlying items:

The table below shows the total financial effect of the portfolio simplification programme and other non-underlying items since 30 June 2015.

(300 x 250 px).jpg)

.gif)