The government is to press ahead with new plans to tackle phoenixing of firms in an attempt to safeguard workers, pensions and small suppliers.

Under the shake-up, bosses will face investigation if they try to escape paying a dissolved company’s debts to their own staff and creditors.

Business Minister Kelly Tolhurst said that while the vast majority of UK companies were run responsibly, there were a minority of directors who deliberately dodge debts by dissolving companies then starting up a near identical business with a new name.

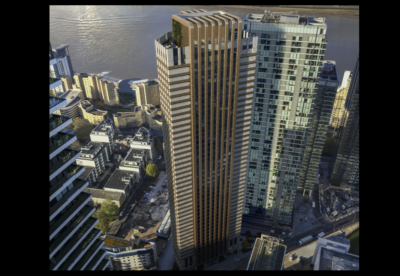

Construction is one of the UK industries that suffers the most from phoenixing.

When the new powers are passed, the Insolvency Service will be able to fine directors or even have them disqualified for cheating trade contractors and suppliers.

The government is also planning fresh measures, similar to the US’s Chapter 11 Bankruptcy Code, to give financially-viable companies more time to rescue their business.

Distressed firms will get ‘breathing space’ to allow more time to restructure or seek new investment. This will enable companies in financial distress to continue trading through the restructuring process, ensuring that small suppliers and workers still get paid.

Struggling firms will be supported through a rescue process with new rules to prevent suppliers terminating contracts solely because the company is entering an insolvency process.

As part of a raft of planned measures The Investment Association will also be asked to investigate to see if action is needed to ensure that bigger companies are giving their shareholders an annual vote on paying out big dividends to directors.

Tolhurst said: “The UK is a great place to do business with some of the highest standards of corporate governance. While the vast majority of UK companies are run responsibly, some recent large-scale business failures have shown that a minority of directors are recklessly profiting from dissolved companies. This can’t continue.

“That is why we are upgrading our corporate governance to give new powers to authorities to investigate and hold responsible directors who attempt to shy away from their responsibilities, help protect workers and small suppliers and ensure the UK remains a great place to work, invest and do business.”

.gif)

MPU 300_250px.gif)