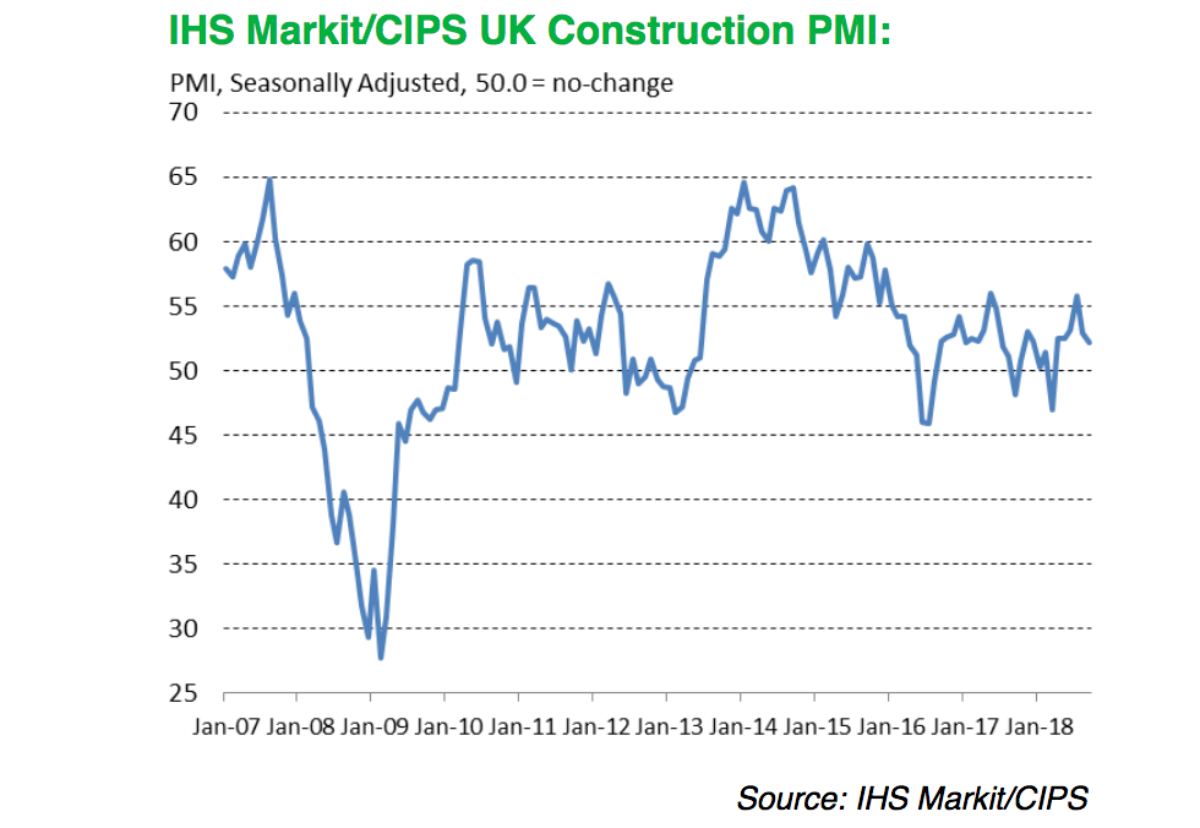

The bellwether Markit/CIPS UK Construction Purchasing Managers’ Index fell to 52.1 in September from 52.9 in August.

Civil engineering suffered an accelerating decline in workloads while house building and commercial construction increased at a solid pace.

New business volumes hit their highest levels of growth since December 2016.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “Despite the biggest rise in new orders since December 2016, the sector remained in a downbeat mood with business optimism at its second lowest level since the beginning of 2013.

“A cause of this malaise pointed to increased cost burdens with both fuel prices on the rise, and acute shortages in raw materials, as supplier delivery times have lengthened to an extent not seen since 2015.

“The Brexit blot on the landscape was still in evidence as housing activity slowed to a pre-April growth rate and clients hesitated to place orders.

“Civil engineering was hit the hardest however and under 50 for the second month in a row, which points towards another contraction”

Max Jones, Global Corporates relationship director for infrastructure and construction at Lloyds Bank Commercial Banking, said: “Events earlier this year have focused minds on bidding discipline and this continues to be the watchword, with evidence that the top-tier contractors are holding prices rather than lowballing.

“The commercial sub-sector is facing myriad headwinds, with the London market still heavily exposed to Brexit uncertainty and retail suffering an annus horribilis.

“Against this background, many contractors are betting big on infrastructure, yet there is only so much work to go round. And with some questioning the merit of the current pipeline of megaprojects, it underlines that there is no risk-free part of the market in which to be invested.”

.gif)