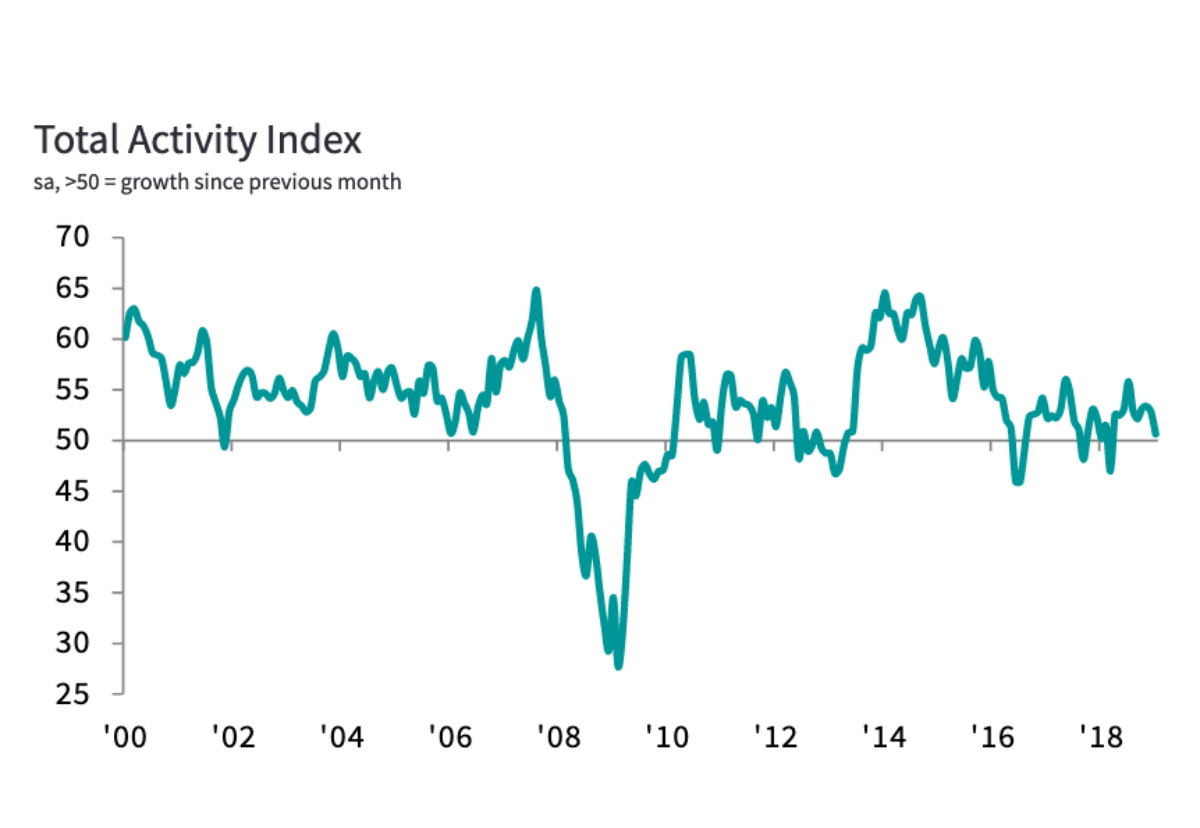

The latest IHS Markit/CIPS UK Construction Total Activity Index dropped to 50.6 in January, from 52.8 in December.

Residential work was the strongest performing area, although the latest expansion was only modest and the slowest seen since March 2018.

Civil engineering activity increased marginally, with the rate of growth much softer than December’s 19-month high.

Commercial work was the weakest performing area of construction output in January as data indicated a decline in work on commercial construction projects for the first time in ten months.

Anecdotal evidence suggested that Brexit-related anxiety and associated concerns about the domestic economic outlook continued to weigh on client demand.

Construction firms still remain positive about the outlook for this year with 41% expecting a rise in output while only 16% forecast a fall.

Large-scale civil engineering projects were cited as a key source of optimism, while and Brexit uncertainty was the most commonly cited concern.

Tim Moore, Economics Associate Director at IHS Markit, which compiles the survey said: “UK construction growth shifted down a gear at the start of 2019, with weaker conditions signalled across all three main categories of activity.

“Commercial work declined for the first time in ten months as concerns about the domestic economic outlook continued to hold back activity.

“The latest survey also revealed a loss of momentum for house building and civil engineering, although these areas of the construction sector at least remained on a modest growth path.

“Staff recruitment slowed to a crawl in January, with construction firms reporting the softest rate of job creation since July 2016.

“Delays to client decision-making on new projects in response to Brexit uncertainty was cited as a key source of anxiety at the start of 2019.

“Difficulties converting opportunities to sales were reflected in a slowdown in total new business growth to its lowest since last May.

“Business expectations for the year ahead slipped to a three-month low and remained subdued in comparison to historic trends in January.

“Positive sentiment towards the outlook for civil engineering work remains a key factor helping to support business sentiment across the construction sector, according to survey respondents.”

.gif)