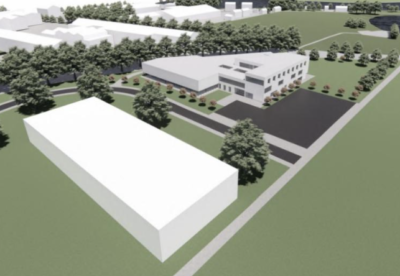

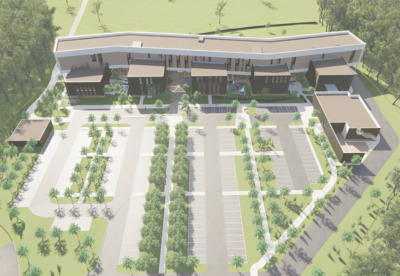

The 3.4 acre site currently comprises a mixture of office and industrial uses including the historic Rembrandt House, a four storey Edwardian building.

The consented redevelopment will include the refurbishment and asset management of office space at Rembrandt House and the demolition of the remaining office and industrial buildings on the site to provide 107 new houses and apartments to be developed in partnership with a house builder.

Development Securities acquired the investment property in January 2011 for just over £4m at an initial yield of 8.3%.

Matthew Weiner, Executive Director, Development Securities, said: “This latest planning consent follows on from the recent positive announcements with respect to planning at the Wick Site in Littlehampton, Shepherd’s Bush Market in London W12 and The Old Vinyl Factory in Hayes.

“These recent planning gains are evidence of early progress being made in our strategy to invest the equity we raised in 2009 and 2010 in selected secondary assets which through repositioning and redevelopment can be delivered into the prime or near prime market.

“On average we are targeting a 3 to 3.5 year turnaround of assets and to this end, it is pleasing to note that Rembrandt House is advancing on schedule.”

.gif)