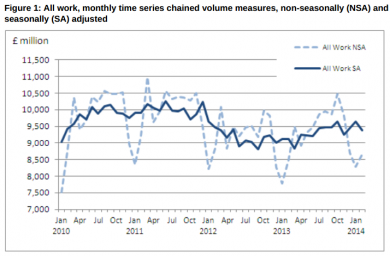

Latest output figures for February suggested the seasonally adjusted volume of work fell 2.8% compared to January.

The slide was driven by both new work, falling 2.6%, and repair & maintenance, falling 3.1%, in the month.

But February’s output compared to the same month last year was up 2.8%.

The more reliable longer term data shows a slightly improved picture emphasising the volatility in the short term estimates.

The three-monthly (December to February) estimate of construction output is that all work grew 0.3% when compared with the previous three months, due to a 1% increase in new work.

Compared to a year ago, output is 4.5% higher, with new work up 4.9%.

Unsurprisingly the big winners were house building, up almost 22%, and housing maintenance, up 7%.

A big concern is that infrastructure took a dive of 3.1% in the past three months compared to a year ago. While private commercial remains largely flat.

Simon Rawlinson, Head of Strategic Research and Insight, EC Harris, “Poor weather in January and February is likely to have been a significant contributor to the fall and output is likely to rebound in March – particularly in house building ahead of the Spring Sales season.

“One watch out is infrastructure, where output was lower than a year ago – possibly indicating that efforts to smooth workload during the transition between control periods in the water, gas and electricity industries may not have been as successful as intended.”

.gif)