Laing like Balfour had grown to dominate the market and looked bullet proof as a business.

But what started as a trickle of bad news ended in Laing being sold to O’Rourke only 18 months later.

Laing battled with similar problems of controlling a large conglomerate while instituting sweeping management changes.

But those fixes came too late to avert hefty profit warnings and gushing losses on a handful of jobs.

The parallels with Balfour to this point are striking.

Fourteen years ago the Laing family, cornered by mountainous losses, was left with no alternative but to sell the construction division for just a £1.

Balfour maybe a much bigger player – but the same alarm bells are ringing again.

The decision to call in KPMG to independently assess contracts and work in progress looks like a desperate measure by a board which has lost faith in its own internal financial controls.

Claims that the swelling number of problem contracts stem from legacy jobs that will be fully resolved by the end of the year are falling on deaf ears.

Contract settlements can only get harder to negotiate as Balfour’s woes pile up and its bargaining power diminishes.

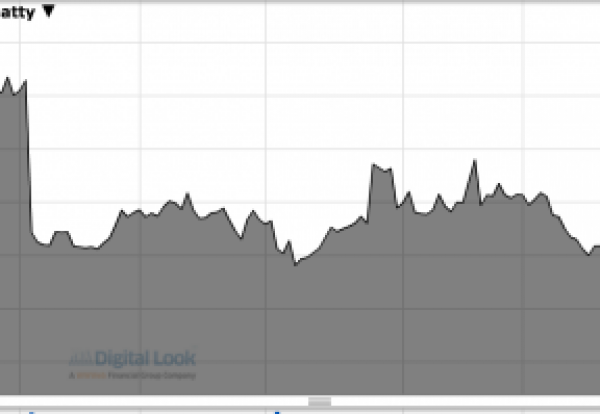

After a fifth profit warning, it is not surprising that city investors have lost patience.

What is unnerving for Balfour and its 40,000 staff is that analysts, fearing the worst, are talking about writing the value of the firm down to zero.

Does anybody actually know where Balfour Beatty stands financially at this moment in time? The answer is a resounding no.

With KPMG going over the books in forensic detail and a new chief executive seeking to clear the decks when they join – it is almost certain that further problems will be uncovered.

Balfour Beatty is standing at a crossroads.

The sale of Parsons Brinckerhoff has bought some time and will help to stem growing net debt.

But Balfour appears too far down the Laing road to simply return to running the group as a UK and US focused construction business.

Carillion is still said to be waiting in the wings, but will need Balfour to approach them this time around.

The alternative is unthinkable for the industry and Balfour’s loyal legions of staff.

(300 x 250 px) (2).png)