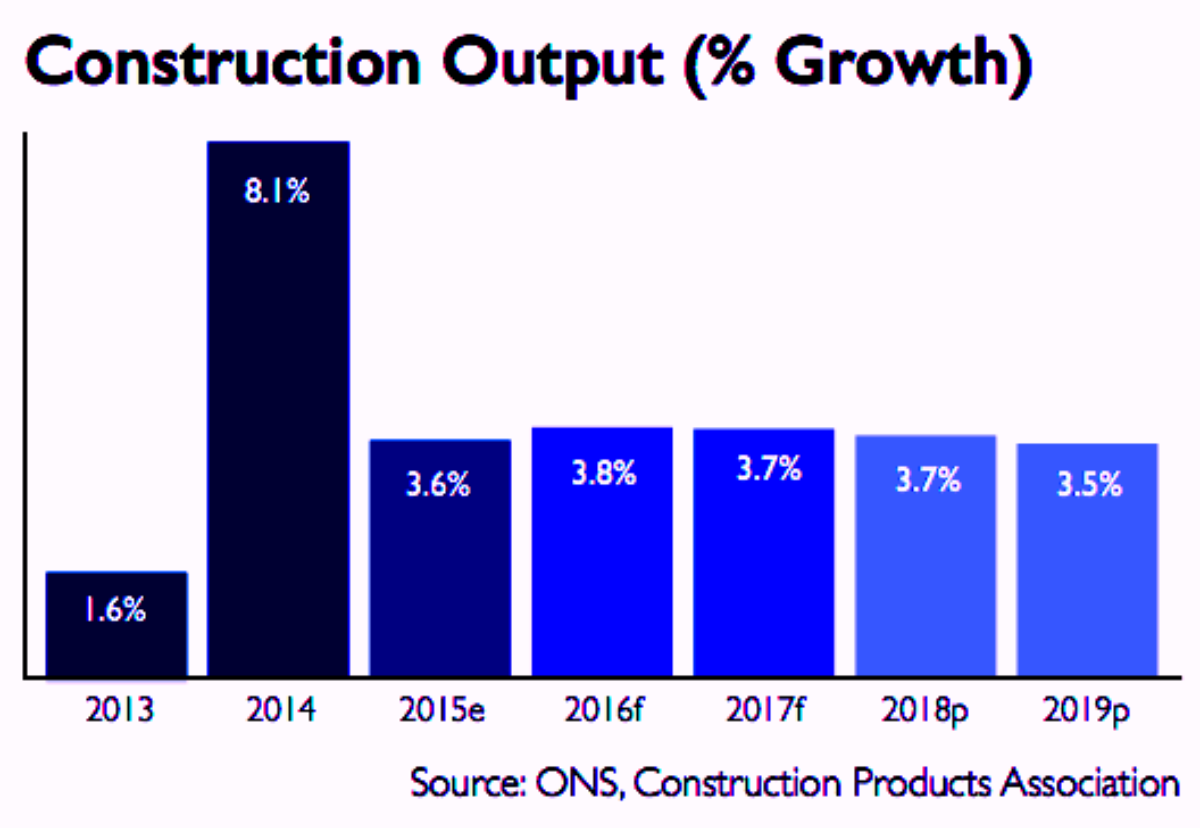

Even with a weaker growth forecast, contractors can still count a near 20% rise in construction from 2015 to 2019. This will be driven by growth in the three largest construction sectors; private housing, commercial and infrastructure.

According to the Construction Products Association industry output is now expected to grow 3.6% in 2015, down from the expected 4.9% spurt forecast back in the summer.

Next year the industry’s growth rate is expected to be slightly ahead of 2015 at 3.8%, down from the 4.2% first forecast.

Forecast highlights

- Construction output: up 3.6% in 2015 and 3.8% in 2016

- Private housing starts: up 7% this year and 5% in 2016

- Public housing starts: down 10% in 2015 and 5% in 2016

- Offices construction: up 8% in 2015 and 7% in 2016

- Infrastructure output: up 13.2% in 2015 and 7.6% in 2016

- Key risks include skills shortages and government austerity

Dr Noble Francis, economics director, said: “We remain positive about prospects for the construction industry. The slowdown in Q3 activity is expected to be temporary.

“The commercial sector is forecast to enjoy growth from 2016 averaging 3.9% per year through to 2019. New offices construction is expected to be the primary driver, with increasing activity in cities such as Birmingham and Manchester as well as growth in the capital.

“Retail construction is expected to improve but a consolidation of expansion plans by major supermarket chains will constrain growth rates.

“Infrastructure activity continues to thrive. Output in the sector is forecast to grow 11.2% on average per year between 2015 and 2019, supported in large part by the £411bn National Infrastructure Plan.

He said that the roads and energy sub-sectors would be strongest but work is forecast to increase throughout the forecast period in all key sub-sectors; roads, energy, rail, water and sewerage.

“Private housing starts are forecast to rise, with major house builders signalling their intention to build more homes over the next 12-18 months,” said Dr Francis.

“Help to Buy accounts for one quarter of new build purchases and will help to sustain demand. House prices continue to increase in most regions, especially in London and the South East, illustrating a strong underlying demand.

“Public housing, however, is expected to be adversely affected by uncertainty and a lack of funding due to the extension of Right to Buy to housing associations and cuts to social rent. As a result, public housing starts are estimated to fall 10.0% in 2015 and a further 5.0% in 2016.”

But Dr Francis warned: “While growth prospects in construction remain positive, there are significant risks. Government austerity focuses on current spending rather than capital investment but the risk remains that if government cannot reduce current spending as much as it anticipates, it may cut public construction projects to achieve its aims of eliminating the public sector deficit.

“In addition, within the construction industry, the key concerns regard skills shortages, which have already been reported in the housing sector but may become more prevalent across the wider industry over the next 12-18 months due to the forecast growth.”

.gif)