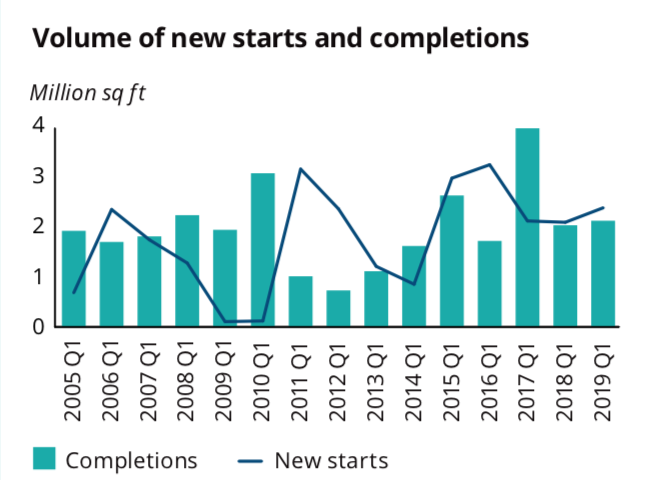

According to the latest Deloitte crane survey the office sector is remaining resilient despite Brexit uncertainty with 3.5m sq ft started over the period, 38% up on the previous survey last autumn.

Overall new build figures were significantly boosted by four new starts at King’s Cross – including Facebook’s new HQ – representing nearly 1m sq ft of all new starts.

The biggest sector of the London market, the Square Mile, has started to see a pronounced shift towards large-scale office refurbishment. Over this period developers began work on eight refurbishments, which will deliver 800,000 sq ft of Grade A space.

The survey also highlighted some concern that the longer term forecast office pipeline of 30m sq ft, is nearly a quarter down over the last two years.

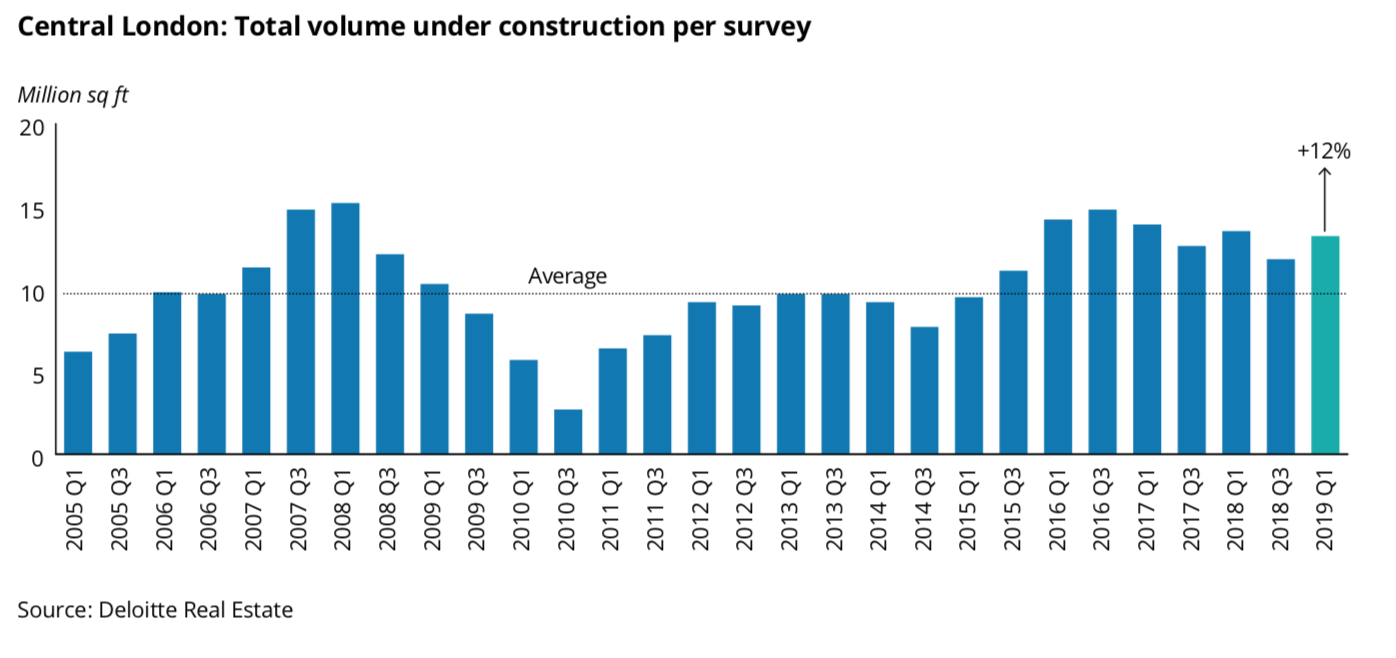

The latest biannual survey recorded 13.2m sq ft of office space now under construction – a 12% increase on the previous survey.

Mike Cracknell, director at Deloitte Real Estate, said: “London’s office market remains resilient in the face of uncertainty as we witness an encouraging increase in new construction starts. This is testament to developers’ continued confidence in London’s office leasing market long-term.”

He added that the uptick in construction activity in the run-up to the originally scheduled EU departure date of March 2019 was remarkable, given the magnitude of political and economic uncertainty.

He said that it demonstrated that developers had not delayed their construction plans and had confidence in the London leasing market over the long term.

The City of London continued to dominate construction activity with 6.7m sq ft across 33 schemes representing half of total volume under construction across the capital.

Among the top concerns for landlords and developers, Brexit uncertainty was cited by around a quarter. But longer term issues of ‘lack of development sites’ (32%) and ‘construction costs’ (32%), were the top two challenges for landlords.

Among key package contractors, most firms expected to see a little increase in work over the next 12 months, although the strength of positive sentiment has waned with the exception of external works firms.

The results around price sentiment in the Q1 2019 survey suggest an average 3% rise in prices over the next 12 months – similar to the figure reported in the Q3 2018 survey.

.gif)