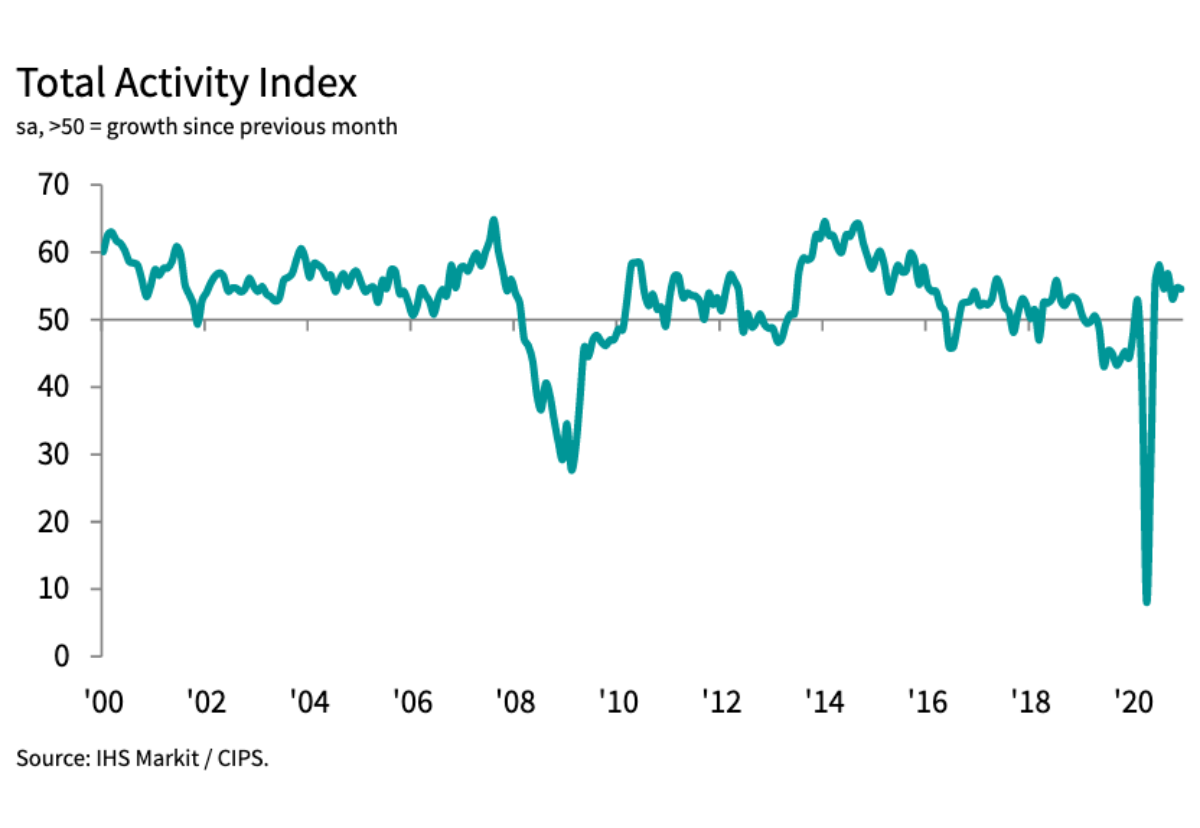

House building led the way as the bellwether IHS Markit/CIPS UK Construction Total Activity Index posted 54.6 in December compared to 54.7 in November.

Anything above 50 represents growth and the index rose beyond that crucial level for the seventh month in a row.

House building saw a sharp rise to hit 61.9 while commercial activity also expanded at 51.2 but the rate of growth eased to its lowest since the recovery began last June.

Civil engineering was the weakest-performing category at 48 with activity falling for the fourth time in the past five months.

New orders grew strongly in December with firms highlighting improving client demand alongside a boost from new business wins on construction projects that had been deferred at the start of the pandemic.

Exactly half of the survey panel forecast a rise in business activity over the course of 2021, while only 10% anticipate a decline, which signalled the strongest optimism across the construction sector since April 2017.

Tim Moore, Economics Director at IHS Markit, which compiles the survey said: “Construction companies are hopeful that higher demand will broaden out beyond residential projects in the next 12 months, led by infrastructure spending and a potential rebound in new commercial work from the depressed levels seen during the pandemic.

“Transport delays and a lack of stock among suppliers were the main difficulties reported by UK construction firms at the end of 2020, which contributed to the fastest rise in purchasing prices for nearly two years.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply said: “Some positive news for the construction sector in December as the uplift from summer’s close continued through to the end of 2020 and new order levels increased for the seventh successive month.

“Long-term prospects came to fruition and halted projects started again as clients became more optimistic after the covid hiatus.

“To meet this demand head-on, builders opted for job creation for the first time in 21 months to increase previously pared-back capacity.

“Further down the line, with purchasing growth close to its highest for six years, supply chains were groaning at the seams and delivery times increased to the most dramatic extent for six months.

“Low availability for finished products and raw materials as a result of port disruptions added to builders’ woes as suppliers named their price for goods in acutely short supply and input price inflation increased to its highest level since April 2019.

“Once again residential building was the strongest sector and construction companies focussed on this segment seem resilient for now.

“As the appetite for building resources grows in the first quarter of the year however, suppliers will find it difficult to ramp up production quickly to pre-pandemic levels, so we could see even longer delivery times potentially delaying some building projects as post-Brexit disruption also remains an ever-present threat.”

.gif)

.png)

MPU 300_250px.gif)