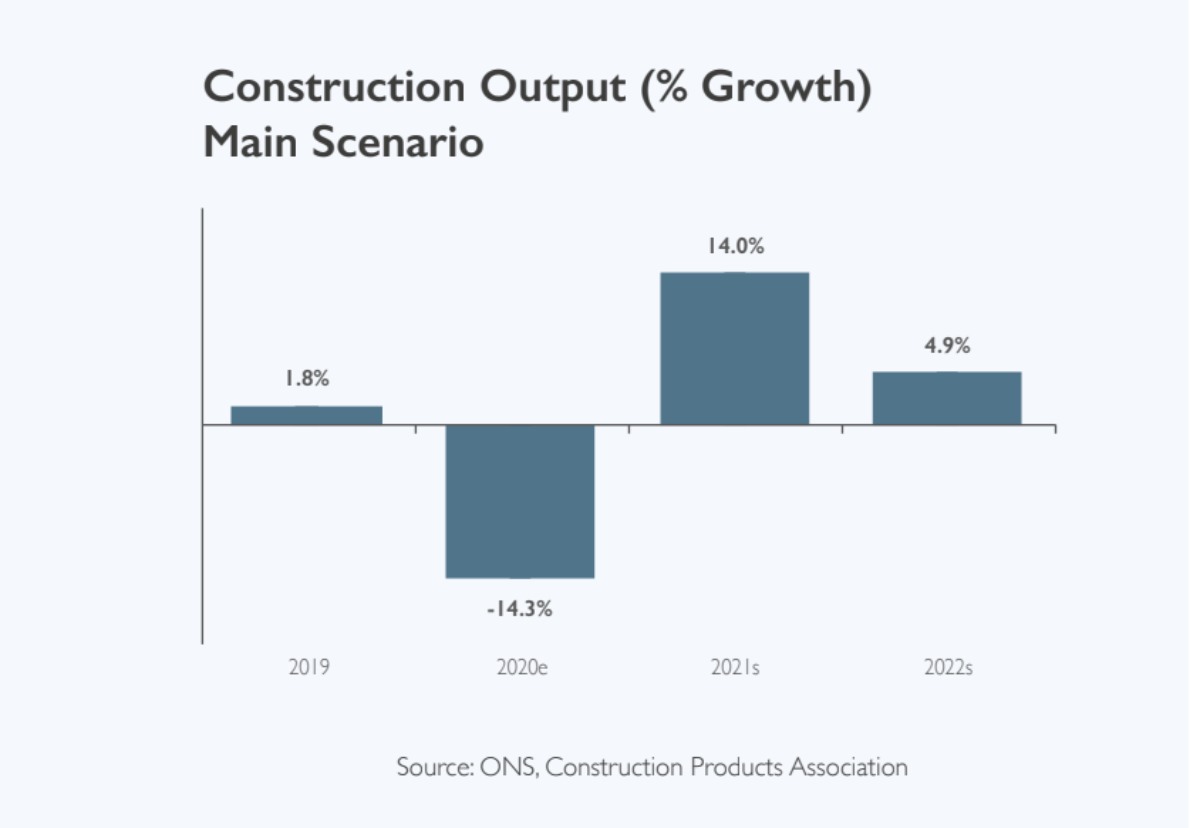

Experts at the Construction Products Association now believe the industry will see a ‘W’-shaped recession and recovery.

The CPA’s latest scenarios take into account the current lockdown and are a downgrade on last summer’s numbers when an 18% increase was predicted this year before the second covid wave hit.

The 14.0% rise in 2021 follows an estimated contraction of 14.3% overall last year caused by the sharp fall during the first lockdown.

Output is now only expected to recover to pre-Covid levels in 2022 and “there is also the risk that once the furlough and self-employment support schemes end in April, there may be a sharp rise in unemployment that could potentially dampen this recovery.”

Private housing was one of the quickest sectors to recover in 2020, with mortgage lending and property transactions above pre-Covid levels at the end of the year.

Demand for private housing is expected to moderate in 2021 after these policies end on 31 March and then subsequently pick up once again in line with the economic recovery throughout late 2021 and 2022.

CPA Economics Director, Noble Francis, said: “The long term impact of Covid-19 on the structure of the economy still remain.

“This continues to leave questions about the fortunes of certain construction sectors. This is most notable in the commercial sector, where there is still lots of uncertainty about the future of retail and office space.

“It will be crucial to observe how businesses change their operations as the vaccine is rolled out in the coming months and to what extent there is a ‘return to the office’.

“While the fortunes of some sectors have been tied to Covid restrictions and associated business and consumer confidence in the wider economy, infrastructure has largely escaped such uncertainty.

“Projects have been able to effectively enact safe operating procedures given the sector’s large construction sites that have fewer different trades mixing than in most sectors.

“As such, infrastructure has been least-affected by Covid restrictions and output is expected to lift the whole industry over 2021 and 2022.

“Main works on HS2, Europe’s largest construction project, along with offshore wind and nuclear projects are expected to be the main drivers of activity.”

.gif)

(300 x 250 px).jpg)