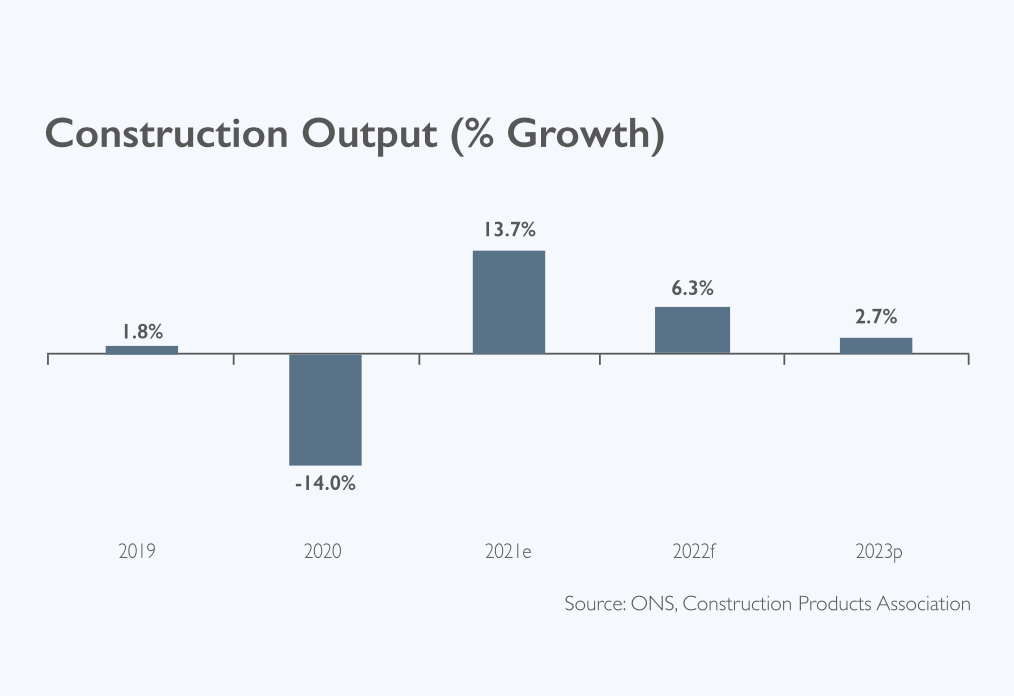

Despite worries about materials and labour shortages dampening activity, forecasters at the Construction Products Association have upgraded growth forecasts for this year and next.

Infrastructure and private housebuilding will continue to drive construction growth in 2021 and 2022, while the outlook for the commercial sector remains subdued.

Key points

- Infrastructure output to rise 23% in 2021 and 10% in 2022

- Private housing starts rise 24% in 2021 and 10% in 2022

- Commercial output at the end of 2023 still expected to be 10% lower than in 2019 despite three years of growth

- Private housing RM&I to grow by 16% in 2021 and 3% in 2022

- Public housingRM&I to rise by 14% in 2021 and 8% in 2022

As all major house builders continue to report that demand in the housing market and house price inflation continues to be robust, CPA forecasts house building starts to rise by 20.9% in 2021 and a further 9.0% in 2022.

This is despite the government’s stamp duty holiday and Help to Buy schemes continuing currently in a restricted form.

The outlook is particularly strong for houses outside major cities, owing to shifts in working patterns, and is likely to remain so for the next 6-9 months at least according to house builders.

Changes to the way people work as a result of the coronavirus pandemic have also positively impacted on private housing repair, maintenance and improvements, which has been the quickest construction sector to recover since the initial national lockdown.

Output in March 2021 was 19.3% higher than pre-Covid times, according to the Office for National Statistics, due to the ‘race for space’ – driven by demand for better quality outdoor domestic leisure space and home office work environments.

And most SME contractors are reporting projects lined up for at least the next six months.

In the commercial sector, the beginning of the year saw a rise in activity owing to fit-out work remodelling offices for staff to return in a socially distant manner.

This was also the case in retail and leisure where refurbishing, reusing and repurposing helped prepare for reopening as social distancing restrictions eased.

In addition, some larger office towers projects that had the contract signed or were started pre-Covid-19 continued in the first half of this year. Outlook for sector remains subdued, however, largely because of fewer big projects in the pipeline – particularly for new towers in London.

CPA Economics Director Noble Francis, said: “The key constraint to the CPA construction forecasts remains the cost and availability of imported products and skilled labour.

“The sharp recovery for both UK construction and also in places such as the US, has led to sharp cost increases and extended lead times for some key products such as paints and varnishes, timber, roofing materials, copper and steel.

“This is of concern particularly for SMEs, which account for 86% of construction employment.

“Whilst larger contractors and house builders have greater certainty in their pipelines of work and are better able to plan and purchase in advance, SMEs often purchase what they need on the day at builders merchants.

This makes them subject to greater issues if supply is limited or costs have risen significantly, particularly for firms working on fixed price contracts.

“On the labour side, some contractors are finding that there is currently a shortage of key skills in some key hotspots of activity, which has been exacerbated by the fall in EU construction labour by 42% over the past four years according to the ONS.”

.gif)

(300 x 250 px).jpg)