Latest Government figures suggest the pandemic bounce back has run out of steam, mainly due to falls in repair and maintenance and private housing new work.

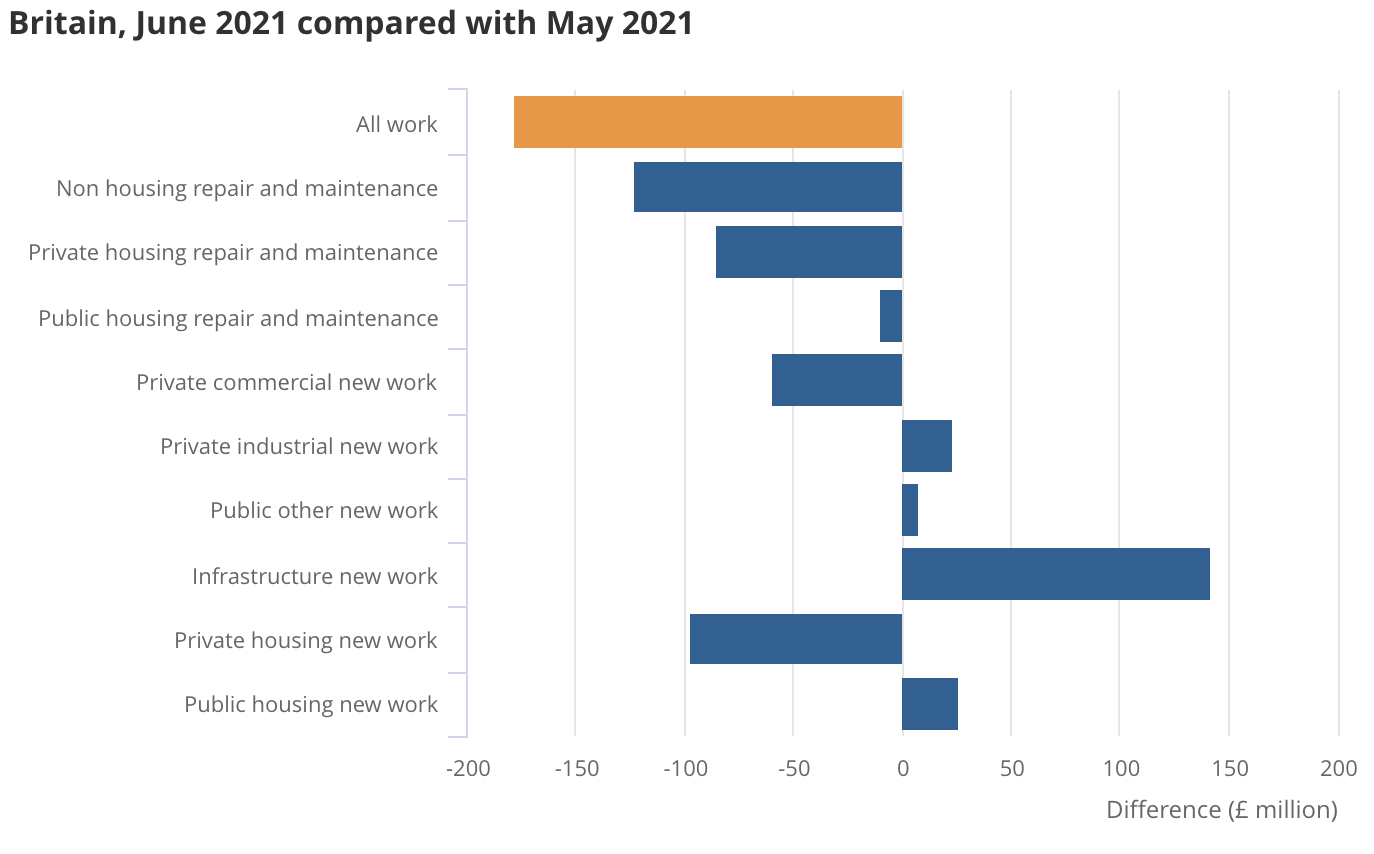

Monthly construction output fell by 1.3% in June, driven by a decline in repair and maintenance (4.2%) offset by a small rise in new work (0.5%).

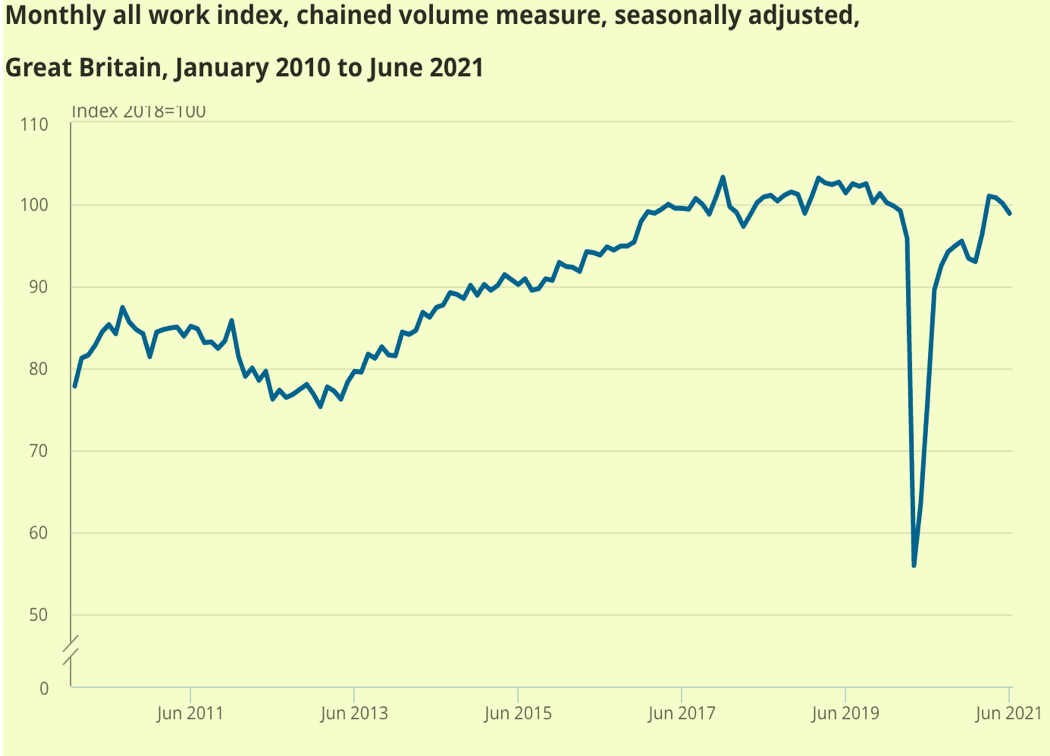

This drop dragged industry output below the February pre-pandemic high watermark.

Despite three consecutive monthly falls in growth through April to June, trend second quarter growth remained 3.3% above the first quarter due to steady infrastructure expansion.

The annual rate of construction output price growth hit 3.4% in June, the strongest annual rate of construction output price growth for nearly two years.

Fraser Johns, finance director at Beard, said: “For output to drop for the third consecutive month to below pre-pandemic levels, should start to ring some alarm bells.

“As an industry we’ve been saying for months now that the pandemic bounce-back could potentially be scuppered by a combination of the serious materials shortage, rising prices, labour shortages and now not enough HGVs on the roads to supply building sites.

“It’s not the kind of prediction anybody wants to be right about, but today’s stats demonstrate that these issues are really beginning to bite.

“At the same time, it is encouraging to see quarterly levels of growth up 3.3% in Q2 compared to Q1, driven in part by new orders, but it is some way below the growth in the economy overall at 4.8%. And of course, that first quarter was spent still under lockdown.

“Right now, we have to work together with suppliers, surveyors, customers and consultants to be proactive about the issues we face and take a multi-step approach to things like procurement to manage our way out of this current decline.”

Mark Markey, managing director at Scottish civils contractor Akela Group, said: “It is disappointing that the monthly output has fallen and there is no doubt that the sector has been impacted by the supply and rising costs of materials.

“At Akela, we have adapted our procurement processes to ensure the necessary materials are on site when needed.”

Across the industry limited availability of timber, steel, cement and tiles hit most sectors except infrastructure, industrial and public housing new work.

Looking forward, new order levels point to a brighter outlook if projects starts are not constrained by shortages of labour and materials.

Total construction new orders grew by 18%in the second quarter compared with the January to March first quarter period.

Most notably offices within private commercial saw strong growth (48%) likely to be caused by workers returning back to the office. The growth in infrastructure (25%) was driven by orders for both roads and rail projects.

New housing orders were more subdued with private housing up nearly 5% and public housing down 15%.

(300 x 250 px).jpg)

.gif)