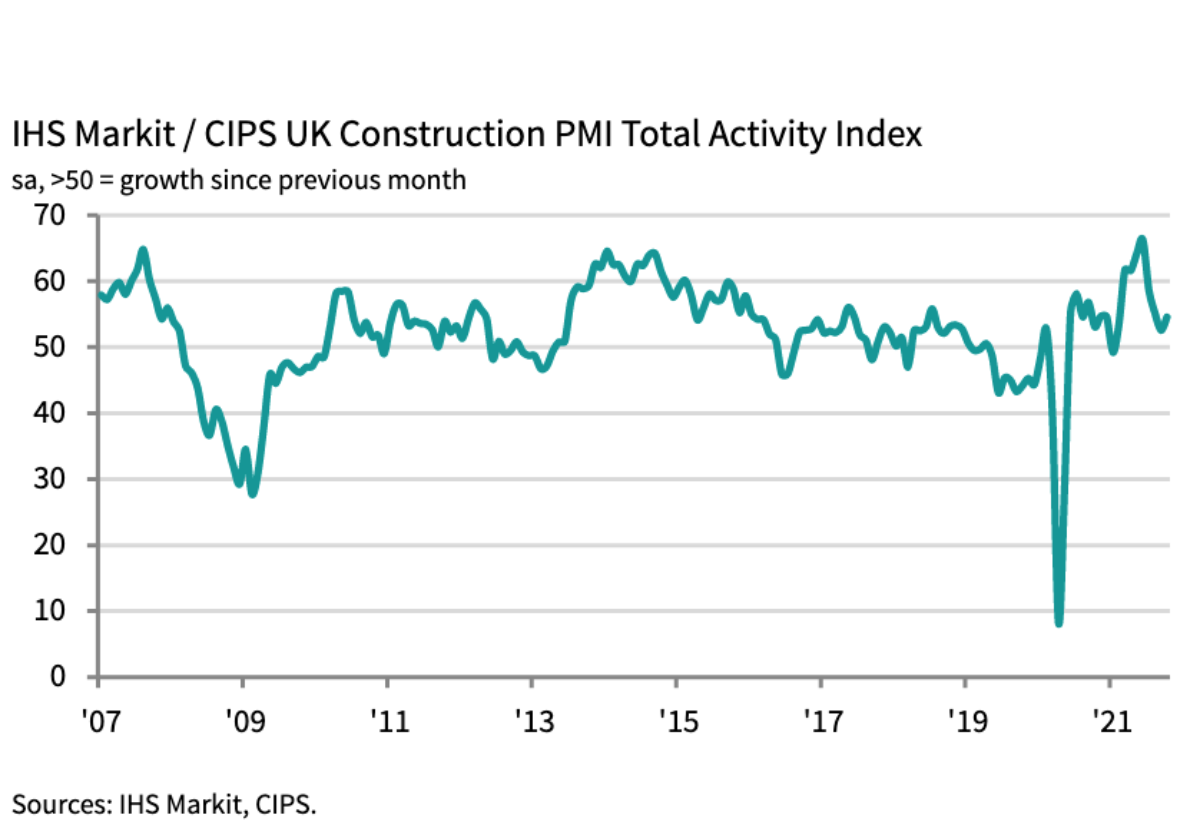

The IHS Markit/CIPS UK Construction PMI Total Activity Index registered 54.6 in October, up from 52.6 in September.

The index has now posted above the crucial 50 no-change value in each of the past nine months and hit a peak of 66.3 in June.

Work increased across all sectors as materials and staff shortages eases slightly.

Buyers reported another steep rise in input costs but the rate of inflation slipped to a six-month low.

The near-term outlook for construction growth remained positive in October. Just over half (52%) forecast an increase in output during the year ahead, while only 8%

expect a decline.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “Activity in the construction sector powered ahead in October with the fastest rise in purchasing for three months as builders continued their summer bounce into the autumn and resorted to forward buying and building stock levels.

“New order growth remained constant but increasing lead times from suppliers made commitment to contracted projects difficult because of the unpredictability of materials arriving on time as reported by over half of all supply chain managers.

“A slight moderation in input price inflation also gave hope to builders that price rises were receding, which could mean fewer delayed projects as costs were reviewed.

“With rising optimism and employment levels builders seem confident that the next 12 months will be rosier. However, with the squeeze on supply and staff shortages, its far from guaranteed that uncertainty and instability are behind us just yet.”

Tim Moore, Director at IHS Markit, which compiles the survey added: “UK construction companies achieved a faster expansion of output volumes in October, despite headwinds from severe supply constraints and escalating costs.

“House building showed the most resilience, as signalled by the fastest rise in residential work for three months.

“However, the volatile price and supply environment added to business uncertainty and continued to impede contract negotiations. As a result, the overall rate of new order growth was unchanged from the eight-month low seen in September.

“There were widespread reports that shortages of materials and staff had disrupted work on site, while rising fuel and energy prices added to pressure on costs.

“Nonetheless, the worst phase of the supply crunch may have passed, as the number of construction firms citing supplier delays fell to 54% in October, down from 63% in September.

“Similarly, reports of rising purchasing costs continued to recede from the record highs seen this summer.”

Get all the construction data and work-winning information you need

The Enquirer has introduced a new construction data page offering easy-to-access market intelligence to help your business.

Alongside interactive contracts leagues and daily tender invites, it helps you make informed business decisions with coverage of breaking economic news, latest workload and tender prices forecasts.

There is also a snapshot of current freelance labour rates and a guide to the best and worst payers within the major Tier 1 contractors.

For those looking to navigate the ever-changing world of contract and employment law, lawyers at Fenwick Elliot also give you the benefit of their expert insight.

And, of course, it’s all completely free for readers.

Click here to take a look.

(300 x 250 px).jpg)

.gif)