But widespread supply constraints and rapidly increasing input costs dampened the year-ahead outlook for activity, with confidence at the lowest since January 2021.

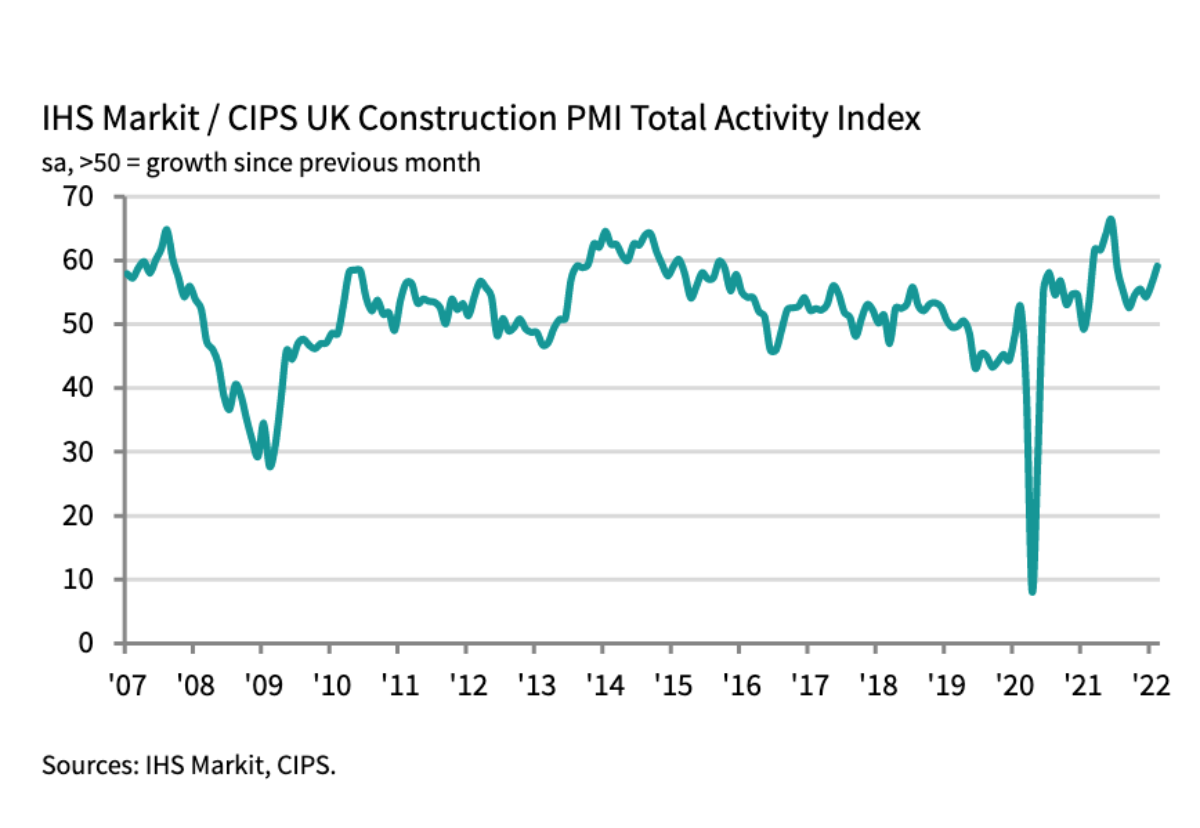

The bellwether IHS Markit/CIPS UK Construction PMI Total Activity Index hit 59.1 in February, up from 56.3 in January.

The headline index has now posted above the neutral 50.0 threshold in each of the last 13 months.

Resilient pipelines of new work were highlighted by a steep rise in input buying across the construction sector during February.

The latest expansion was the fastest for seven months and reflected pre-purchasing ahead of new project starts.

Staffing levels also increased at a sharp pace, extending the sequence of job creation to 13 months.

Around 36% of buyers reported longer delivery times among suppliers in February, while only 4% saw an improvement.

Delays were overwhelmingly linked to driver and material shortages, as well as international shipping delays.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “The construction sector maintained its growth momentum

whilst battling a number of headwinds such as supply issues and higher input costs to put in its best performance for eight months in February.

“All three sectors offered positive news, but housing stormed ahead with the strongest rise in residential building since June last year.

“The reasons for this improvement ranged from securing contracts in the pipeline of new work and improved deliveries for some materials. That said, hampered supply

chains still made business difficult across all sectors and deliveries remained painfully slow.

“Also, the highest rise in order books for six months didn’t do enough to improve future optimism as business expectations dropped to January 2021 levels.

“Curbing inflation will continue to be a big issue for building firms who will be nervous about securing continuing supply and offsetting price rises to improve business margins, especially if costs continue their skyward trajectory.”

.gif)

(300 x 250 px).jpg)