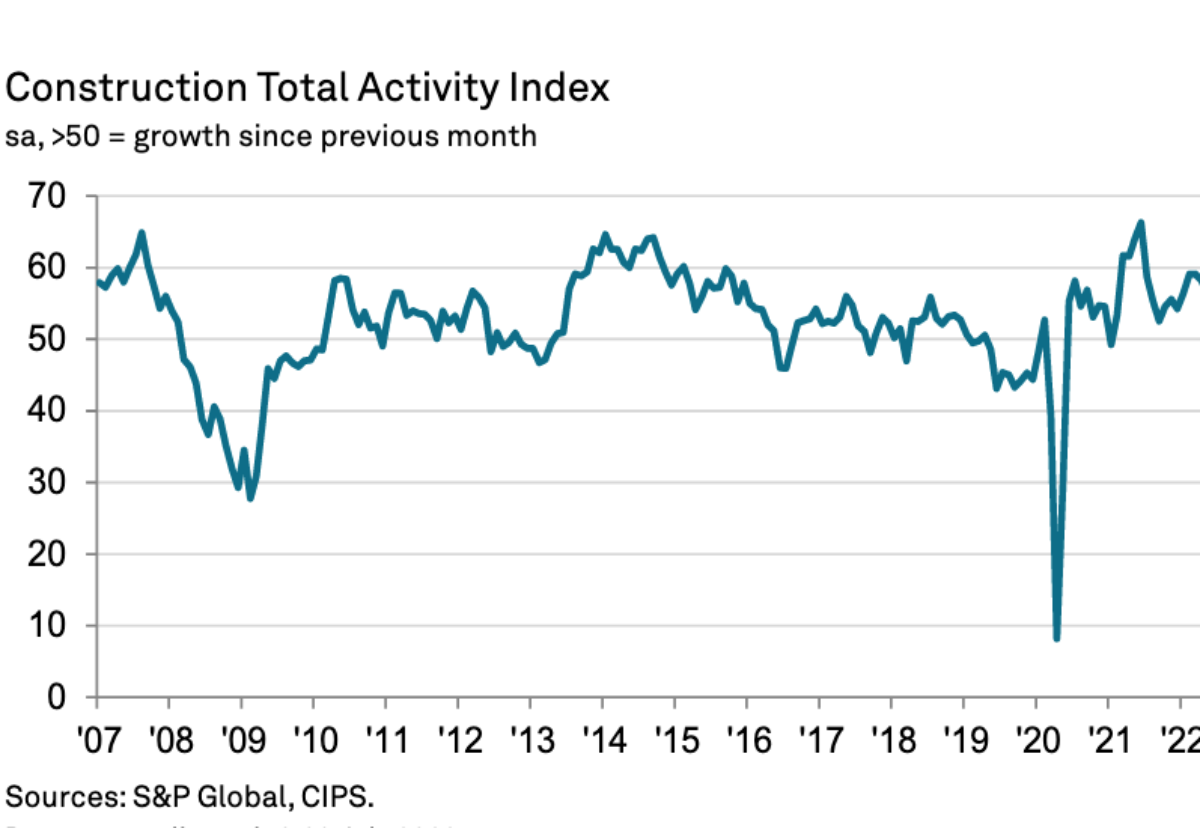

Commercial work saw the only increases as civils and housing falls dragged down the bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index to 48.9 in July from 52.6 in June.

The index was below the crucial 50 no-change threshold for the first time since January 2021 and the rate of decline was the fastest since May 2020.

Civil engineering was the worst-performing segment in July (index at 40.1), with business activity falling to the greatest extent since October 2020.

House building declined for the second month running, but the rate of contraction was only slight (index at 49.4). Commercial work bucked the downturn seen elsewhere (52.3 in July), although growth was the weakest for 18 months.

Survey respondents commented on headwinds to client demand from rising inflation, fragile consumer confidence and higher interest rates.

Purchase price inflation meanwhile eased considerably (index at 78.1, down from 85.8 in June), with the latest rise in cost burdens the least marked since March 2021.

Construction firms noted upward pressure on business expenses from higher energy, fuel and transport costs, but this was partly offset by some easing in commodity prices (especially for metals and timber).

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “After several months of difficult conditions for builders, these challenges have now resulted in a contraction in construction with the biggest fall in activity since May 2020.

“This disappointing result was felt across all the sectors, including housing which had demonstrated more resilience over the last couple of years, but fell for the second month in a row in July.

“However, it was civil engineering that fell the hardest and furthest. With fewer new orders in the offing, it may be some time before we see a rebound in this sector bearing in mind the time lag of infrastructure projects.

“Builders optimism remained at the lowest levels seen for two years. Job creation was healthy to complete work in hand but the danger remains that should the UK economy turn unfavourable, this will affect job hiring and the development of key skills.

“A feather-like fall in prices may ease some of the pain as access to raw materials also improved, but prices at historically high levels will continue to hamper activity in 2023.”

.gif)

(300 x 250 px).jpg)