But business expectations dropped to a 29-month low as the government seems intent on talking and taxing the country into recession.

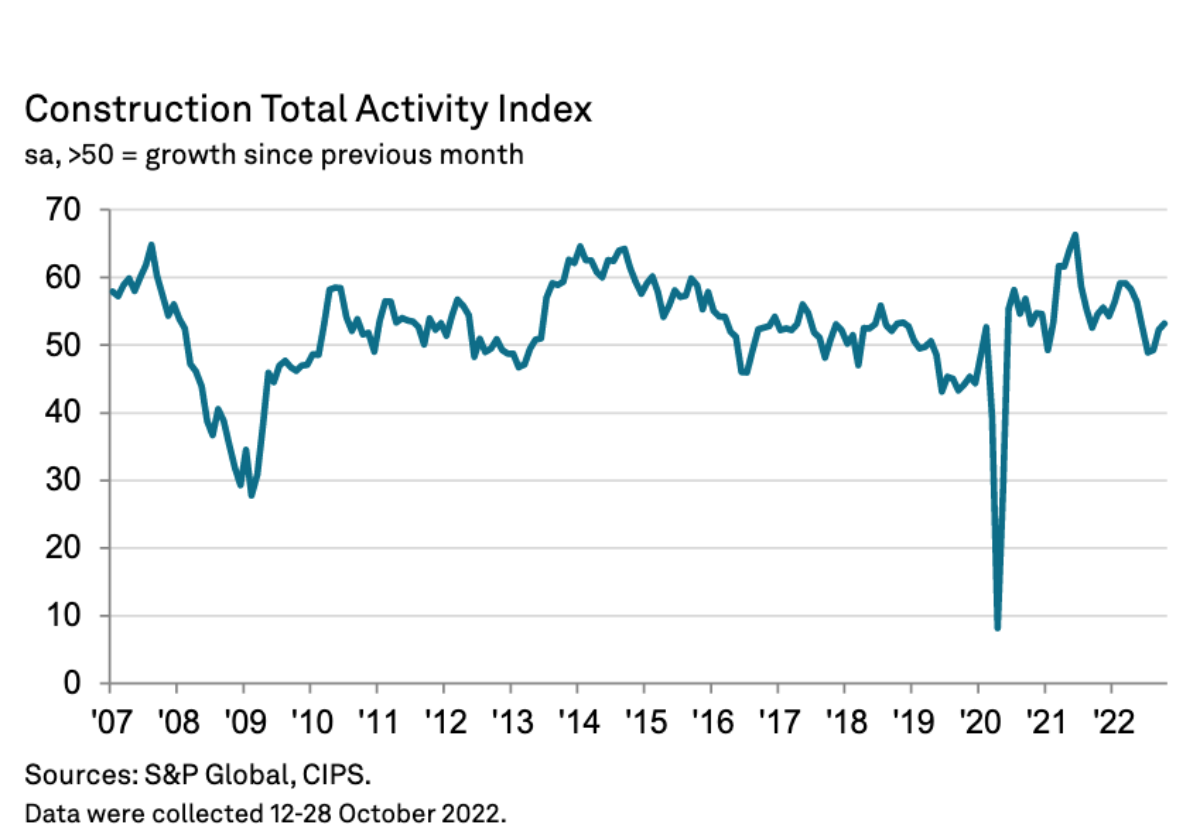

The bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index posted 53.2 in October, up from 52.3 in September and the highest reading since May.

Higher levels of business activity were attributed to a combination of new project starts and strong pipelines of unfinished work with commercial building the best performing sector.

But looking ahead construction firms are relatively downbeat about their growth projections for the year ahead with around 33% of buyers anticipating a rise in business activity while 26% predict a decline as the resulting index signalled the lowest degree of optimism since May 2020.

Tim Moore, Economics Director at S&P Global Market Intelligence said: “Construction output has staged a modest recovery after the downturn seen through much of this summer, with

growth hitting a five-month high in October.

“Commercial work was the best-performing area of activity as delayed projects moved forward, while increased house building also provided a positive contribution to overall workloads.

“However, the forward-looking survey indicators highlight that growth will be harder to achieve in the coming months as rising borrowing costs, economic uncertainty and cost constraints all had a negative influence on order books in October.

“The reduction in total new work was the first since May 2020 and this fuelled increased concerns about longer-term tender opportunities.

“Business optimism regarding the year ahead slumped in October and was by far the weakest since the early pandemic months.

“Construction firms cited concerns about a broad-based decline in client demand due to cutbacks on non-essential spending among clients, although some noted that growth linked to green energy projects, planned infrastructure spending and success in niche markets could help to offset the UK economic headwinds.”

.gif)

(300 x 250 px).jpg)

.gif)