Deloitte’s London Office Crane Survey is predicting that next year will see the beginning of a resurgence in office project planning and construction activity in the capital.

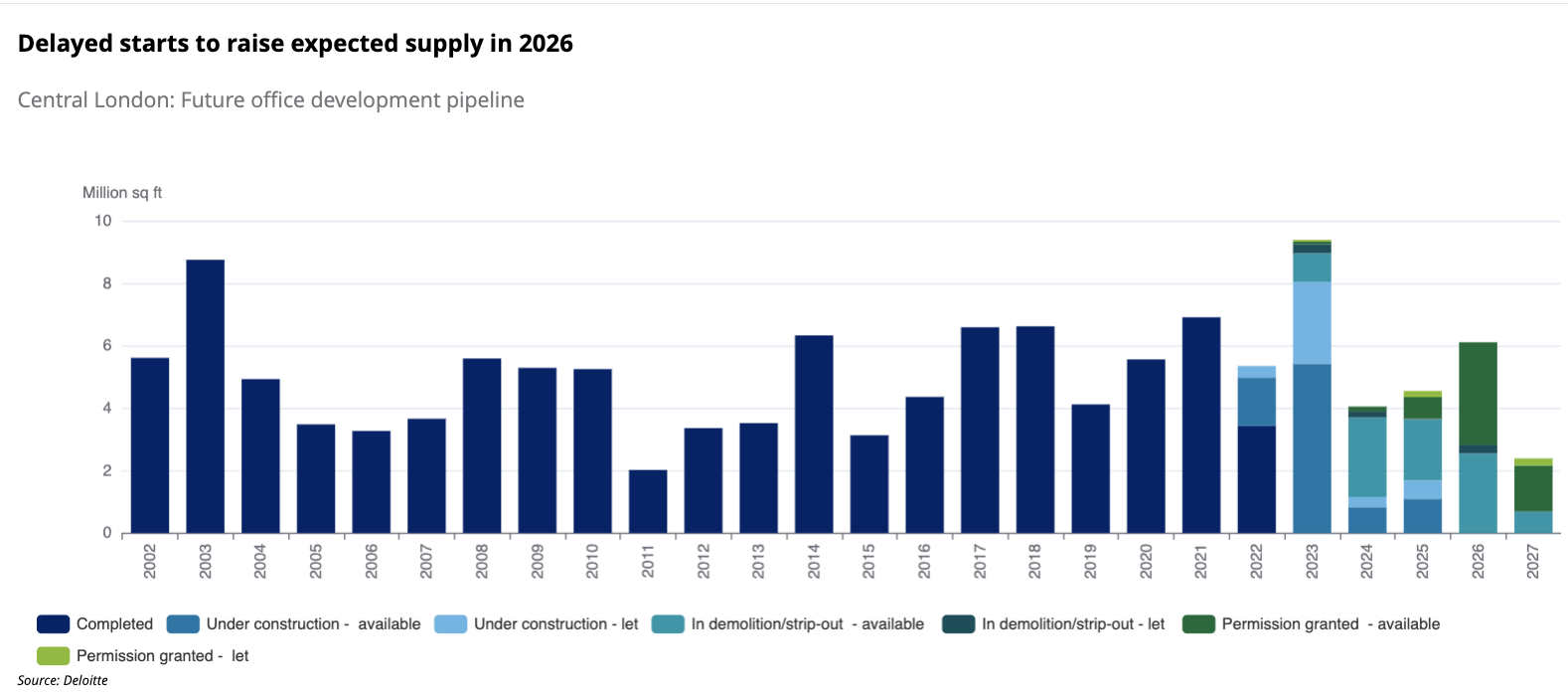

Latest data collected on schemes with planning permission and those in demolition suggests an extra 15.6m sq ft of new office stock is expected to be delivered between 2023 and 2027, all of which is yet to begin construction.

Presently there are 26 schemes currently in demolition/strip-out, with a total volume of 4.3 m sq ft.

Despite economic headwinds, these are expected to start construction during the next survey period, between October 2022 and March 2023, and will probably drive a significant rise in new start volumes in next survey.

Margaret Doyle, chief insights officer and partner for financial services at Deloitte, said: “The past year has been characterised by an uptick in post-pandemic refurbishment activity.

“Looking forward, 2023 could turn out to be the ‘Year of the Catch-up,’ but this will depend on whether supply chain disruptions, labour shortages, financing difficulties or material price inflation cause further completion delays.

“Looking further forward to 2025, we anticipate it will be the ‘Year of the Investor’ as renewed pressure on stock stimulates rental growth, creating a wave of fresh opportunities for developers.”

In the six months to September, the London Crane Survey recorded 31 schemes with a total volume of 2.5m sq ft were started.

Refurbishments remain a strong feature of new construction activity, representing 26 of the total new starts during the survey period.

This represents a 6% rise in volume from the previous survey (2.3m sq ft), but remains below the ten-year average (2.9m sq ft).

Almost nine in ten developers continue to rate construction costs as their leading challenge, albeit a smaller proportion than seen in the previous survey (100%).

Now concerns are turning to the availability of funding. More than a quarter of developers (27%) cite availability of funding as an issue, compared to none in the previous survey.

Sophie Allan, director of real assets advisory at Deloitte, said: “Construction costs are likely to remain a major challenge over the near term.

“Likewise, rapidly increasing debt funding costs will continue to weigh on scheme viability where sites have already been acquired. This, along with inflation in tender prices, will put pressure on land prices going forward.”

The legal profession has taken the largest proportion of under-construction pre-lets, representing a third (33%) of total pre-completion let volumes.

Meanwhile, by contrast, the share of pre-completion letting volumes taken by financial services firms has shrunk by almost half in under five years to 17%. The overall share for these two sectors has grown since the last survey, from 44% to 50%.

Doyle said: “The decline in financial services pre-completion letting volumes is balanced by significant growth in the legal sector. In many cases, office moves have been driven by a desire to move to accommodation with stronger ESG credentials and helps support employee wellbeing. The preference for higher quality Grade A space that we see across sectors is one we expect to endure.”

.gif)

.png)

MPU 300_250px.gif)