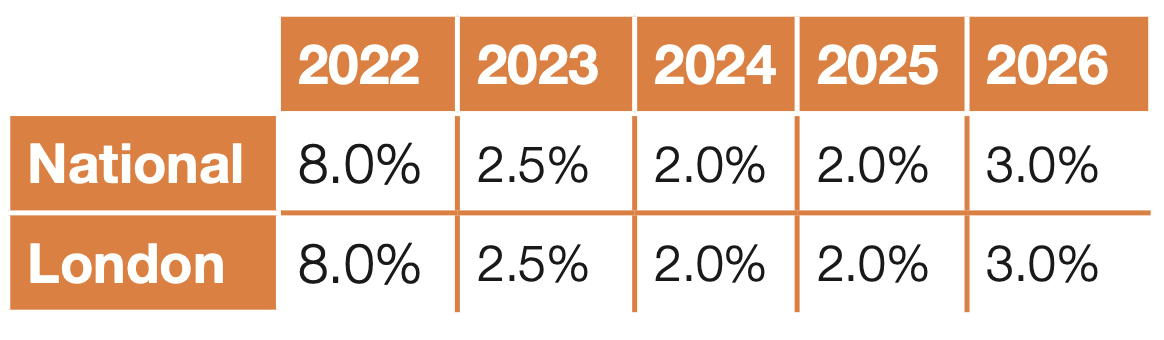

In its second downward revision for this year, tender price rises are now expected to rebalance at around 2.5%, down from the 5.5% high for 2023 predicted last Spring.

Mace’s cost consultancy market report was downgraded to take account of headwinds from the Bank of England’s interest rate rise to 3.5% and the 0.2% drop in GDP seen in Q3, a drop in material prices and the likelihood of a recession for the UK economy.

But cost consultants have held back from predicting a real fall in tender prices pointing to the resilience of construction amid a developing recession in the wider UK economy.

Additionally, an increase in new orders of 6.4% in the third quarter of 2022 is expected to result in a moderately healthy pipeline for the start of the year.

Andy Beard, global head of cost and commercial management for Consult, Mace said: “In a challenging market and with increasing inflation and further cost-of-living pressure, the industry faces a difficult year ahead.

“However, the construction industry’s moderate output growth and increase in new orders is an optimistic indicator for the industry to remain resilient compared with other sectors.

“The industry is likely to face obstacles in terms of material cost pressures and the impact of inflation on profit margins.

“Against this backdrop, it’s key that clients and consultants continue to prioritise their sustainability goals.”

(300 x 250 px).jpg)

.gif)