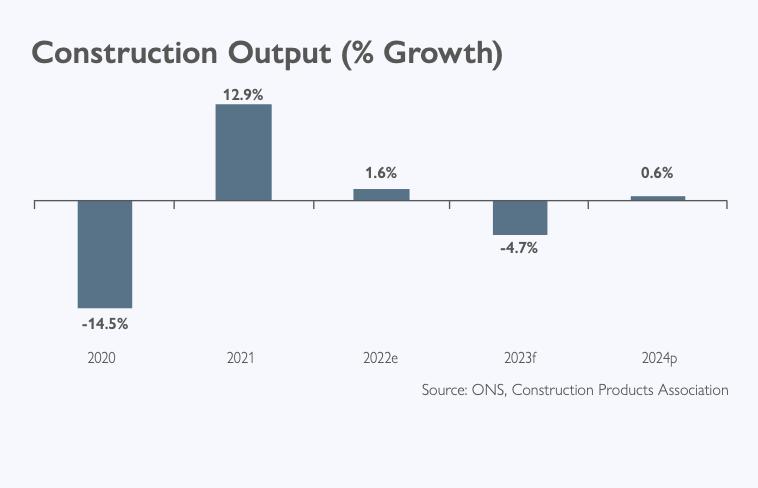

The big downward revision from -0.4% forecast just last summer and -3.9% forecast in the autumn is mainly due to the impact of a wider economic recession, rising interest rates and inflation.

Two of the three largest sectors of activity, private housing new build and housing repair, maintenance and improvement, are forecast to be the worst affected this year.

Falls in activity in these areas are expected to be partially offset by continued growth in infrastructure, the second largest sector, which is already at historic high levels of activity.

Even here, however, there is growing concern over the impact of double-digit construction cost inflation. Given financial constraints for government, this means the industry will see the value of activity expected previously, but not the volume.

Key points

• Construction output falls by 4.7% in 2023 before growth of 0.6% in 2024

• Industrial output up 2.3% in 2023 before falling by 4.6% in 2024

• Infrastructure output to increase 2.4% in 2023 and 2.5% in 2024

• Private housing output falls by 11.0% in 2023 and by 1.0% in 2024

• Private housing RMI to fall by 9.0% this year before 1.0% rise in 2024

Even anticipating a soft landing for housing in the spring, forecasters predict private housing output this year will experience an 11% fall as house builders focus on completing existing developments rather than starting new sites.

Further growth in infrastructure output is expected but it is likely to be slower than in previous years due to cost inflation and financial constraints.

The Chancellor stated clearly in the Autumn Statement that capital expenditure would be maintained in cash terms. In the near-term, this is likely to mean that current central government projects go over budget given double-digit construction cost inflation.

But CPA Economics Director Noble Francis warned there would be hesitancy from the public sector signing up to new projects due to uncertainty over costs spiralling further.

He said that in addition, financially constrained councils were likely to cut spending on new projects to cover the rising costs of essential repairs and maintenance.

In the medium-term, projects towards the end of the government’s Spending Review are expected to be pushed back into the next review period due to budgetary constraints. After 4.9% growth in 2022, infrastructure output is forecast to rise by 2.4% in 2023 and 2.5% in 2024.

.gif)

(300 x 250 px).jpg)