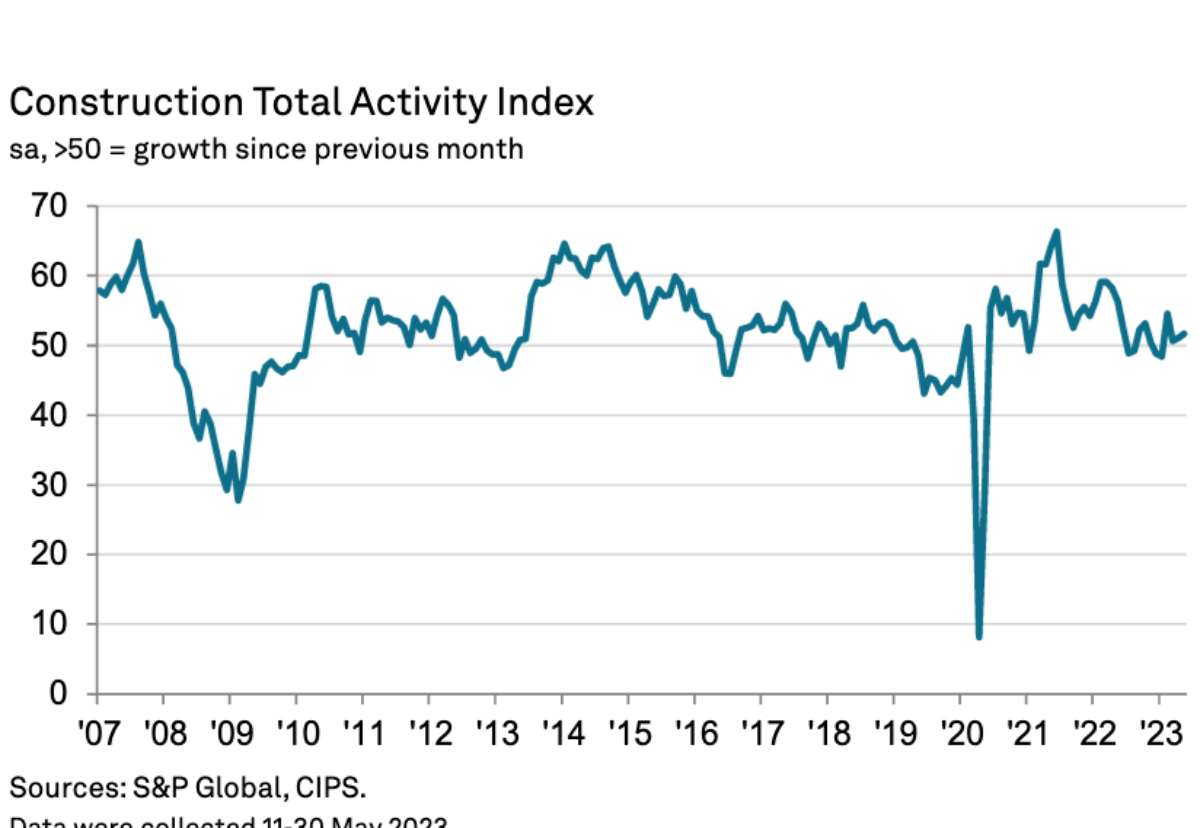

The bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index registered 51.6 in May, up from 51.1 in April and above the neutral 50.0 mark for the fourth successive month.

Construction buyers reported inflation easing to its weakest for 32 months while new business increased rapidly with the overall rise in construction order books the strongest recorded since April 2022.

But work on residential building projects decreased for the sixth month running and at the steepest pace since May 2020.

Construction companies remain upbeat about their growth prospects for the year ahead. Around 45% of the survey panel expect an increase in output levels, while only 14% predict a decline.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “May data highlighted a mixed picture across the UK construction sector as solid growth rates in commercial and civil engineering activity contrasted with a steeper downturn in house building.

“Rising demand among corporate clients and contract awards on infrastructure projects meanwhile underpinned the fastest rise in new orders since April 2022.

“However, cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years. This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008.

“Survey respondents also commented on concerns about the broader UK economic outlook, which contributed to an overall drop in output growth projections to the lowest for four months.

“Inflationary pressures meanwhile eased considerably in May, with purchase prices increasing to the smallest extent since September 2020.

“Supply chain normalisation helped to moderate cost inflation, as signalled by the strongest improvement in delivery times for construction products and materials for almost 14 years.”

.gif)

.gif)

(300 x 250 px).jpg)