The firm is more downbeat about prospects for construction predicting that the expected 2024 recovery will be delayed.

Arcadis has downgraded its outlook because of the Government’s high interest rate policy, the growing cost of debt and an emerging slowdown in public project delivery.

In its latest Autumn report, Arcadis said sands appear to be shifting across the construction landscape, with a mixed bag of trading updates, evidence of restructuring and a disturbingly high level of business failures.

Simon Rawlinson, head of Strategic Research and Insight at Arcadis, said there were now concrete signs of a construction slowdown that was set to rock the sector, with new orders falling for the third consecutive quarter.

He said: “Conditions for our markets have deteriorated significantly over the summer.

“Borrowing costs are expected to remain high for the next two years and prospects for the investment economy including house building and commercial development are likely to be further downgraded.

“The unexpectedly rapid slowdown in public sector procurement is also a reminder that there are few safe havens for workload other than net-zero and fire-safety retrofit which still see strong demand.

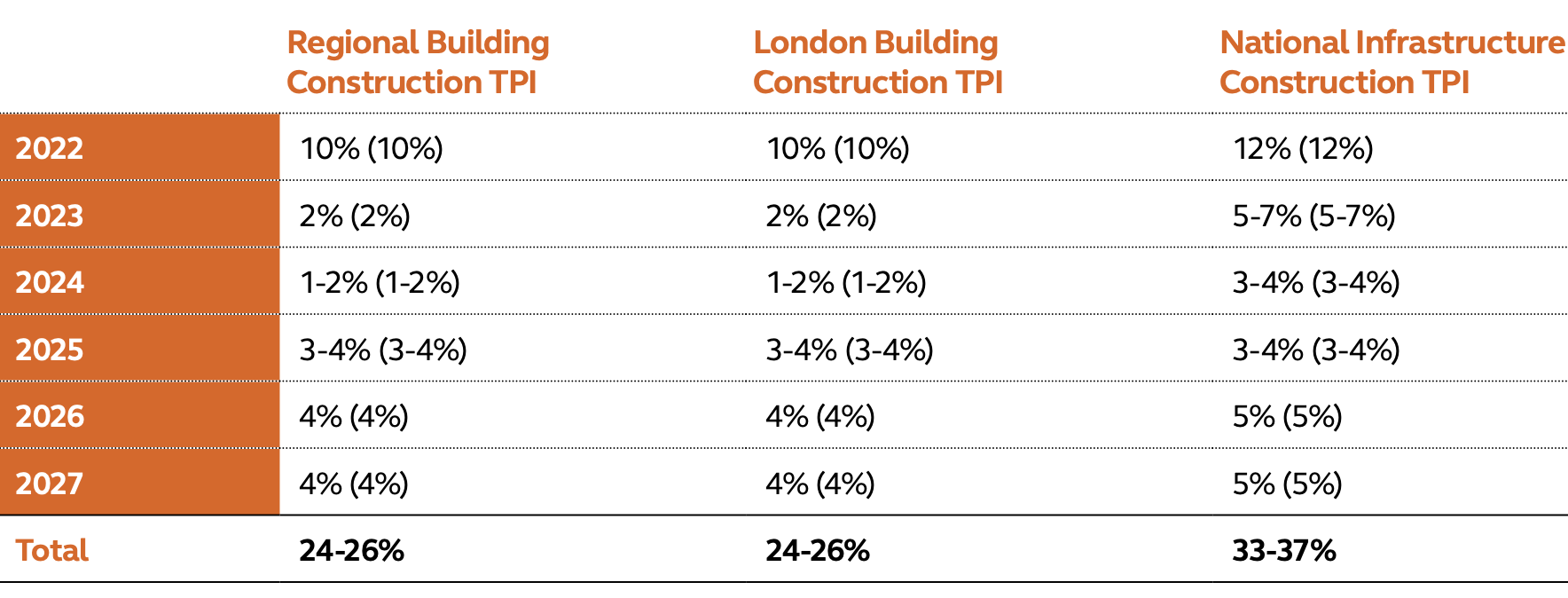

“Our central prediction for the period from 2023 to 2025 remains low inflation, not deflation.

“However, in the light of worsening data, particularly in connection with the house building sector, we highlight that there is now a material downside risk of a competitive price correction in 2024.”

Arcadis is concerned about a drop in public sector ‘other new work’ such as health and education, which fell 33%, as well as a 27% decline in infrastructure new work.

These figures corroborate a recent National Audit Office report, which found the Department for Education was behind its initial schedule for awarding contracts on its 10-year programme of major rebuilding and refurbishment, having awarded just 24 contracts as of March 2023. This was well below its target of 83.

Rawlinson said the that construction was responding to the storms ahead by battening down the hatches, with contractors like Wates, Sir Robert McAlpine and BAM implementing restructures to create efficiencies and focus on sectors with a greater potential for growth.

Similar measures can be seen among housebuilders like Bellway, which is weighing up the potential closure of two divisions and a limited number of redundancies, whilst major brick manufacturer Forterra has outlined job losses following a restructure of its commercial and support operations.

These restructures come amid reports of disturbingly high level of business failures across the sector.

Latest data from the Government’s Insolvency Service showed there were 2,244 business failures in construction in England and Wales in the second quarter of 2023. That is the highest quarterly total since at least 2010 and way above the average quarterly total over the past 13 years (1,579).

The loss in industry capacity, alongside continuing high labour costs and core background national inflation, is expected to contractors hold tender prices despite lower orders and general economic slowdown

.gif)

(300 x 250 px).jpg)

.gif)