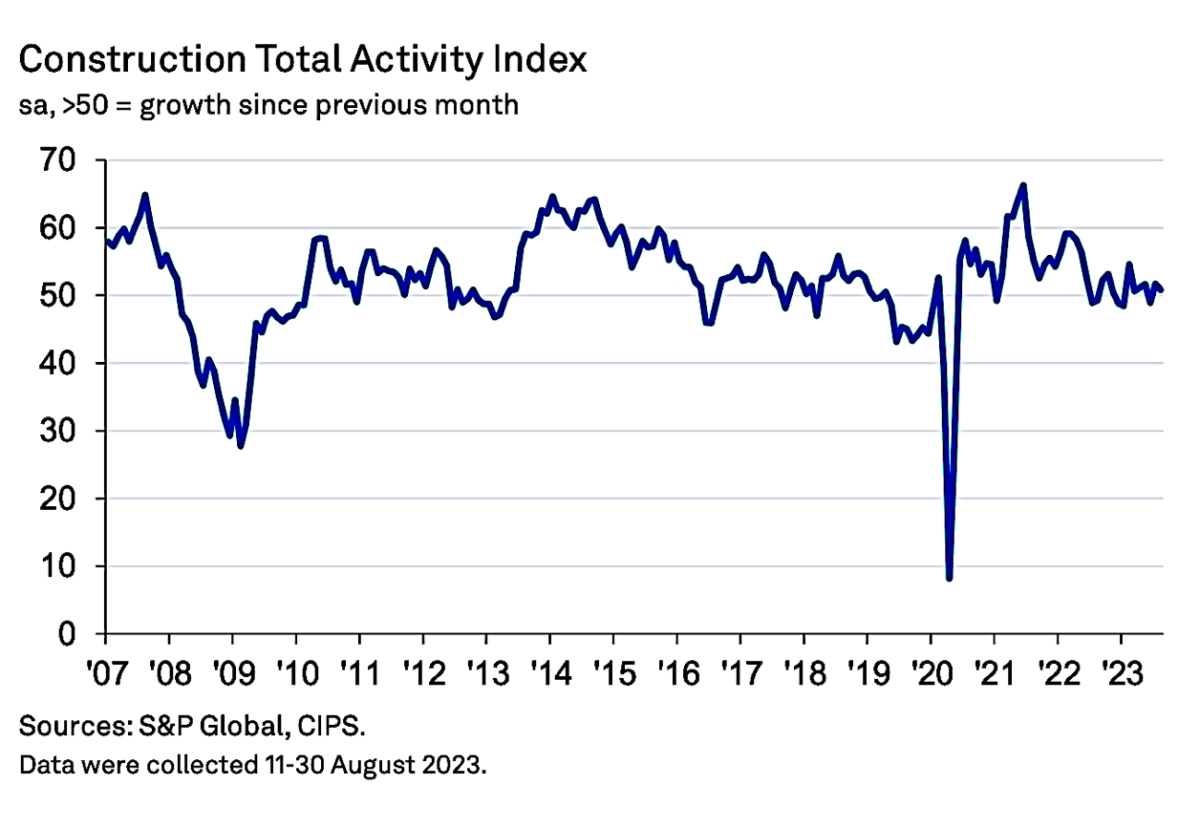

The bellwether S&P Global / CIPS UK Construction Purchasing Managers’ Index posted 50.8 in August – down from 51.7 in July – but still in positive territory in the sentiment index.

Growth in the commercial and civil engineering segments helped to offset a slump in house building.

However, business activity forecasts for the year ahead were the weakest since January and job creation lost momentum since the previous month.

This was largely due to falling sales volumes across the construction sector.

Fresh August data signalled a decline in total new order volumes for the second time in the past three months, which contrasted with solid growth in the spring.

Although modest, the downturn in order books was the steepest since May 2020.

Construction companies noted that rising interest rates and concerns about the near-term economic outlook had led to more cautious spending among clients, especially in residential building segment.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey, said: “UK construction companies experienced another slump in house building activity during August as rising interest rates and subdued market conditions resulted in cutbacks to client demand and new build projects in particular.

“Aside from the pandemic, the recent downturn in residential work has been the steepest since spring 2009.

“Resilient demand for commercial work and infrastructure projects are helping to keep the construction sector in expansion mode for now, but the survey’s forward-looking indicators worsened in August.

“Total new orders decreased at the fastest pace for more than three years amid worries about the broader economic outlook and the impact of elevated borrowing costs.

“Rising risk aversion also meant that construction firms pared back their own output growth projections, with business activity expectations slipping to the weakest since January. ”

.gif)

(300 x 250 px).jpg)