Comparing ONS figures from 2022 with contract awards data from 2023, researchers discovered spending shifting away from the traditional construction powerhouses.

Barbour ABI’s head of business and client analytics, Ed Griffiths said: “There are clear hotspots for upcoming construction activity over the next 6-24 months, with hotspots outnumbering coldspots, where activity has gone down, by almost three-to-one overall and six-to-one for infrastructure.

“Encouragingly, regions with hotspots were spread across Great Britain and hotspots outnumbered coldspots in all regions of Great Britain.”

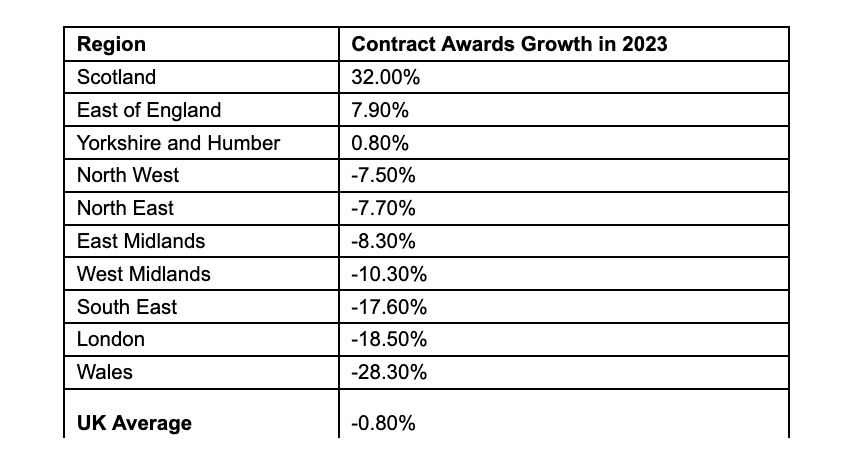

London and the Southeast, which have seen the highest spending on construction in the UK, saw contract awards reduce by 18.5% and 17.6% respectively – wiping out gains made in 2022. Westminster, traditionally responsible for one of London’s biggest spending shares, took a 20% hit along with Berkshire (39%) and West Surrey (32%) in the Southeast.

Analysts found contract awards growth of 7.9% in the East of England, with Cambridge, Suffolk and the Essex regions all registering double or triple digit increases. Yorkshire and the Humber also registered a 0.8% increase with Leeds a notable hotspot with a 23.7% increase and Lincolnshire seeing a 159.1% increase.

Scotland saw a 32% increase in contract awards which included the Scottish Borders, which recorded the highest increase in the UK at 374.3% and Glasgow, which rose 30%.

Griffiths said: “Overall contract awards remained stable at a national level, but looking at a more granular level reveals stark differences in regional performance with growth rates ranging between +374% and -95%. What we can say is that the post-pandemic boom initially focused itself on London and the Southeast is finally showing signs of trickling out to the rest of the UK.

“This will come as a relief for more regionally focused businesses and a signal to contractors that it may be time to start looking outside of the big powerhouse areas for more projects to add to their pipeline.”

Overall, the report found 82 construction hotspots in the UK compared to just 31 coldspots, with 29 hotspots related to infrastructure projects.

(300 x 250 px).jpg)

.gif)