Economists at the Construction Products Association said cautious optimism is returning to the industry, led by an improving outlook for private housing and hopes for infrastructure spending growth next year.

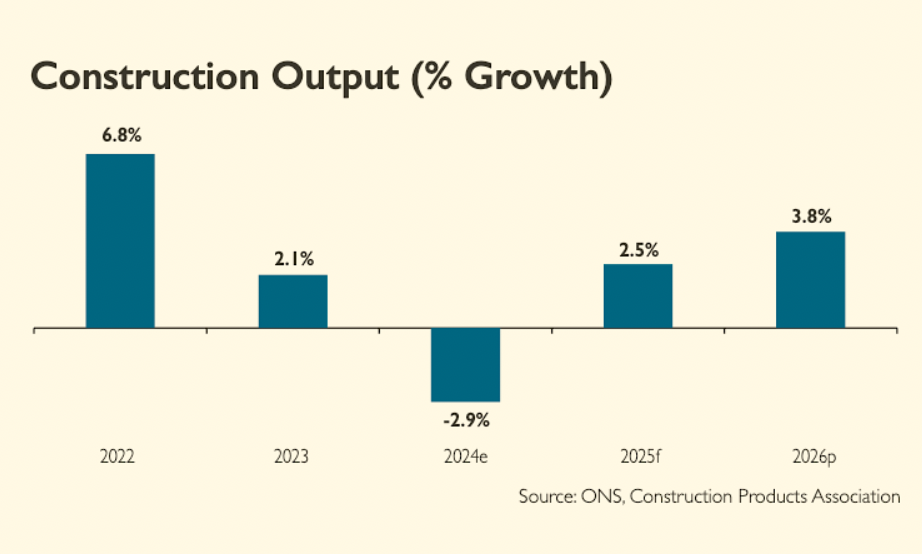

Overall, total construction output is forecast to rise by 2.5% in 2025 and 3.8% in 2026 after falling by 2.9% this year.

Autumn forecast highlights

• Construction output falls by 2.9% in 2024 and rises by 2.5% in 2025

• Private housing output falls by 9.0% in 2024 and rises by 8.0% in 2025

• Private housing repair, maintenance and improvement to fall by 4.0% in 2024 before rising by 3.0% in 2025

• Infrastructure output to fall by 0.4% in 2024 but rise by 1.6% in 2025

• Industrial output to fall by 4.7% in 2024 and by 3.7% in 2025

In private housing falls in interest rates and mortgage rates appear to be leading to a gradual recovery in demand for the wider housing market.

This is expected to lead to better prospects for house builders. Economists at the CPA said the new government had signalled clear intent to boost house building through easing planning by proposing major changes to the National Planning Policy Framework, which could ease one of the most-cited supply constraints, particularly for smaller house builders.

The Autumn Budget could have significant implications for critically needed investment in health, education and infrastructure.

Infrastructure, the third-largest construction sector, is forecast to rise by 1.6% in 2025 and 3.8% in 2026 after falling marginally, by 0.4%, this year.

Increases in investment in the water to deal with sewage dumping in rivers is expected to boost activity from 2026. Energy infrastructure activity, however, continues to go from strength to strength as wind farm activity ramps up again.

CPA Economics Director Noble Francis said: “Construction has suffered a very challenging period over the past two years, with sharp downturns in the two largest sectors, private housing new build and repair, maintenance and improvement.

“However, cautious optimism appears to be creeping back into the industry. Broader UK economic growth, helped by lower interest rates and sustained real wage growth, combined with a stable government, appears to be leading to improving consumer and business investment. However, the government’s Autumn Budget will be key to ensuring that this remains the case.

“There are significant upside risks to the forecasts if the new government can improve the delivery of house building and infrastructure.

“However, downside risks continue to prevail. The UK construction industry has lost over 10,000 firms in the last two years. ISG, the 6th largest construction firm, is the latest example, as high costs, project delays, and skills shortages on fixed-price contracts acutely affect the whole supply chain.

“In addition, concerns remain over whether the government will cut capital expenditure and pause, delay, review and cancel yet more investment in key infrastructure projects in the short-term to meet its fiscal rules. If so, falls in infrastructure activity could overshadow recovery in house building and rm&i.”

(300 x 250 px).jpg)

.gif)