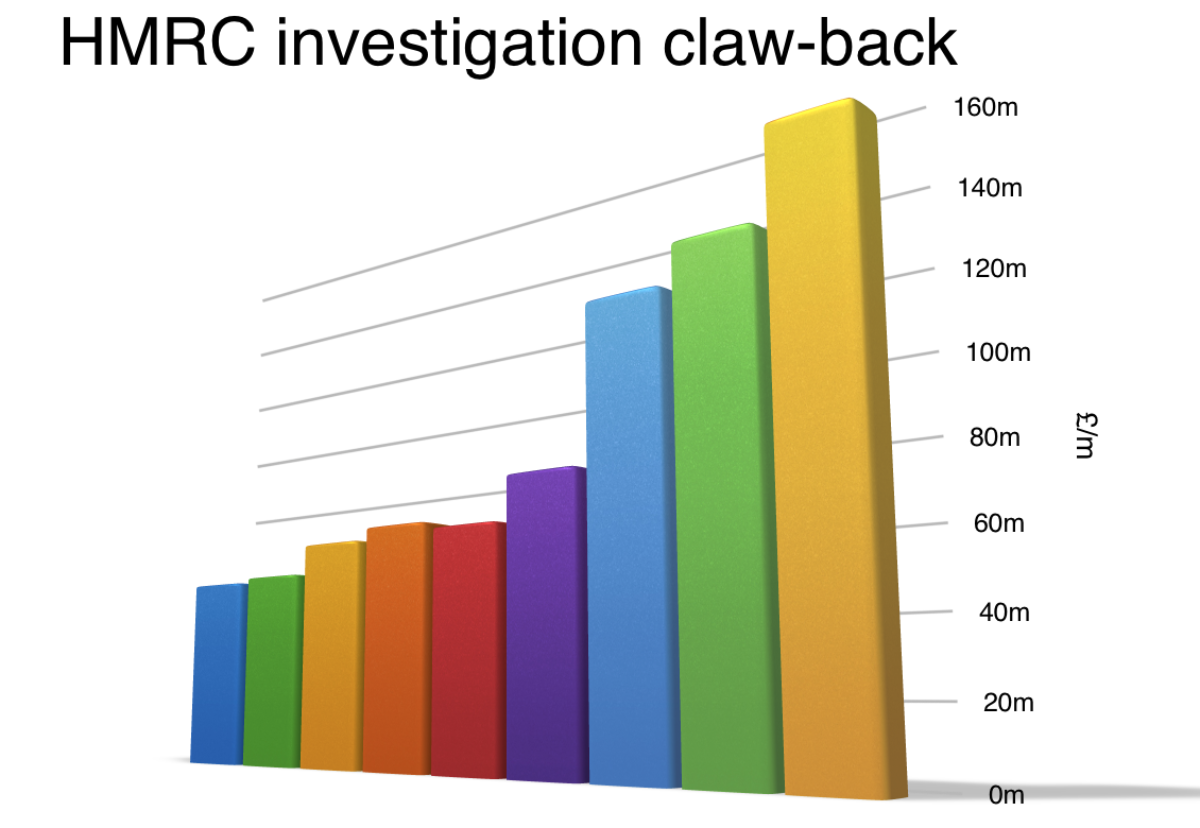

The yield from tax compliance investigations in construction soared to a record high of £154m, now more than double that of five years ago, according to accountants UHY Hacker Young.

Latest figures comes after the HMRC clamped down on self-employed workers finding work through intermediary companies.

Since April last year employment intermediaries have had to start providing quarterly reports explaining why workers on their pay roll are not using PAYE.

Roy Maugham, tax partner said: “The increased yield from tax investigations and the new rules indicate just how much HMRC are clamping down on tax evasion in the construction industry, and this trend is likely to continue in the future.”

“The construction industry is seen as an easy target by HMRC and has been subjected to increasingly intense investigations in the last few years.”

He warned that it was now more important than ever for companies to keep paperwork to prove that their workers have self-employed status, or a sub-contractor certificate.

“Individuals and companies working in the construction industry must make sure that they have all the relevant paperwork otherwise they risk a high penalty from HMRC.”

Any companies that fail to provide the correct paperwork risk paying up to six years’ worth of PAYE and National Insurance contributions, plus interest and up to 100% of the tax in additional penalties.

(590 × 200px) - Dec 24.gif)

MPU 300_250px.gif)

.gif)