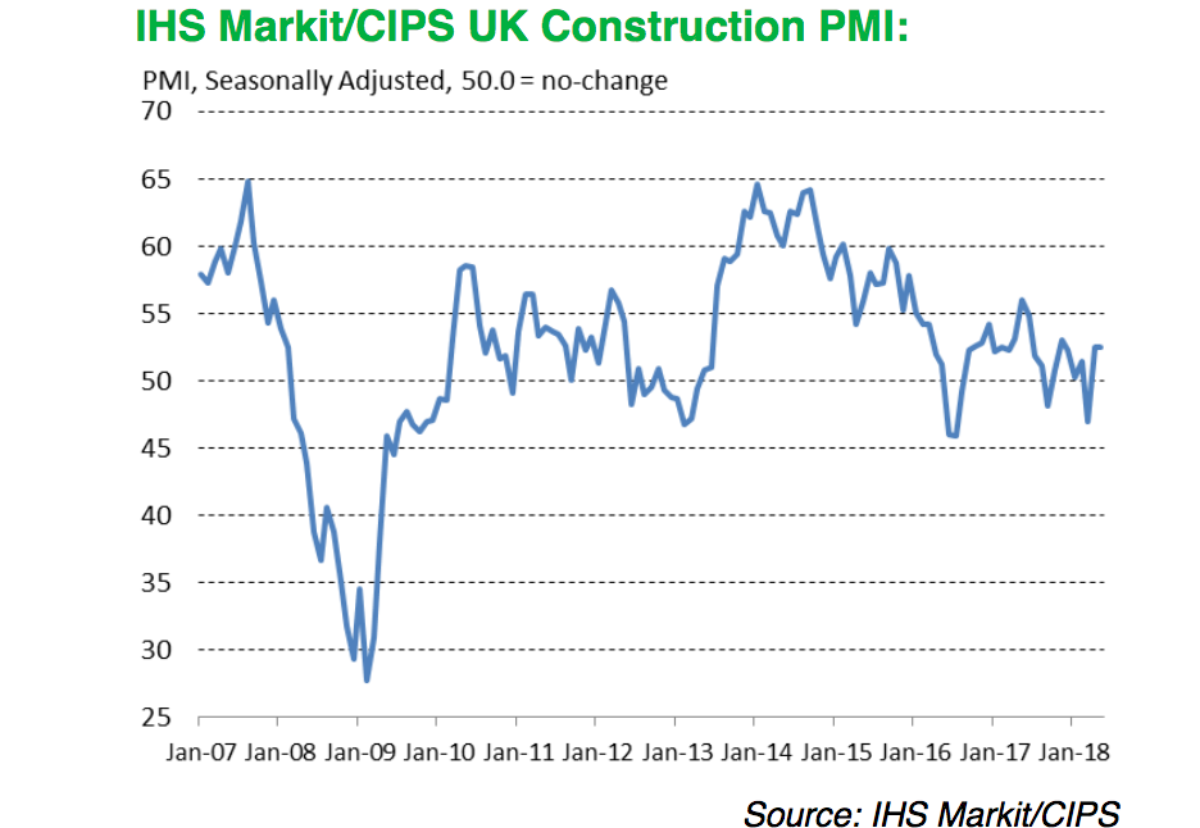

The latest IHS Markit/CIPS UK Construction Purchasing Managers’ Index for May registered 52.5 – exactly the sme figure as April.

Crucially the figure remains above the 50 mark which represents the threshold for continuing expansion.

But optimism about future growth fell to a seven month low and purchasing costs rose sharply particularly for fuel, plastic and steel.

Sam Teague, Economist at IHS Markit and author of the report said: “The May PMI data signalled an unchanged pace of activity growth across the UK’s construction sector since April’s somewhat underwhelming rebound, yet nevertheless indicating a recovery in the second quarter after the contraction seen at the start of the year.

“However, activity in May was once again buoyed by some firms still catching up from disruptions caused by the unusually poor weather conditions in March, and a renewed drop in new work hinted that the recovery could prove short-lived.

“Inflows of new business slipped back into decline, signalling the resumption of the downward trend in demand seen during the opening quarter.

“Companies frequently noted that Brexit uncertainty and fragile business confidence led clients to delay building decisions in May.

“With new order books deteriorating and cost pressures picking back up, it’s not surprising to see construction firms taking a dimmer view of prospects and pulling-back on hiring, all of which makes for a shaky-looking outlook.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “The two millstones of uncertainty and weak economic growth gave the sector plenty to worry about this month, and whilst activity still grew, the lowest business confidence in seven months suggests the subdued pipeline of new work is having an effect. With a decline in new orders for a fourth time in five months, it was client hesitation and consumer diffidence towards spending that had construction activity stuttering.

“Higher prices for fuel, raw material shortages, higher labour costs combined with slow delivery times were further obstacles to growth as firms nervously assessed their workforce for much-needed talent and sub-contractors could name their price.

“However, it’s encouraging to see the housing sector put in a strong performance for a second month running, after stumbling at the beginning of the year, and with only small improvements in the other sectors, residential building is keeping construction’s head above water.

“It’s likely that the construction sector’s performance will be a slow and steady crawl through the second quarter, as the spectre of Brexit continues to dominate, and the double pincer movement of few orders, and higher costs, could see the sector stutter further.”

.gif)