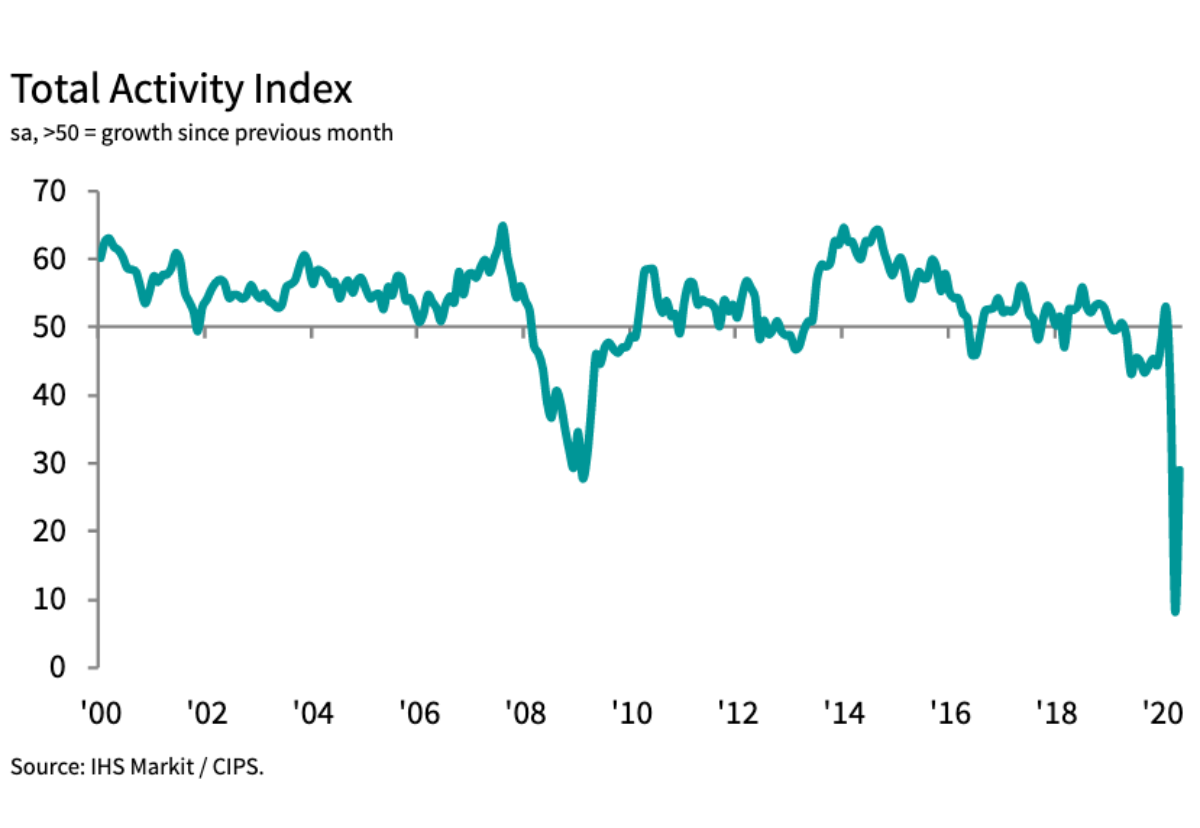

The bellwether Markit/CIPS UK Construction Total Activity Index registered 28.9 in May after a record low of 8.2 in April.

Any reading below 5o represents a decline in industry output and May’s figure was the second lowest in more than a decade.

Residential work was the most resilient category in May (index at 30.9), followed by civil engineering (28.6).

Commercial building also fell at a slower pace but was the worst performing broad area of construction (26.2).

May data also indicated a rapid drop in new orders received by UK construction companies as survey respondents commented on a sharp decline in demand for new construction projects.

Supply chain disruptions were also widespread with lead times for construction products and materials continuing to lengthen “at a rapid pace.”

Firms also highlighted that a lack of capacity for deliveries and ongoing business closures had resulted in the need to source alternative suppliers, which had also pushed up costs.

Tim Moore, Economics Director at IHS Markit, which compiles the survey: “A gradual restart of work on site helped to alleviate the downturn in total UK construction output during May, but the latest survey highlighted that ongoing business closures and disruptions across the supply chain held back the extent of recovery.

“It seems likely that construction activity will rebound in the near-term, as adaptations to social distancing measures become more widespread and the staggered return to work takes effect.

“However, latest PMI data pointed to another steep reduction in new orders received by UK construction companies, with the pace of decline exceeding the equivalent measures seen in the manufacturing and service sectors.

“Survey respondents often commented on the cancellation of new projects and cited concerns that clients would scale back spending through the second half of 2020, especially in areas most exposed to a prolonged economic downturn.

“With construction firms anticipating a reduced pipeline of work and fewer tender opportunities, business expectations for the next 12 months remained negative in May. Since the start of the lockdown period in March, business sentiment has remained more downbeat than at any time since October 2008.”

.gif)