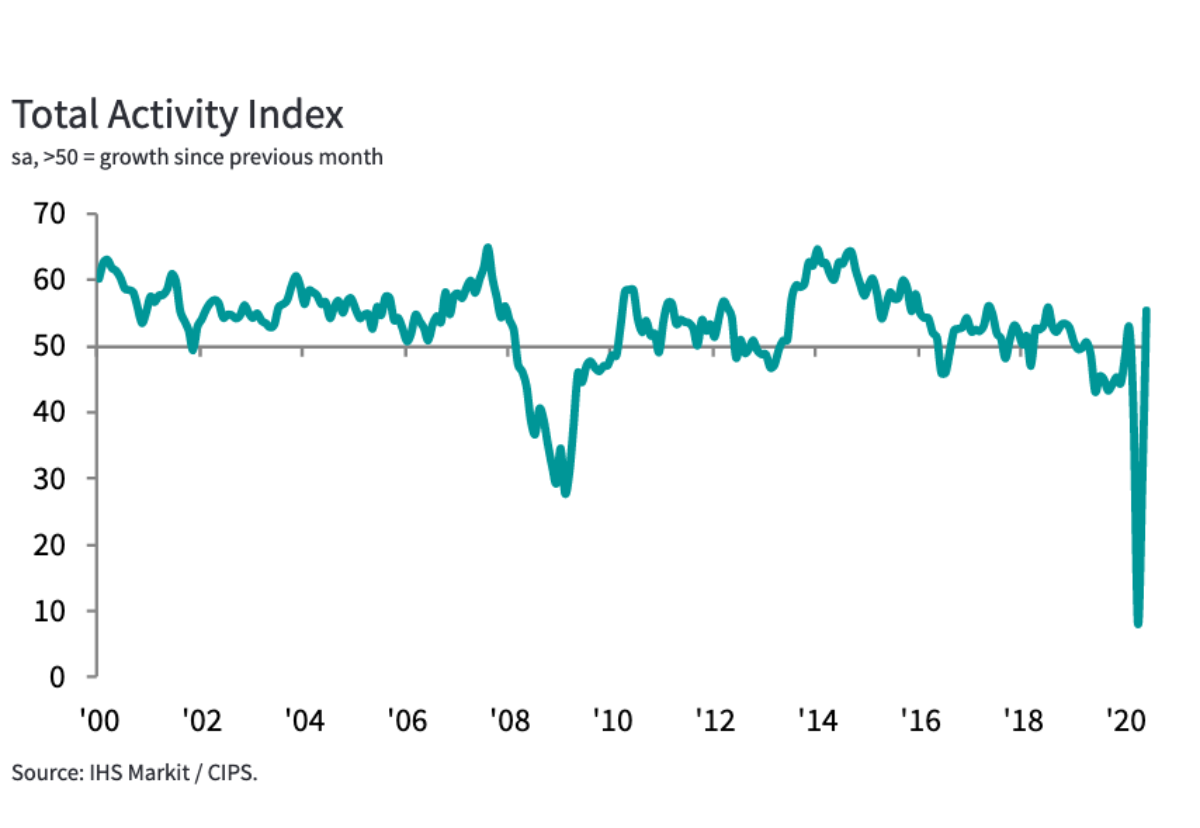

The bellwether IHS Markit/CIPS UK Construction Total Activity Index jumped to 55.3 in June from 28.9 in May to record the sharpest monthly jump in output since June 2018.

Residential work led the way while commercial work and civil engineering activity also returned to growth in June.

The index measuring business expectations for the year ahead remained historically subdued, but climbed to its highest since February with 46% of the survey panel anticipating a rise while 31% forecast a reduction.

Tim Moore, Economics Director at IHS Markit, which compiles the survey said: “As the first major part of the UK economy to begin a phased return to work, the strong rebound in construction activity provides hope to other sectors that have suffered through the lockdown period.

“While it has taken time for the construction supply chain to adapt and rebuild capacity after widespread business closures, there is now clear evidence that a return to growth has been achieved.

“While some survey respondents commented on cautious optimism about their near-term prospects, construction companies continued to face challenges securing new work against an unfavourable economic backdrop and a lost period for tender opportunities.

“At the same time, operating expenses are rising due to constrained capacity across the supply chain and the impact of social distancing measures.

“Looking ahead, construction firms are more confident than at any time since the start of the COVID-19 pandemic.

“However, the ongoing reductions in staffing numbers seen in June provide a stark reminder that underlying conditions across the sector are a long way off returning to those seen before the public health emergency.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:”Builders were the stars of the UK economy in June with the fastest rise in purchasing activity in almost five years, as pent-up building plans were unleashed following the easing of lockdown measures.

“As business confidence improved to its largest extent since February, companies were buying up materials and laying the groundwork for a stronger summer’s end.

“This resulted in the highest input price inflation since the start of the year as supply chains creaked under the strain of increased shortages.

“Building performance is dependent on other sectors recovering at a similar pace, and as businesses were opening up, some fell short of their usual delivery capacity.

“Only two months ago the construction sector produced the worst results in the history of the PMI, and there are still some potholes to navigate around as Government support for jobs is stripped away.

“Employment levels remained deflated, with reports of redundancies, furloughed staff and a reluctance to boost staff numbers when new order levels remained so flat.

“But with a significant rise in the headline output number, it looks as though all the building blocks are there for the sector’s increasing health.”

.gif)