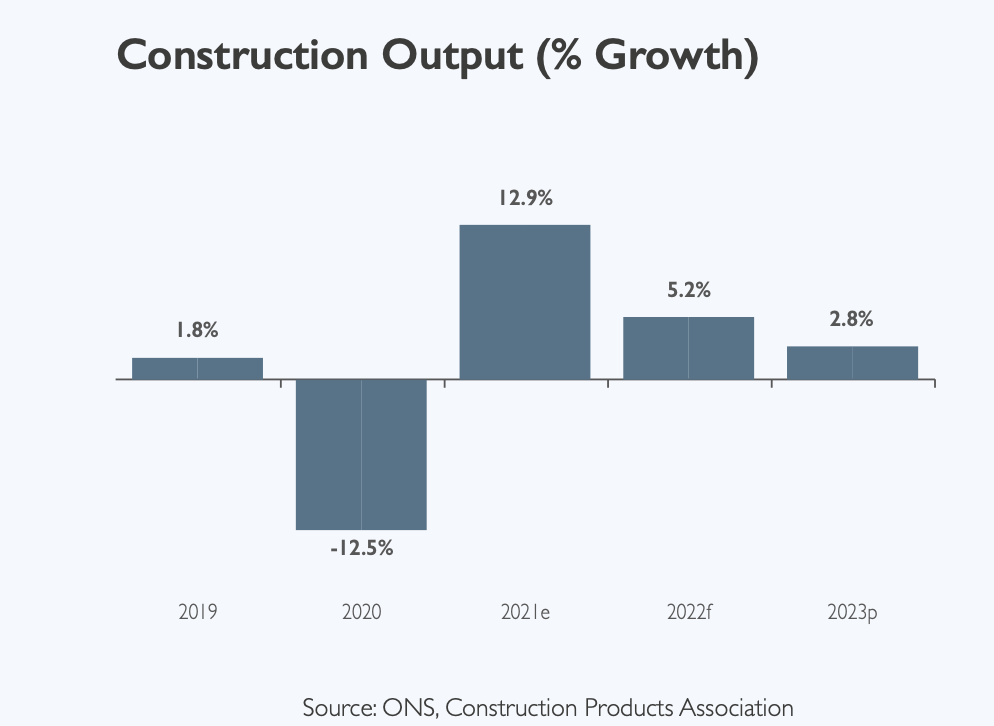

But crystal ball gazers at the Construction Product Association have downgraded growth forecasts slightly fearing impacts from supply constraints for key imported construction products and uncertainty around demand for housing new builds, and commercial space.

Construction activity accelerated in the first quarter of the year, although the story varies from sector to sector.

Infrastructure was least affected by the initial lockdown, and is set to motor ahead 29%, reaching its highest level on record.

This will be driven by activity on major projects such as HS2, as well as activity on long-term frameworks in water, roads, electricity and broadband sectors.

Key points

- Infrastructure output to rise 29% in 2021 and 6% in 2022

- Private housing output rises 14% in 2021

- Commercial output at the end of 2023 to be 10.5% lower than in 2019

- Private housing RM&I to grow by 12% in 2021

- Public housing repair, maintenance and improvement to rise by 15% in 2021

Extensions to the stamp duty holiday, Help to Buy and job support schemes are expected to help sustain demand in private housing and private housing rm&i in 2021.

Private housing is expected to continue its strong recovery with the Chancellor’s mortgage guarantee scheme likely to enable demand in the general housing market.

Coupled with expectations of rising house prices during the year, starts activity is forecast to gather pace in 2022.

CPA economics director Noble Francis, said: “While outlook is largely positive, the recovery in commercial – the third-largest construction sector – is expected to be muted given a lack of major investment in new projects, particularly in Central London.

“Questions remain over future demand of commercial space, particularly in offices and retail, which may be converted into residential or warehousing and logistics, if homeworking and online spending persists in the long-term.

“More notably, however, there are significant risks to the recovery in the form of supply constraints in terms of extended lead times and sharp rises in costs for vital imported products such as paints and varnishes, timber, roofing materials, copper, steel and polymers.

“This may hinder the ability of construction activity to increase in line with our forecast.

“Furthermore, concerns remain whether the high levels of demand for housing new build and rm&i can be maintained after the government stimulus and policy measures end on 30 September, particularly the furloughing and self-employment income schemes and stamp duty holiday.”

.gif)

MPU 300_250px.gif)