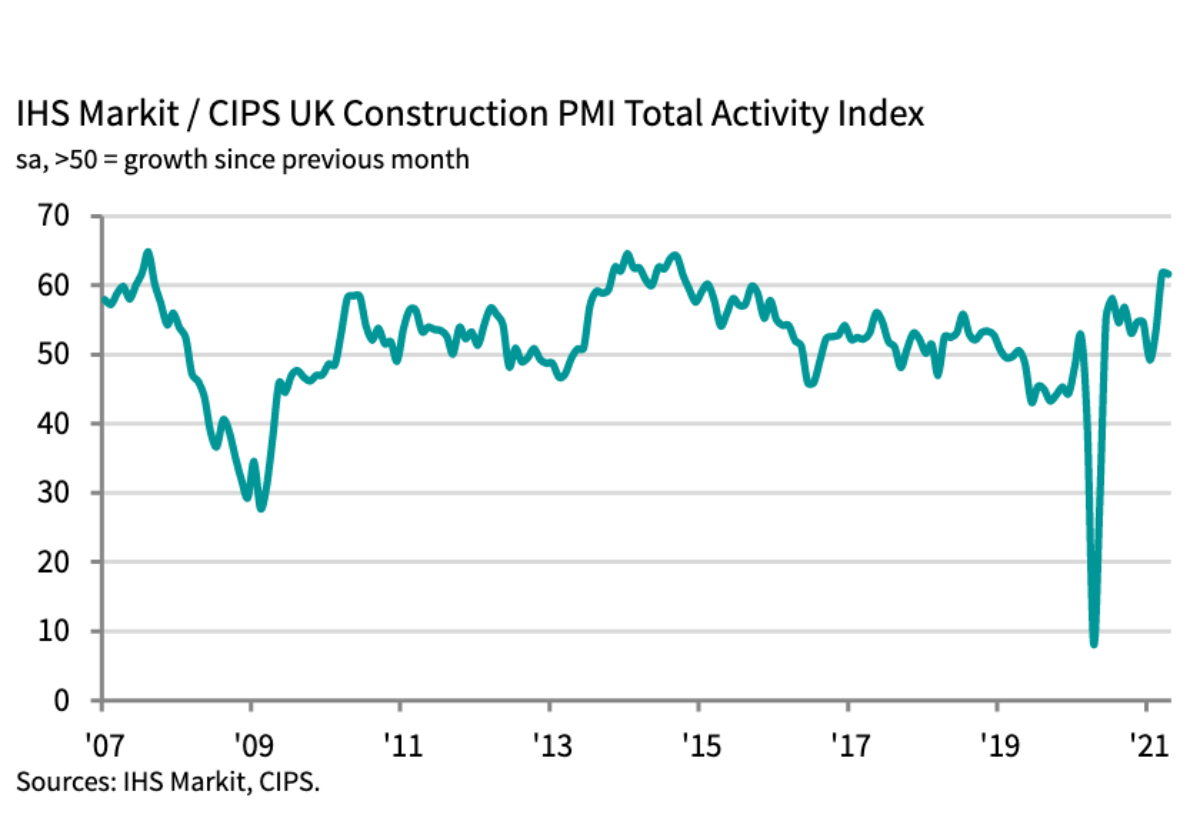

The latest bellwether IHS Markit/CIPS UK Construction PMI Total Activity Index posted 61.6 in April, down only fractionally from March’s six-and-a-half year peak of 61.7.

Any figure above 50.0 indicates an overall expansion of construction output and the index has posted in growth territory in ten of the past eleven months, with January 2021 the exception.

But demand and supply imbalances meant that the rate of input cost inflation picked up for the seventh month in a row to its highest since the survey began in April 1997.

Commercial work was the best performing sector in April with civil engineering enjoying its fastest speed of recovery since September 2014.

A rapid rise in demand for construction products and materials continued to stretch supply chains and the latest lengthening of suppliers’ delivery times was the third-greatest since the survey began in 1997, exceeded only by those seen during the lockdown in April and May last year.

Higher prices paid for a wide range of construction items contributed to the fastest overall rate of cost inflation since the survey began in April 1997 (index at 84.6, up from 77.8 in March).

Steel, timber and transportation were among the most commonly reported items up in price.

Looking ahead, construction companies remained highly upbeat about their growth prospects in April. More than half of the survey panel (57%) expect a rise in business activity during the next 12 months, while only 7% forecast a decline.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply: “The building blocks were in place in April as builders confirmed more work, more job opportunities and strong optimism for the next 12 months.

“The overall growth rate of new business strengthened to the fastest since September 2014 as all three sectors improved and civil engineering the laggard of last year gained the most momentum.

“Issues around supply chain performance acted as a drag on capacity however as supply constraints on essential materials increased to one of the third highest levels since 1997 when the survey began. Brexit issues remained a factor affecting deliveries from the EU and suppliers generally were struggling to meet the sudden rush in demand leading to shortages of basic materials.

“This inevitably led to the sharpest rise in cost inflation in a generation as builders scrambled to catch up on projects but the biggest rise in job creation since December 2015 also followed, signalling sustainable growth in the sector this summer.”

Get all the construction data and work-winning information you need

The Enquirer has introduced a new construction data page offering easy-to-access market intelligence to help your business.

Alongside interactive contracts leagues and daily tender invites, it helps you make informed business decisions with coverage of breaking economic news, latest workload and tender prices forecasts.

There is also a snapshot of current freelance labour rates and a guide to the best and worst payers within the major Tier 1 contractors.

For those looking to navigate the ever-changing world of contract and employment law, lawyers at Fenwick Elliot also give you the benefit of their expert insight.

And, of course, it’s all completely free for readers.

Click here to take a look.

(300 x 250 px).jpg)

.gif)