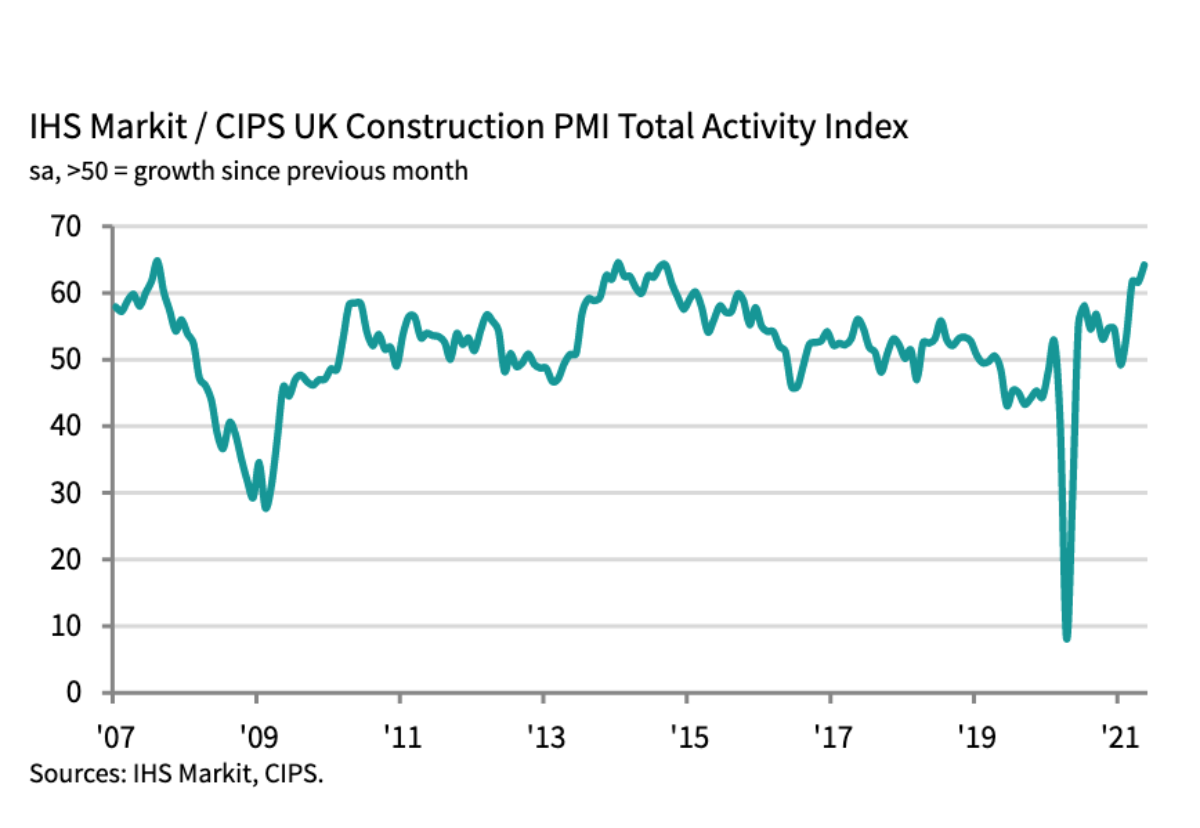

At 64.2 in May – up from 61.6 in April – the bellwether IHS Markit/CIPS UK Construction PMI Total Activity Index registered above the 50 no-change value for the fourth consecutive month and signalled the strongest rate of output growth for just under seven years.

House building (index at 66.3) was the best-performing category of construction activity in May, followed by commercial work (64.4).

The latest increase in work on commercial projects was the steepest since August 2007, reflecting strong demand conditions following the reopening of customer-facing areas of the UK economy.

Civil engineering activity (index at 61.3) also increased sharply during May, although the pace of expansion eased slightly since the previous month.

Suppliers’ delivery times lengthened sharply in May, with the downturn in vendor performance the second-steepest since the survey began (exceeded only by that seen in April 2020).

Stretched supply chains and steep rises in raw material prices contributed to a rapid increase in average cost burdens. The overall rate of input price inflation was the highest in just over 24 years of data collection.

Construction companies remain highly upbeat about their growth prospects for the next 12 months. Around 61% of the survey panel predict a rise in business activity, while just 8% anticipate a decline.

Positive sentiment was mostly attributed to resurgent customer demand, alongside optimism about the UK economic outlook following the successful vaccine roll out.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply said: “The construction sector continued its expansion programme with a phenomenal acceleration in growth and the strongest for seven years as new orders filled in at the fastest rate for almost a quarter of a century.

“Residential work was back in the top spot as house building rose at the quickest pace since August 2014, serving as an antidote to the recent scarcity in housing for lets or buy, and driven by consumer demand and a boost from the stamp duty holiday.

“Busy purchasing managers were under pressure to keep up and buying up at the fastest rate since April 1997, changing sourcing strategies to find depleting essential materials and stocking up just as supply chain problems continued to mount along with prices.

“With inflation for goods and raw materials at a 24-year high, companies will be concerned that much-needed profits will be eaten away as building projects take shape and could be held up by some of the longest delivery times on record.

“Skills shortages are also becoming a problem, with recruiters finding talented labour hard to find, as job creation was at robust levels and the threat of staffing cutbacks has become a distant memory.”

(300 x 250 px).jpg)

.gif)