Results for the half year to June 30 2021 show pre tax profits of £52.4m – up 285% on last year and 48% on 2019 before the impact of Covid-19.

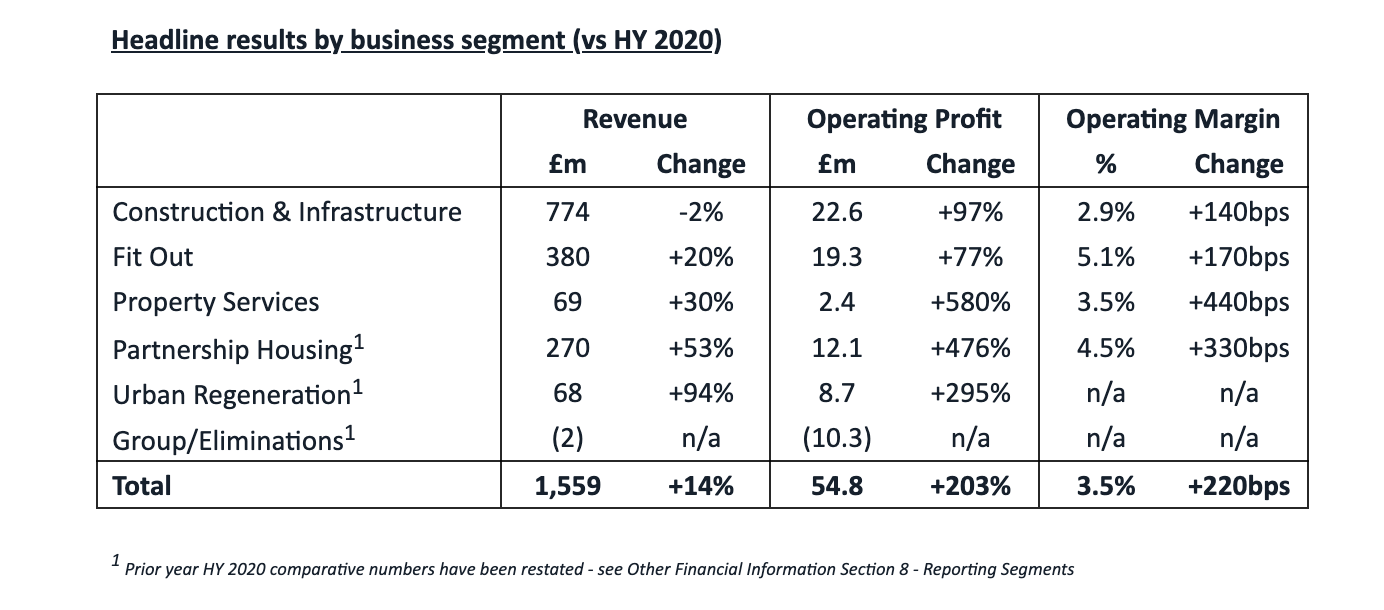

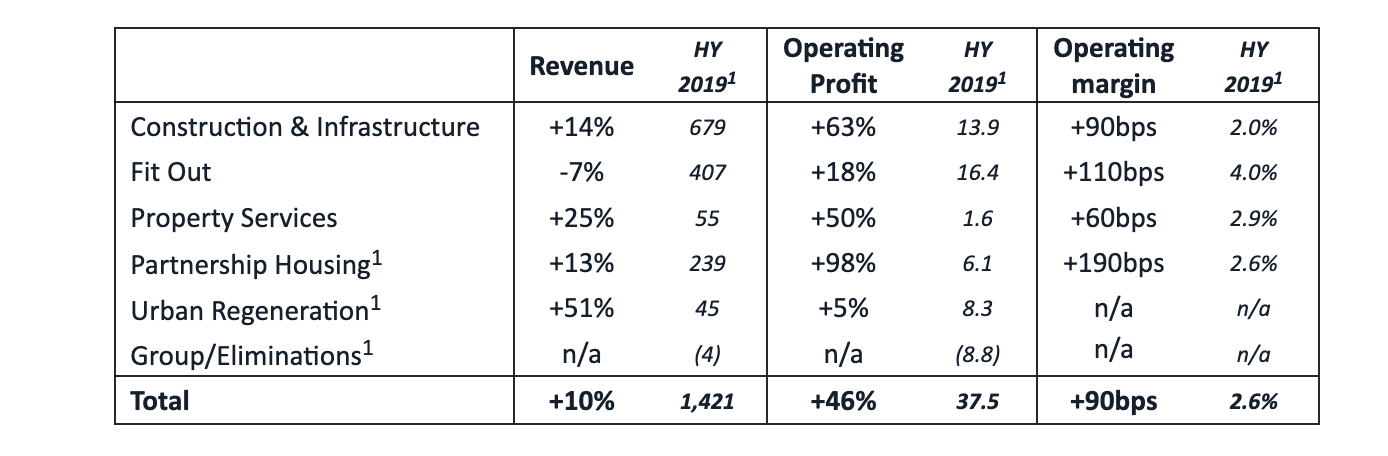

Turnover was up to £1,559m from £1,363m last time and £1,421m in 2019 as net cash rose to £337m at the end of June from £146m last time and £223m in 2019.

Average daily net cash increased significantly to £294m while margins nearly doubled to hit 2.9% in Construction & Infrastructure with operating profit up to £22.6m.

Chief Executive, John Morgan was delighted by the results and expects a continued strong performance for the rest of the year.

He said: “We’ve had a very strong first half in which we’ve upgraded our profit guidance three times. We continue to make significant operational and strategic progress across the Group. With such positive momentum across all our activities, I am excited by the opportunities ahead.

“As ever, we are extremely focused on our cash generation and cash position. Maintaining a strong balance sheet including a substantial net cash position provides a significant competitive advantage for us. It enables us to continue making the right decisions for the business and to best position us in our markets for continued sustainable long-term growth.

“Today’s results, combined with the current visibility for the rest of the year, gives us every confidence of another strong performance by the Group in the second half.”

Morgan Sindall said the company was managing materials shortages currently hitting the industry.

It said: “During the first half, there have been some increases in lead times for product deliveries to site and a limited number of significant price increases in certain product categories where there is greatest scarcity of supply.

“In most instances, the impact of this has been managed at a divisional and local level without any consequent disruption to operations.

“The additional costs attached to sourcing some materials have generally been offset by a combination of contractual protection, operational efficiencies and (in the case of Partnership Housing) by house sales price inflation.

“It is expected that these pressures will normalise in the medium term and that any disruption can be minimised through focused sourcing through the supply chain and ongoing operational efficiency.”

The divisional results compared to last year and 2019 were:

.gif)

.gif)

(300 x 250 px).jpg)