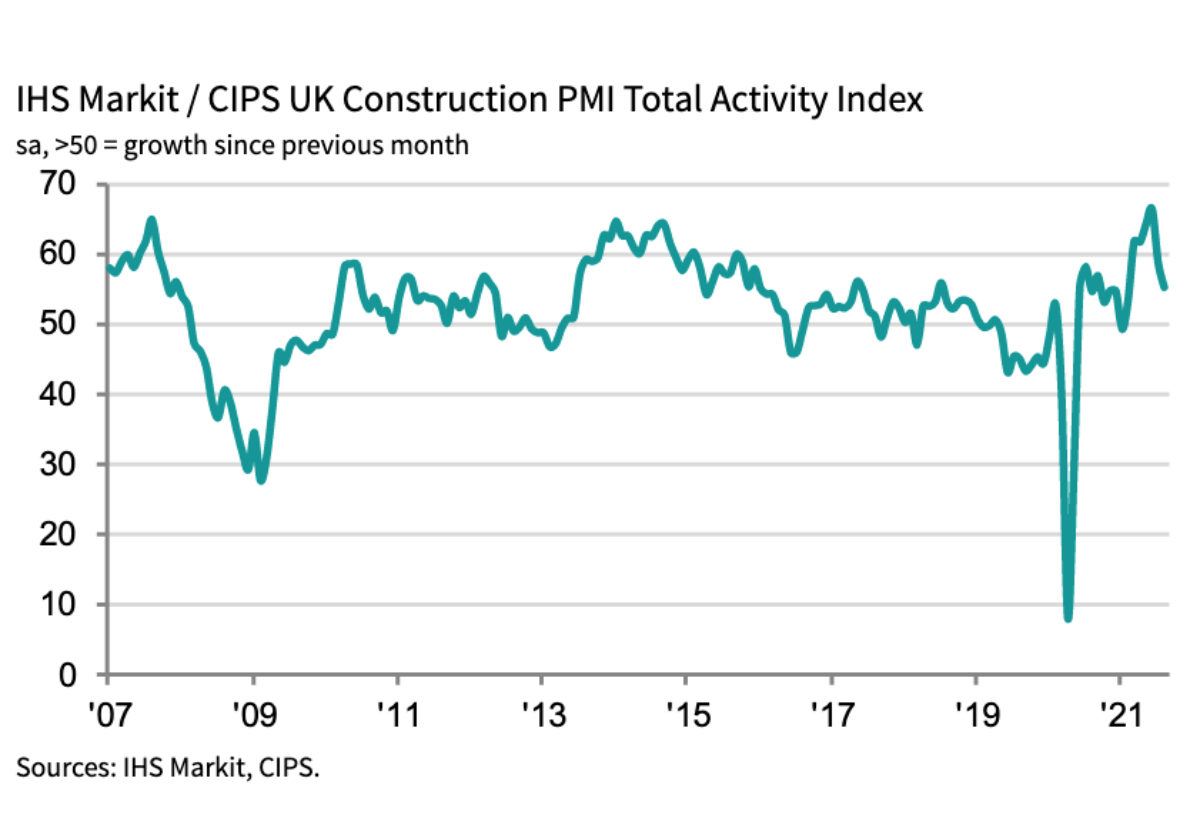

The bellwether IHS Markit/CIPS UK Construction PMI Total Activity Index posted 55.2 in August, down from 58.7 in July, as activity continued its seven-month run of expansion.

But growth rates slowed as supply chain pressures saw cost inflation grow at the second highest rate in the survey’s 24 year history.

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said: “Formidable supply chain pressures restrained purchasing activity and building projects across the board in August as 68% of construction companies reported even longer delivery times for materials compared to July.

“A combination of ongoing covid restrictions, Brexit delays and shipping hold-ups were responsible as builders were unable to complete some of the pipelines of work knocking on their door.

“Material and staff costs went through the roof as job hiring accelerated to fill the gaps in capacity left behind by employee moves, overseas worker availability and brought on by skills shortages.

“Paying higher wages for experienced staff along with low stocks of materials at suppliers meant inflationary pressure rose at a rate almost on a par with June’s survey record. 84% of supply chain managers reported paying more for their purchases.

“These obstacles to construction’s progress are set to continue and are now affecting last year’s strongest performer – house building, which will exacerbate the problem of housing supply.

“However optimism improved on last month as more than half of building firms believe that output will continue to rise in the year ahead.”

Usamah Bhatti, Economist at IHS Markit, which compiles the survey said: “Evidence that the UK construction sector began to feel the impact of ongoing supply chain disruption was widespread midway through the third quarter of 2021.

“Growth rates for overall activity as well as the three monitored subsectors eased further from the recent highs earlier in the summer.

“Similarly, new business inflows have continued to increase at a marked pace, yet even here the rate of growth has eased to a five-month low.

“Supply chain disruption continued to disrupt activity across the UK construction sector, as demand for materials and logistics capacity outstripped supply.

“Average vendor performance continued to deteriorate at a near-survey record rate, as firms noted severe shortages of building materials, a lack of available transport capacity and long wait times for items from abroad due to port congestion.

“As a result, the rate of input cost inflation faced by construction companies accelerated to the second-fastest on record, while the increase in subcontractor rates hit a fresh series high, fuelled by supply shortfalls in the sector.

“Despite this, businesses noted a stronger degree of optimism regarding the year-ahead outlook, as more than half of survey respondents predicted a rise in activity.

“This was underpinned by expectations that new contracts would be brought to tender across the construction sector as markets continued to recover from the economic disruption caused by the pandemic.”

.gif)

(300 x 250 px).jpg)