The small 0.2% fall in August was down to contraction of the refurbishment and maintenance sector with new work remaining flat at the same level as July.

Government economists at the ONS said anecdotal evidence suggested supply chain issues were a key factor behind falling GDP.

Many firms said that order books were healthy but the availability of products was impacting on projects currently underway.

Mark Robinson, group chief executive at procurement body SCAPE, said: “A decline in output highlights a telling loss of momentum across the construction industry, as energy costs, labour shortages and fast-rising material prices continue to paint a concerning picture heading into winter.

“With attention turning to this month’s Budget and Spending Review, the industry will be considering how best to mitigate these challenges when it is handed the baton to deliver more of the community-focused regeneration needed to deliver on the government’s ‘Levelling-Up’ ambitions.”

Mark Markey, Managing Director of civils contractor Akela Group, said: “It is disappointing that the monthly output has fallen, however this is not reflective of what we are experiencing at Akela Group.

“Instead, we are seeing growing levels of demand for a wide range of ground engineering and civil engineering services, and in fact this appetite has been a key driver in our recent expansion into the English market.

“Our new North of England hub in Leeds is well placed to meet this growing demand, especially in the house building sector.”

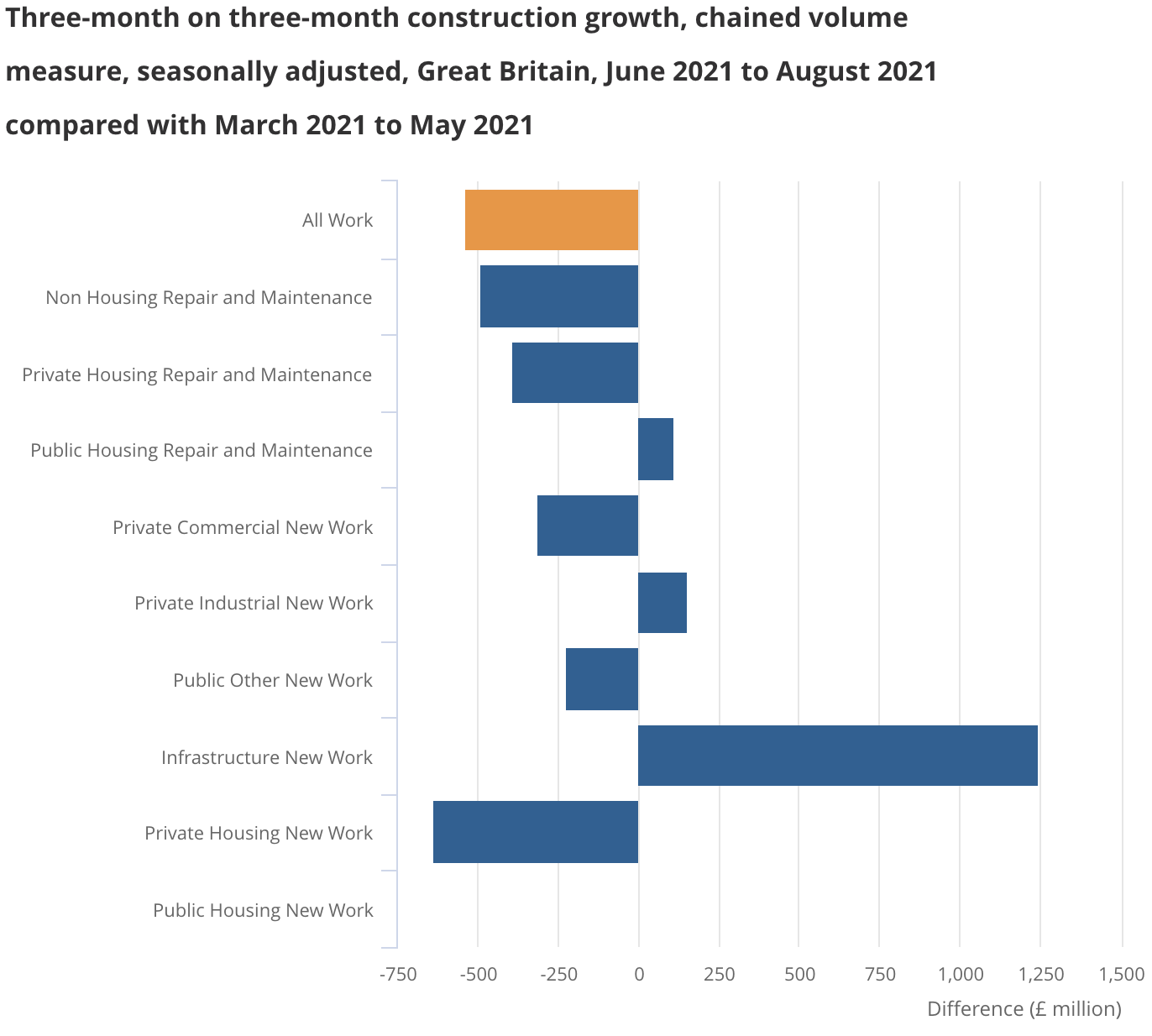

According to the three-month trend figures infrastructure, industrial and public housing repair and maintenance were the only three sectors to see growth.

Latest cost figures for building materials in August show prices increased by 2.8% compared with July and 23.5% compared with a year ago.

Specific construction materials with the greatest annual price increase in August were imported plywood (78.4%), fabricated structural steel (74.8%), and imported sawn or planed wood (74.0%).

.gif)