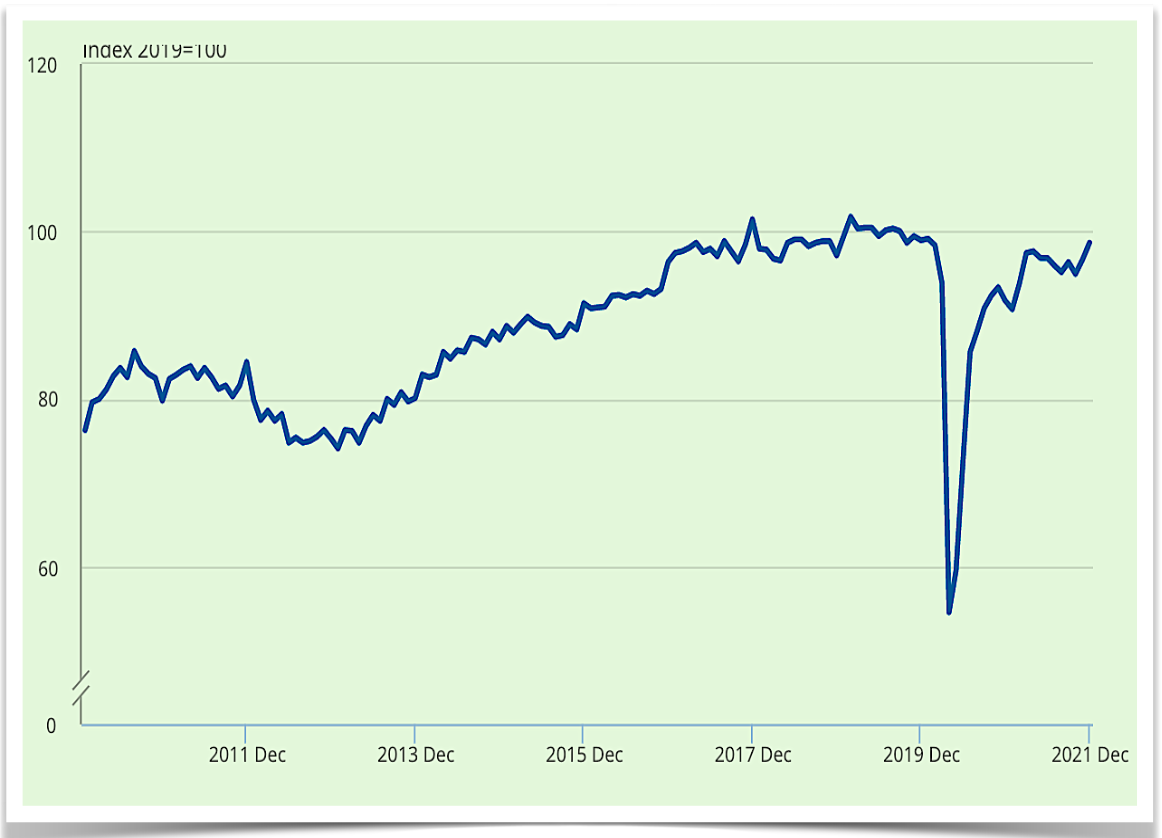

Official figures from the Office of National Statistics show construction enjoyed an r-shaped rebound in output from the pandemic, helped by the industry’s big effort to return to work after the first shutdown.

Latest orders figures also indicate the growth trend is set to continue albeit at lower rates despite inflationary pressures.

In the last quarter of 2021, total order levels jumped 9.2% on the previous three months.

The latest data records construction inflation running at 6.2%, although steel, timber and concrete far exceeded the all-industry rate.

New housing suffered the highest price inflation rate of all industry sectors at nearly 10%, ahead of the 5% cited by the major volume house builders.

Mark Robinson, group chief executive at procurement body Scape, said: “December was characteristic of a year in which the construction industry largely overcame the odds; particularly in relation to rising Omicron cases, labour and material shortages.

“But, with the final Covid restrictions set to be lifted soon, concerns around rapid and sustained inflation – furthered by soaring energy costs – have no doubt taken its place and look likely to pose a sustained threat to growth prospects in 2022.

“Mitigating the impact of these inflationary pressures will require extensive, ongoing dialogue and collaboration between clients, contractors and their supply chains – qualities that frameworks aspiring to the ‘gold standard’ must embed.

He added: “Crucially, it’s important that payments are prompt and that any increased cost burden continues to be shared, rather than passed on to the supply chain. These firms are most vulnerable to cashflow challenges, but critical to the delivery of projects.”

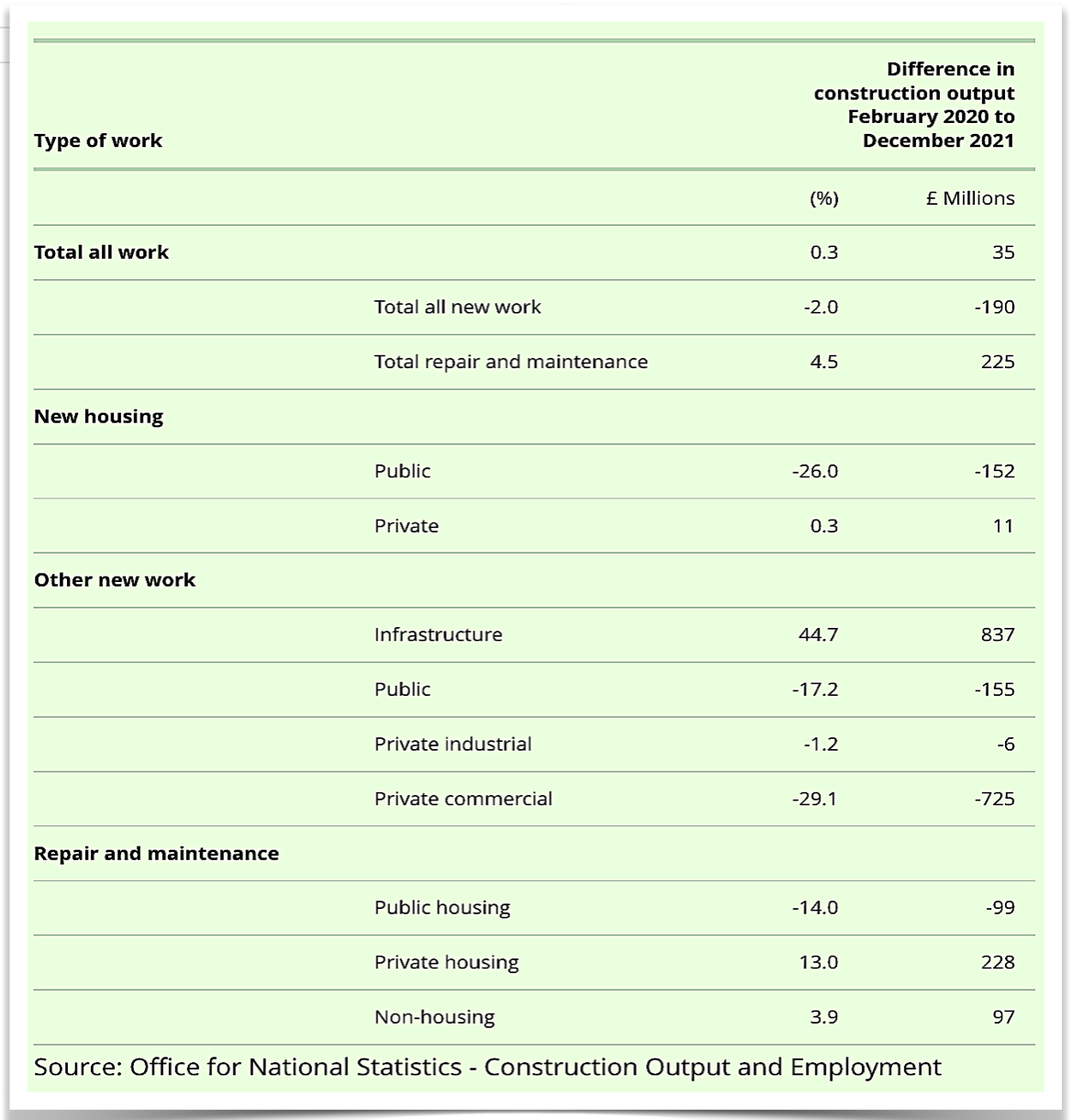

2021 year-end output compared to pre-pandemic level

Most of the overall industry recovery is down to the strength of infrastructure, which is running 45% above the February 2020 pre-pandemic output level.

Private house building was also up 13%.

A rise in repair and maintenance activity also helped to offset a new work lag which is still down 2% on the pre-pandemic level, for the main part due to a slower recovery in private commercial activity.

.gif)