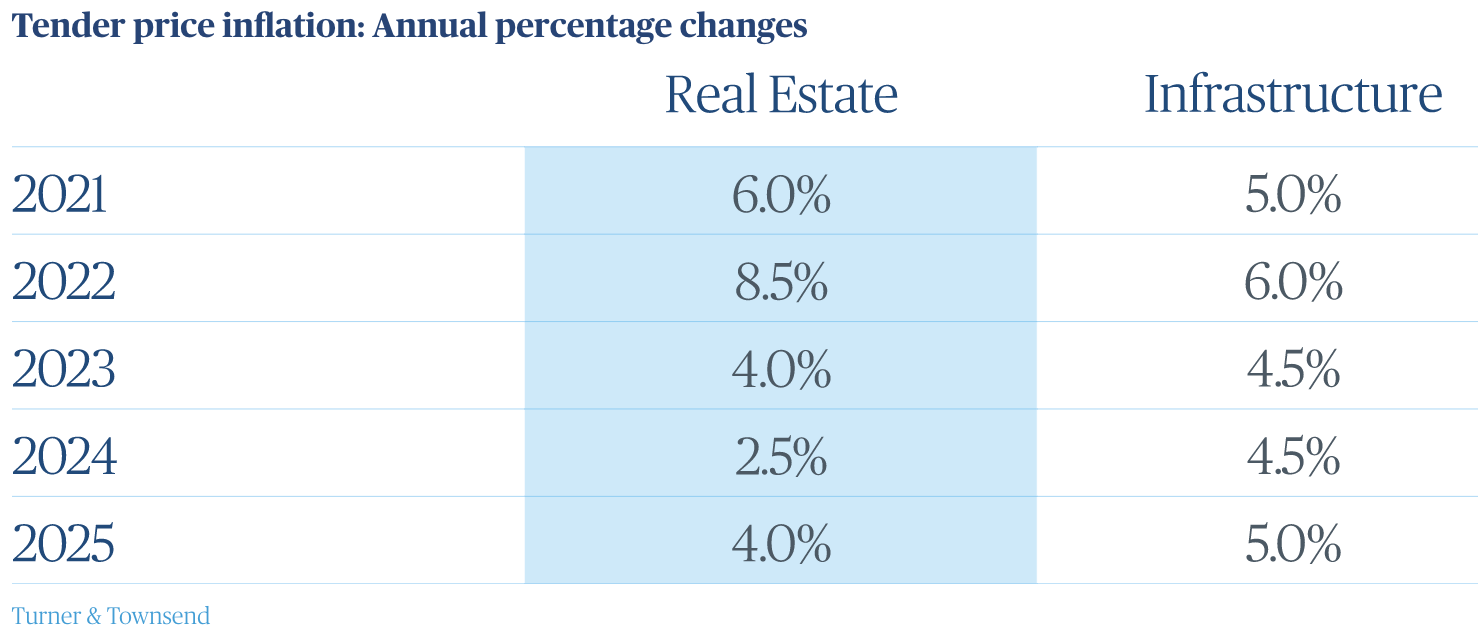

In the face of soaring energy prices exacerbated by the conflict in Ukraine, cost consultant Turner & Townsend has nearly doubled forecast tender price inflation for buildings from its Winter 2021/22 prediction of 4.5%.

Infrastructure is also set to see bid prices rises of 6%, compared to the previous forecast of 4%.

And cost experts are warning that firms seeking to stockpile materials to offset sharp prices rises could inadvertently trigger price bubbles and needless shortages. – as happened when consumers panic-bought at the start of the UK’s first lockdown.

T&T’s latest UK Market Intelligence Report (UKMI) said clients and contractors should prioritise securing a resilient supply chain and getting the basics right to guard against further shocks.

It said in many cases contractors are now adding significant risk allowances on projects that are currently being tendered to compensate for market volatility and price fluctuations.

But in what could be a roller coaster ride, T&T warns that while inflation will be rampant for much of the year, interest rate rises and clients putting projects on ice in the face volatile conditions could lead to a contraction in the market in late 2022 and 2023, in a worse case scenario.

Martin Sudweeks, UK managing director of cost management at Turner & Townsend said: “Now is the time for calm, clear and programmatic thinking – focusing on setting up projects for success with full recognition of challenging cost pressures and a plan to manage them that starts with getting the basics right.

“Contract scrutiny needs to be front and centre. Businesses must avoid panicked procurement in the hope of locking-in pricing, instead taking time to eliminate ambiguity that can be a bigger risk than inflation itself.

“This is about picking the best team and ensuring you have capable and resilient contracting partners. Clients should map out the supply chain and identify weak links, then work to eliminate risk and where necessary share the burden of disruption. Those that successfully diversify their supply chains and build strong relationships with trusted suppliers will maximise resilience and benefit most long-term.”

As a result, our tender inflation forecast for 2022 is now higher than the already high levels of inflation seen in 2021. Prices may peak over the next three months and then see some partial unwinding as the year progresses and markets begin to stabilise.

.gif)

(300 x 250 px).jpg)