It is the first time private commercial work has emerged as a growth driver since the pandemic, recording a 4% rise in March.

Private housing repair and maintenance also saw strong growth up nearly 6%.

Together these sectors drove a 1% rise in new work and a 3% uplift in both repair and maintenance.

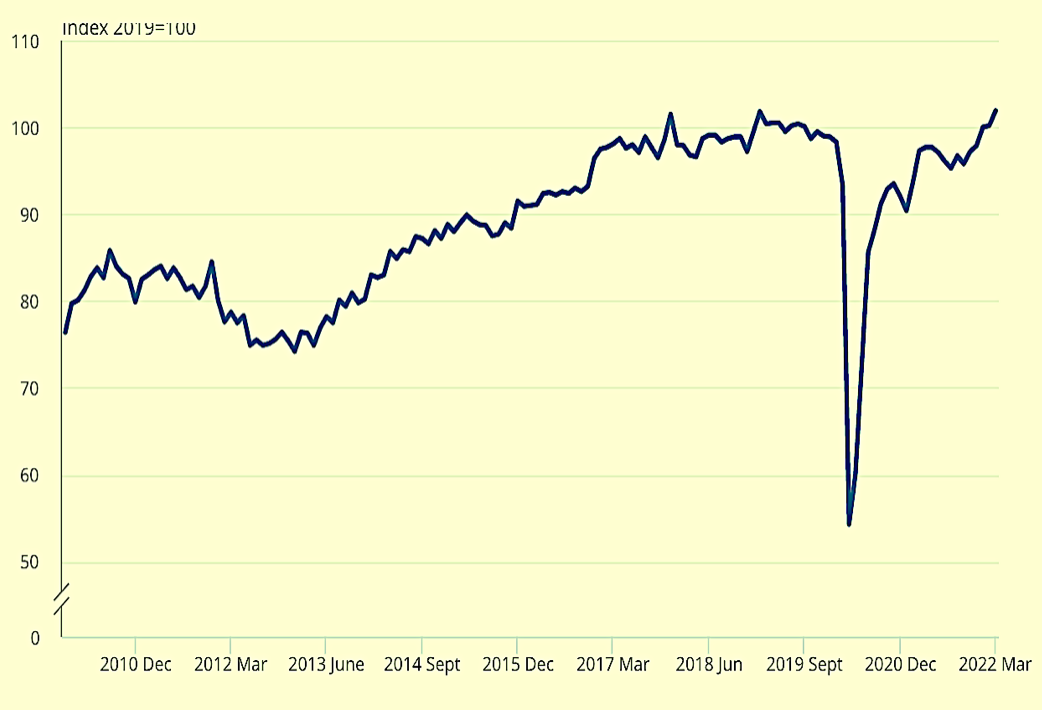

Across the first quarter (Jan-Mar) output rose 3.8%, notable as the strongest quarterly growth since outside the pandemic period since the first quarter in 2017.

But total construction new orders decreased by 2.6% in the first quarter from the last three month in 2021.

Mark Robinson, group chief executive at procurement group SCAPE, said: “A return to growth in March typifies the resilience of the industry, which continues to capitalise on the current elevated levels of demand despite the impact of runaway inflation.

“But contractors are in no doubt that these pressures will soon begin to impact the speed at which projects are commissioned as clients await greater price stability.

“With the public sector continuing to prove a reliable source of opportunities, contractors will be looking to the Levelling Up and Regeneration Bill, announced in the Queen’s Speech on Tuesday, to stimulate a new wave of investment. Coupled with the standard-raising procurement bill proposed, this parliament has the potential to be transformational for community-focused construction.”

Clive Docwra, managing director of property and construction consultancy McBains, said: “Today’s figures show that the industry rallied in March, in part due to new orders coming in from pent-up demand left over from the pre-pandemic period.

“However, inflationary pressures are beginning to bite hard, with interest rate rises, the war in Ukraine and the rising cost of materials contributing to uncertainty about the future.

“March’s increase in output was helped by the return to work of offices, as demand for refurbishments increased. The increase was also propped up by repair work due to the previous month’s storms.

“Other work areas are less robust, however. The cost of living crisis means the private housing sector is particularly at risk, as steep falls in disposable incomes will translate into less demand for new homes.

“The wider longer-term picture is a concern, as total new orders fell by 2.6% in the first quarter of 2022 compared to the last quarter of 2021.”

.gif)

(300 x 250 px).jpg)

.gif)