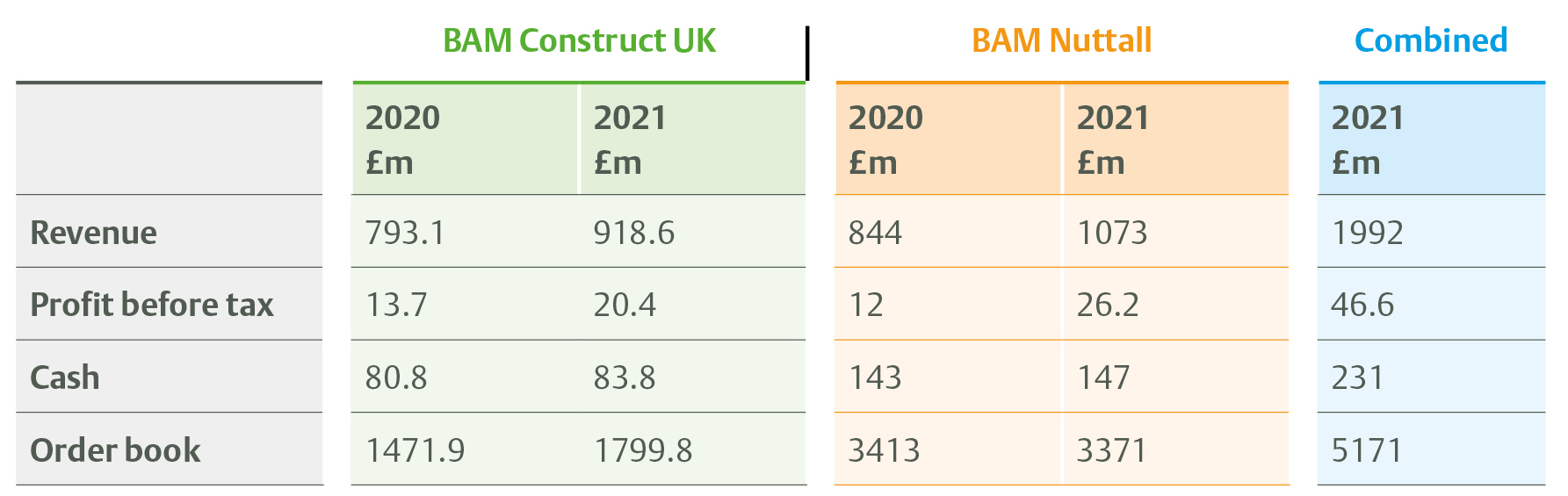

The strong business recovery saw revenue also jump by a fifth to almost £2bn, with orders topping £5bn for the first time.

John Wilkinson, chief operating officer for BAM UK and Ireland, said: “2021 was the first year of Royal BAM Group’s three-year strategic plan to create a more predictable, profitable and sustainable company, and to build a more sustainable tomorrow.

“BAM in the UK had a positive year in both construction and civil engineering.

“We improved our financial performance, grew our order book and have provided an excellent platform for future growth in our structure and operations. We achieved this despite the well-known international economic challenges.”

Civil engineering arm BAM Nuttall delivered the strongest performance of the two UK businesses with revenue up 27% to top £1bn for the first time.

Despite cost pressures, Nuttall continued to make progress in restoring its margin from 1.4% to 2.4%, with pre-tax profit more than doubled to £26m.

Ian Parish, executive director, BAM Nuttall said: “We have continued our success for winning future work, closing the year with a £3.4 billion order book. Our results demonstrate a prudent growth strategy, securing sustainable revenue through selective tendering with our strategic clients.”

BAM’s UK construction and property business also enjoyed a strong improvement last year, achieving an operating margin of 2.1% after a dismal 2020 impacted by its problem University of Sheffield job where BAM was forced to tear down the concrete frame of its £65m Faculty of Social Sciences project.

BAM Construct UK increased turnover by 16%, to £919m, while increasing profit before tax by almost 50% to £20m.

James Wimpenny, executive director, BAM Construction said: “BAM Construct UK maintained its strategy of forming long-term strategic alliances with clients who share our values of collaboration and who are interested in leveraging the benefits of digital construction, and new methods such as off-site fabrication and sustainability.

“We won £1.1bn of new work in 2021, and we aim to maintain a balanced portfolio, across both the public and private sector, as well market sectors such as commercial, education and health.”

(300 x 250 px).jpg)