Construction insolvencies have risen by 72% year-on-year, according to to cost consultant Turner & Townsend.

And the consultancy said it is now advising clients to take a pragmatic approach to project and programme delivery to help tackle both inflationary and insolvency threats.

Contractors that were at risk of insolvency before Covid struck now look increasingly exposed warns T&T in its latest Market Intelligence report.

Martin Sudweeks, UK managing director of cost management at Turner & Townsend, said that a potential return of rising insolvencies showed economic reality catching up with the sector, following the end of the furlough scheme last September, and the end of the temporary easing of insolvency rules in March.

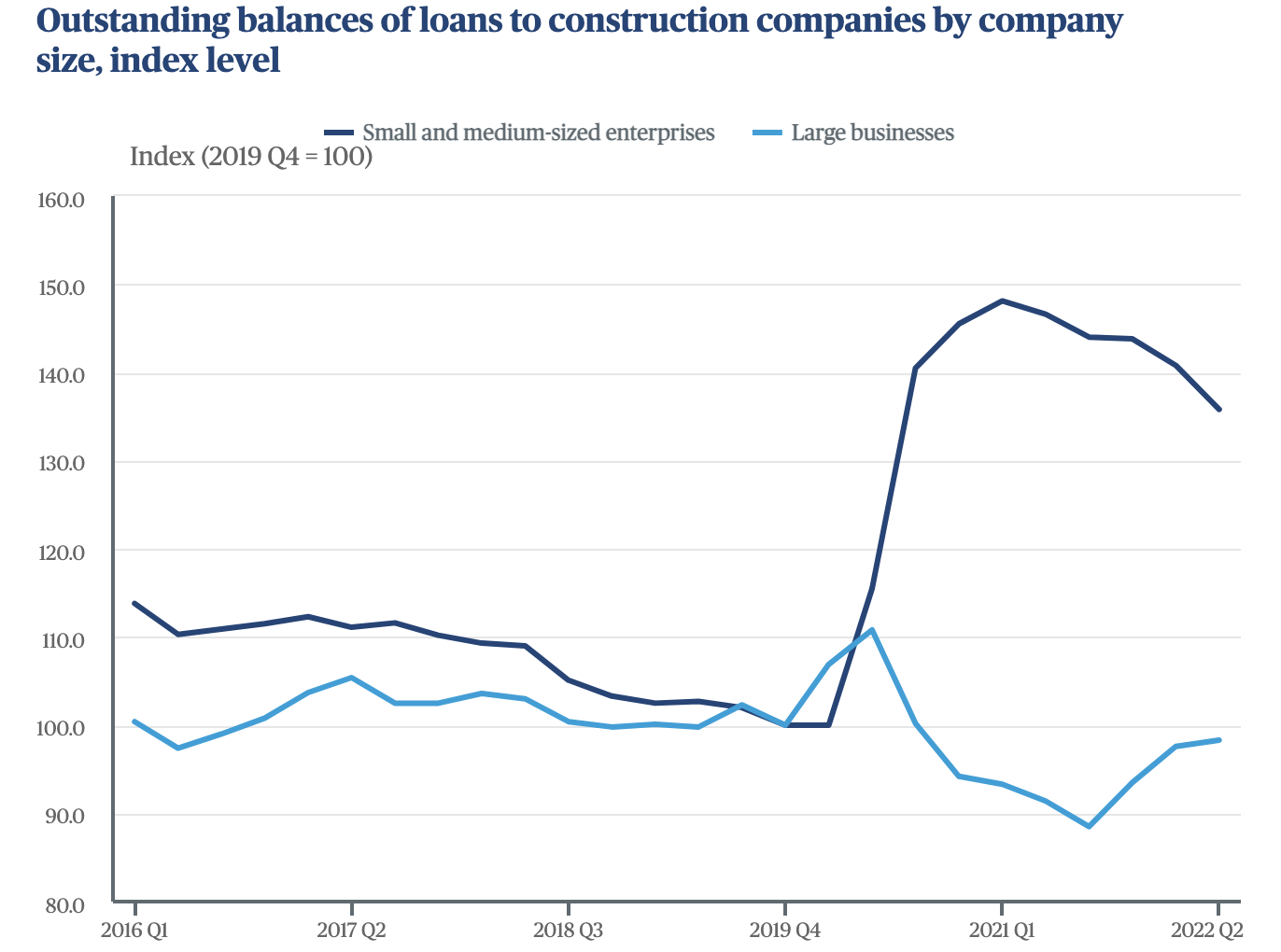

The pandemic led many businesses to accrue debt, but the burden has fallen disproportionately on SME’s rather than large companies.

Since Q1 2020, SME’s balance of outstanding loan payments has increased by 36%, while large businesses saw their balance fall by 8%.

Sudweeks added: “Businesses need to be more alert to insolvency risk across their supply chains as the long-term impact of the pandemic begins to sink in, and the fiscal crutches offered by government are removed.

“It’s essential to spot the tell-tale signs of insolvency risk early – those include low productivity, difficulty securing labour or materials, and failure to pay suppliers. To be prepared, build trust and open communication within your supply chain.”

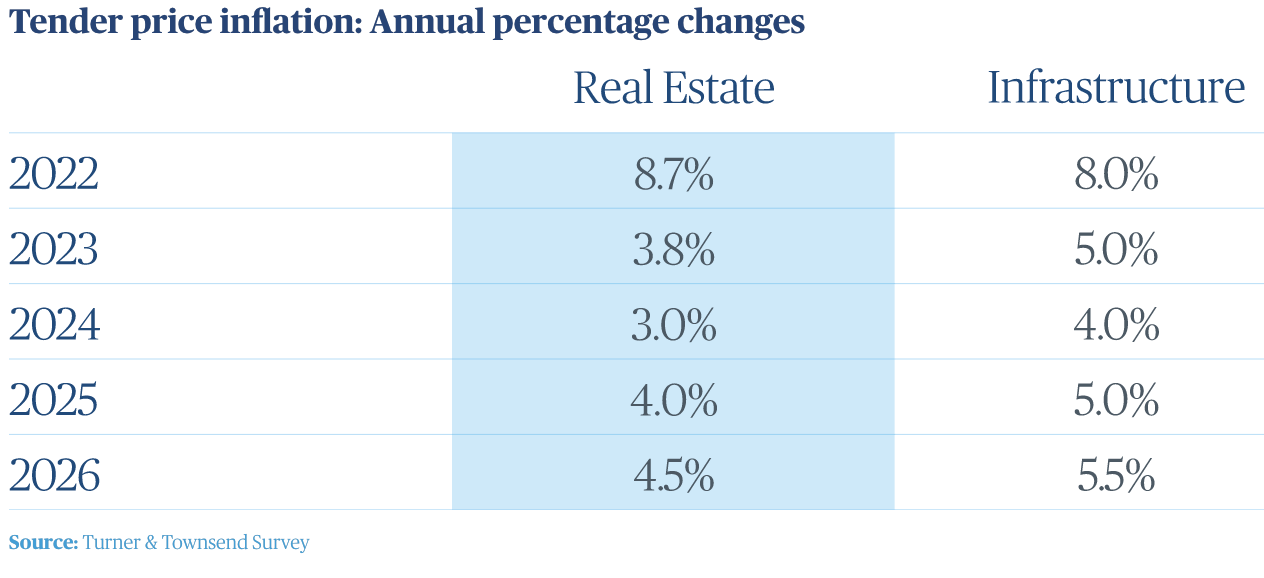

In the report, Turner & Townsend has revised its tender price inflation forecast for this year, now up to 8.7% for building work compared with the spring forecast of 8.5%. Although tender price inflation is now expected to ease more in 2023 falling to 3.8% for real estate.

Across the infrastructure sector, the situation is more pressured, with the cost consultant raising estimates for 2022 up to 8% compared with the 6% forecast in Spring’s report.

In 2023 the forecast has also been raised to 5.0%, up from Spring’s 4.5 percent, and remains elevated into 2026 at 5.5%.

.gif)