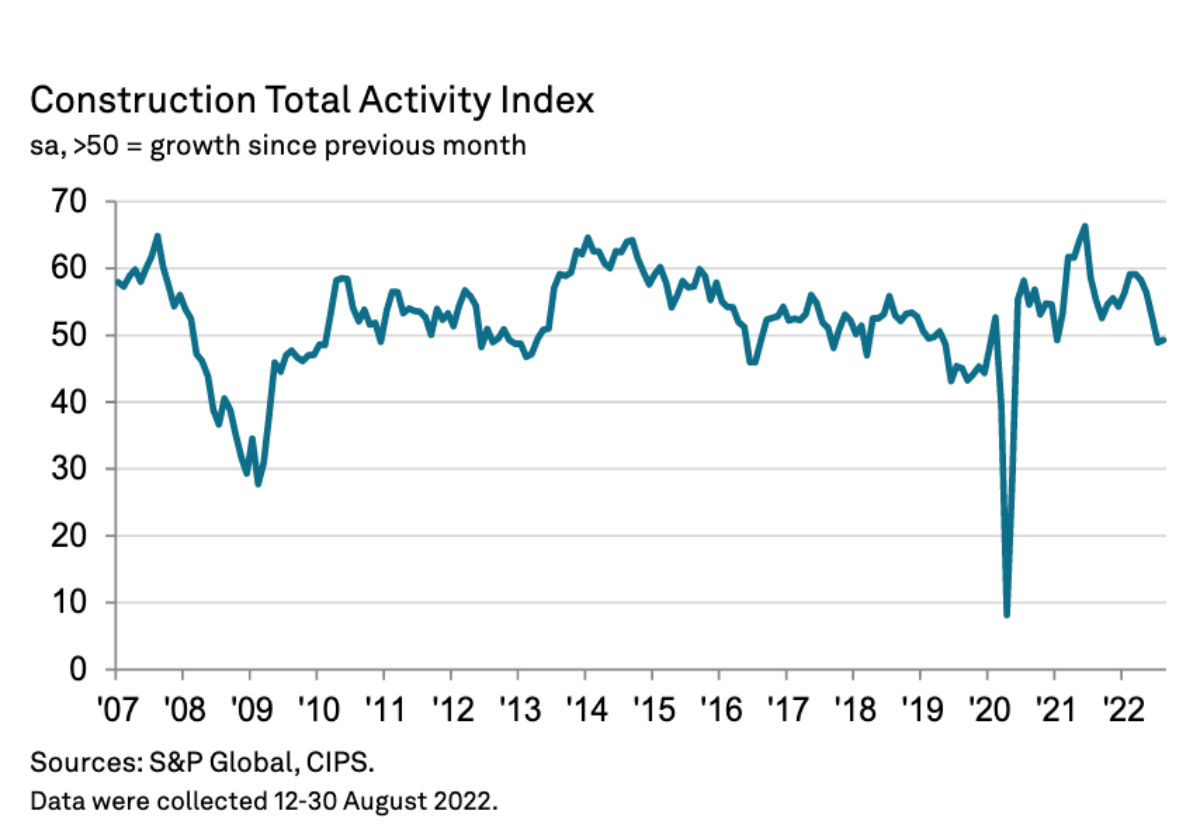

The index was up slightly at 49.2 for August from 48.9 in July but still below the crucial 50 no-change mark signalling another reduction in construction activity over the month.

Civil engineering posted the sharpest decline in activity while commercial work also declined ending a period of growth stretching back for a year-and-a-half and activity on housing projects increased for the first time in three months.

New orders increased only marginally in August and at the lowest rate since June 2020.

Andrew Harker, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “The UK construction sector looks set to be in for a challenging period, according to the latest PMI data.

“Not only did construction activity fall for the second month running, but a range of indicators from the survey pointed to further weakness ahead. New orders slowed to a crawl, while concerns about the sector and the wider economy led to a drop in confidence.

“Activity weakness was broad-based in August, with none of the three monitored categories immune to the wider slowdown.

“Commercial activity dropped into contraction for the first time in just over a year-and-a-half, and while housing activity ticked higher, the segment has been in broad stagnation over the past three months.

“Price and supply pressures showed further signs of easing as waning demand throughout the sector lifted pressure on suppliers.

“Meanwhile, the main positive from the latest survey was a solid increase in employment.

“That said, hiring at least in part reflects an ongoing catch-up following the pandemic. If activity continues to fall, firms will likely soon feel that their staffing capacity is sufficient and pause hiring.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “The UK construction sector is poised for contraction once again as rising prices for raw materials worldwide filtered into UK supply chains.

“Just 14 months since the sector’s recent peak as part of the recovery from the pandemic, inflation is seeing housing and commercial building stagnate with civil engineering activity dropping significantly.

“There is some consolation for the sector as it readies itself for a future of high energy costs, however.

“Lower demand is leading to fewer purchases, downward pressure on input costs and more responsive supply chains.

“Together, these trends could eventually help to reverse inflation, but a prolonged dip in new orders will be a bitter pill for the sector to swallow.”

(300 x 250 px).jpg)