But the firm predicts the looming slowdown will not be a ‘blow-out’ like the 2008-2012 crash.

The industry instead is likely to experience a prolonged but shallow downturn rather than a hard landing in the face of present economic headwinds as the demand-side proves more resilient than the past.

In its Autumn market and tender forecast, entitled ‘Energy Sapping’, Arcadis warns the overall picture of inflationary pressure shows no signs of easing, with material price increases continuing as the main driver.

While there is evidence of price stability emerging, this is threatened by spiralling energy costs which, even with government support to keep prices at current levels, are likely to impact the costs of basic material production and their availability.

According to Arcadis, this means the high inflation of the first half of 2022 will remain baked-in.

The cost-of living crisis will also sustain upward pressure on labour costs fueling catch-up pay demands in 2023 and beyond.

These strains are starting to show with total construction orders falling by 10.45% in Q2 on the previous three months, the largest quarterly fall since Q4 2020.

Key points

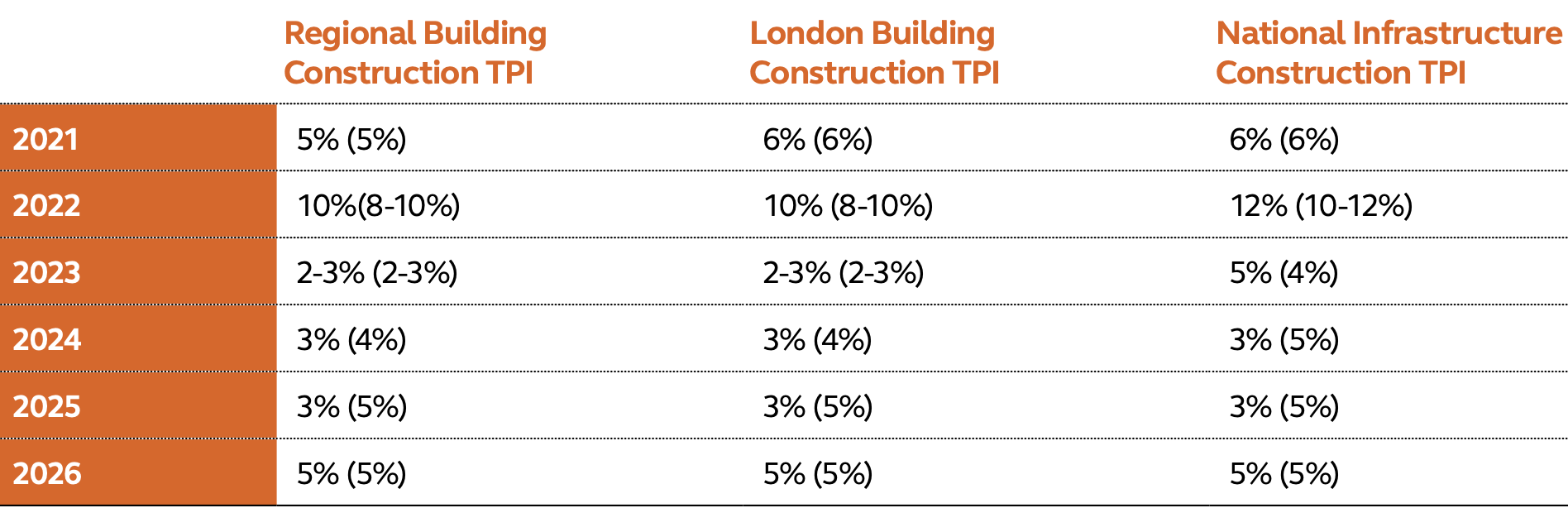

- Tender price inflation forecast is confirmed at 10% for buildings and 12% for infrastructure this year

- Next year building tender inflation to drop to 2-3%, infrastructure revised up from previous forecast to 5%, in recognition of high background demand and potentially greater exposure to material cost inflation

- For 2024-2025, inflation forecasts have been reduced to account for the expected greater levels of competition across all sectors, however prices will remain high despite the weaker outlook for workload

Simon Rawlinson, Head of Strategic Research & Insight at Arcadis, said: “While confidence in the construction market has remained more robust than the consumer market, it’s clear that the current cycle has peaked and we’re entering a period of slowdown.

“However, just how severe the slowdown will be, and whether it will bring down costs, remains uncertain.

“There are certainly signs that commodity prices are falling, but rising energy costs are baked-in, and their full impact yet to be felt.

“Therefore, we expect inflation to continue to be felt throughout the next 12-months and the effects of increased competition to eventually see inflation slow in 2024-25.”

.gif)

(300 x 250 px).jpg)

.gif)