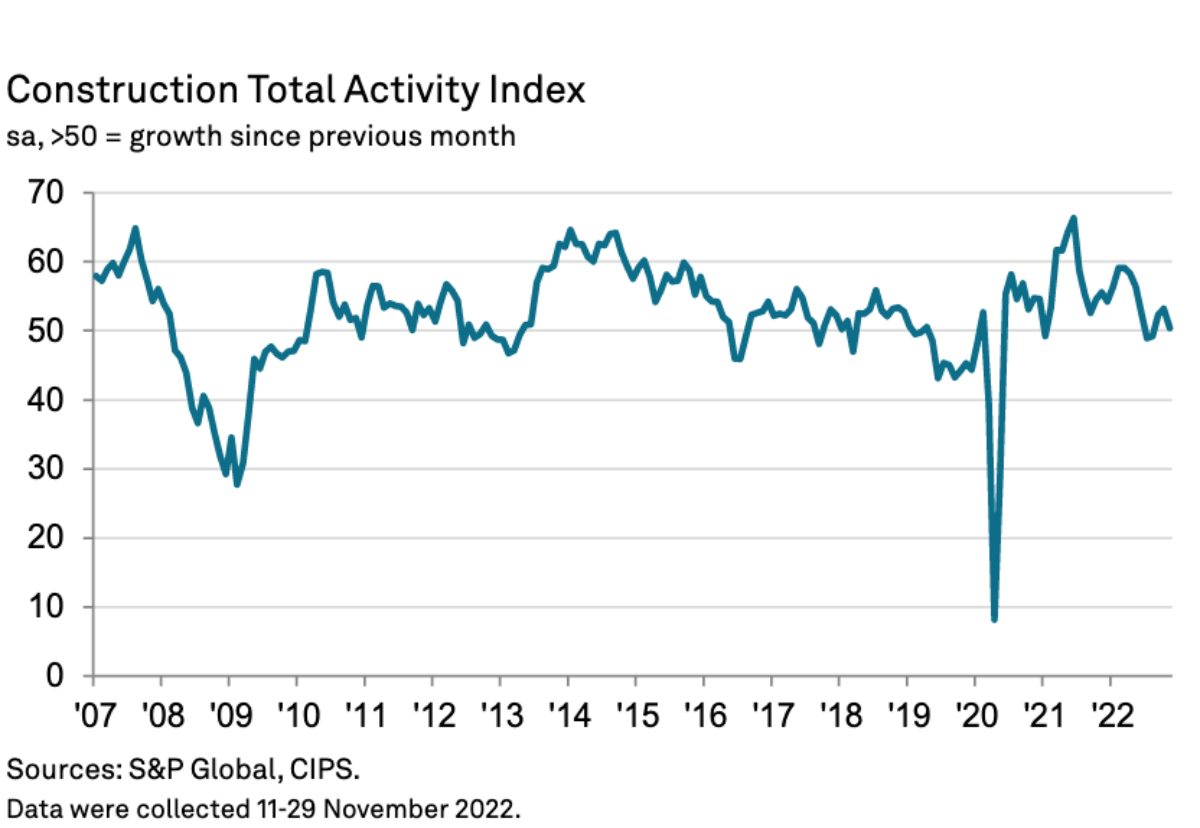

The latest bellwether S&PGlobal/CIPS UK Construction Purchasing Managers’ Index shows expectations for business activity growth during the year ahead dropped to the lowest level since May 2020.

That previous low was back in the days of the start of the pandemic and those times aside the degree of positive sentiment was the joint-weakest since December 2008.

The activity Index recorded 50.4 in November down from 53.2 in October but still above the crucial 50 no-change threshold.

Commercial work was the only sector to record a rise as house building stalled and civil engineering drooped.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “Stalling house building activity contributed to the weakest UK construction sector performance for three months in November.

“Survey respondents noted that new residential building projects had been curtailed in response to rising interest rates, cancelled sales and worries about the economic outlook.

“Construction growth was largely confined to the commercial segment, but even here the speed of expansion slowed considerably since October as client confidence weakened in response to heightened business uncertainty.

“At the same time, a lack of new work to replace completed projects resulted in another fall in civil engineering activity.

“The number of construction firms anticipating a rise in overall business activity during the year ahead exceeded those forecasting a decline by only a very fine margin during November.

“Moreover, disregarding a three-month period of negative sentiment at the start of the pandemic, our survey measure of business expectations across the construction

sector was the joint-weakest since December 2008.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “The small uplift in activity in November did little to dispel builders’ fears about the future as optimism fell to the same level as December 2008 during the last recession and to one of the same lows seen during the pandemic.

“This gloomy view was fuelled in part by continuing shortages of key materials such as steel and timber along with skilled labour, affecting job hires which rose at the slowest pace since February 2021.

“As new order growth remained below the 2022 average to date, builders were becoming hesitant about hiring too many labourers and there was some mention

of shedding jobs over fears of the strength of the economy in 2023.

“Overall, it was civil engineering that remained steadfastly stuck in the mud, with the fastest fall in activity since August. Client hesitancy, concerns around the cost of materials and doing business weighed heavily on the sector which recorded the fifth consecutive monthly fall in activity. Residential building also appears to have run out of steam as greater borrowing costs continue to dampen demand.

“Purchasing activity remained buoyant as businesses concerned about higher costs and potential delays reportedly ordered more than they needed, with delivery times

increasing for the fourth consecutive month. Construction companies now have a tightrope to walk in terms of being ready for recovery and cautious around investment until the road is clear for sustainable building opportunities ahead.”

.gif)

(300 x 250 px).jpg)

.gif)