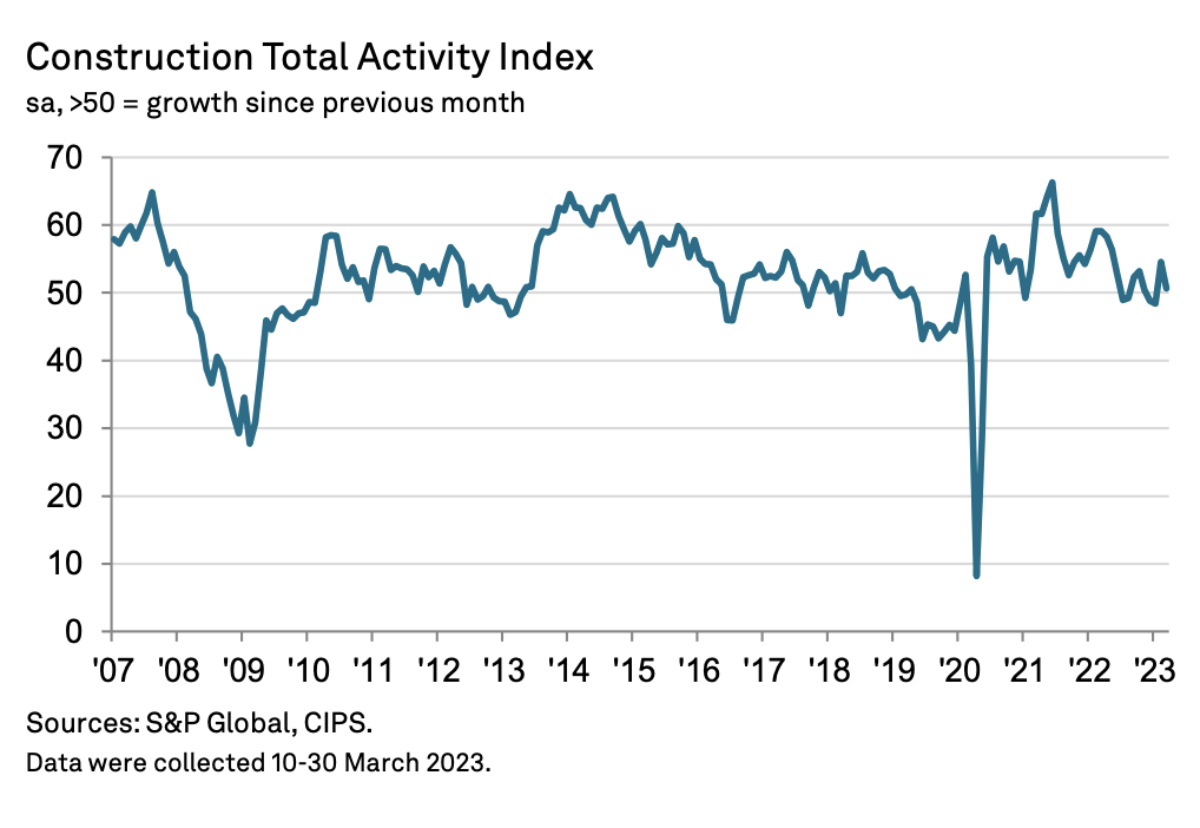

But growth in commercial and civil engineering activity for the second month running kept the headline S&P Global/CIPS UK Construction Purchasing Managers’ Index above the crucial 50 no-change mark.

At 50.7 in March, the headline seasonally adjusted index was down from 54.6 in February, due to housing plunging to 44.2.

Delivery times from suppliers improved at the fastest rate since November 2009 as stocks were unravelled and fewer orders from supply chain managers meant goods got through more quickly.

Builders were also riding high with the highest levels of optimism since February 2022 and there was an uplift in hiring levels to maintain momentum.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “UK construction companies experienced a sustained rebound in output levels during March as work on civil engineering and commercial projects picked up for the second month running.

“Improved tender opportunities were also reflected in an upturn in new orders since February and the strongest rate of job creation for five months.

“A sharp and accelerated decline in house building was the main area of concern in March.

“Cutbacks to new residential projects in the wake of subdued demand and rising interest rates contributed to the sharpest fall in housing activity across the construction sector for almost three years.

“Despite worries about the near-term outlook for housing activity, expectations for total construction output during the year ahead were relatively upbeat in March.

He said that growth projections were boosted by the fastest improvement in suppliers’ delivery times for more than a decade.

Survey respondents often cited improved availability of construction inputs and subsequent hopes that purchasing price inflation would moderate in the months ahead.

.gif)