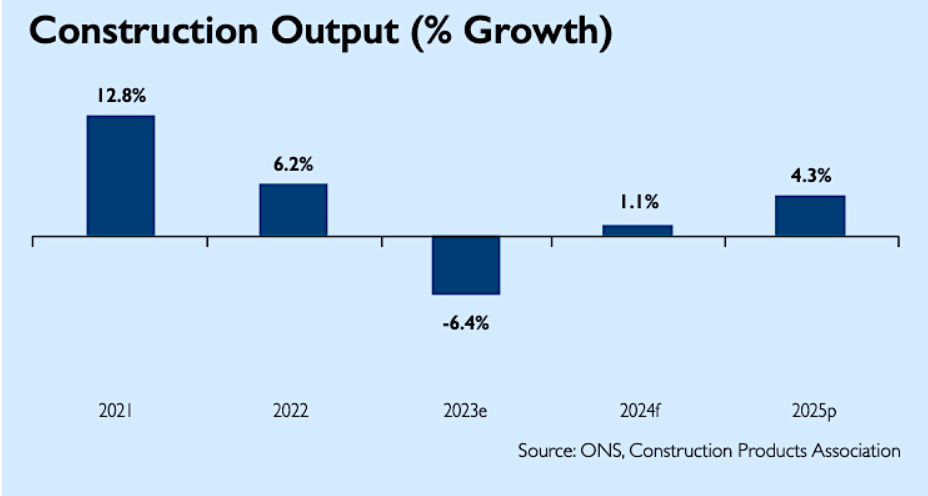

Falling private new housing combined with recent government delays to major infrastructure projects has prompted the spring forecast downgrade from a previously forecast 4.7% fall in output.

Private housing new build, and private housing rm&i account for around 40% of total construction output and are forecast to be the sectors most impacted by falling household incomes and higher interest rates.

On top of that infrastructure output has been downgraded from the Winter Forecasts after the government delaying HS2 work at Euston station and work on major road schemes.

In 2024, a wider recovery in economic growth is predicted to boost demand for both new build housing and rm&i activity returning construction to growth, rising by 1.1%.

Key points of Spring forecast

• Construction output falls by 6.4% in 2023 before growth of 1.1% in 2024

• Private housing output falls by 17% in 2023 and rises by 4% in 2024

• Private housing repair, maintenance and improvement to fall by 9% in 2023 before growth of 2% in 2024

• Infrastructure output to increase 0.7% in 2023 and 1.2% in 2024

• Industrial output to rise by 1.1% in 2023 before falling by 14.8% in 2024

The forecast assumes a pickup beginning in the traditional Spring selling season with mortgage interest rates settling at current levels.

A gradual improvement in housing demand will need to be maintained throughout the Summer and beyond to shore up house builder confidence to start new developments and drive the recovery in building activity in 2024.

In infrastructure, forecast growth rates have been downgraded in the Spring forecasts to 0.7% for 2023 and 1.2% for 2024, from 2.4% and 2.5% respectively in Winter.

In the space of six months, the UK government has gone from announcing it would bring forward 138 infrastructure projects to start by the end of this year to cancelling this and delaying HS2 Phase 2a and Euston station, the Lower Thames Crossing and other roads projects by two years in an attempt to reduce government spending near-term.

HS2 Phase 2a is beyond the scope of the forecasts and previous forecasts had factored in delays and cost overruns on current phases, but the pause of work at Euston, for which preparatory work had begun, will adversely affect activity during the forecast period.

CPA Head of Construction Research Rebecca Larkin said: “Despite the improvement in the outlook for the UK economy compared to six months ago, the headwinds of falling real incomes and interest rate rises remain.

“For construction, the most acute effects of this will be felt in the two largest sectors of activity and those that are most exposed to a slowdown in discretionary household spending: private housing and private housing rm&i.

“The sharp falls that are forecast for housing in 2023 mean that overall, a construction recession will be unavoidable.”

She added: “However, it is important to emphasise that the starting point is a record-high level of activity and the 6.4% contraction expected is smaller than during the construction recessions of 2008/09, 2012 and 2020.

“In previous years, infrastructure activity has helped cushion falls elsewhere, but recent government announcements delaying HS2 work at Euston station and on major roads schemes including the Lower Thames Crossing have weakened the near-term growth prospects for the third-largest sector of construction.

“Unlike the relatively fast bounce back that is expected in housing in 2024, the prospect of delays leading to even greater cost overruns on large infrastructure projects poses a risk to longer-term activity.

“This shines a light on the government’s decision to keep capital spending budgets unchanged in cash terms from 2024/25.”

MPU 300_250px.gif)