The 49% slump in first quarter year on year private home registrations indicates how heavily house builders hit the brakes as sales dried up at the end of last year.

The rental and affordable sector performed better seeing only an 11% drop in the same period.

There is evidence that some developments, initially earmarked for private sale have been block sold to housing associations and other providers indicating a shift towards affordability.

Overall total new home starts were down 40% in the first quarter compared to the same period last year.

But latest monthly figures for March, also indicate early signs of a potential return of confidence, with 11,928 new home registrations in March compared to 8,005 in January and 7,740 in February.

NHBC chief executive Steve Wood said: “Emerging from the economic shocks of 2022 and getting to grips with a demanding regulatory environment, the data indicates house builders are taking stock, planning their output carefully and matching it to expected demand.”

The data also reveals that the number of detached houses being built has halved to 8,041 in Q1 2023 (16,089 in Q1 2022), with terraced homes and apartments representing a larger part of the market than the same period last year.

Wood said this suggests that some builders are focusing on the affordable end of the market.

He added: “Emerging from the pandemic we saw record numbers of registrations for detached homes but now with pressures on family finances it is no surprise that the present focus has shifted towards affordable homes in both the private and rental sectors.”

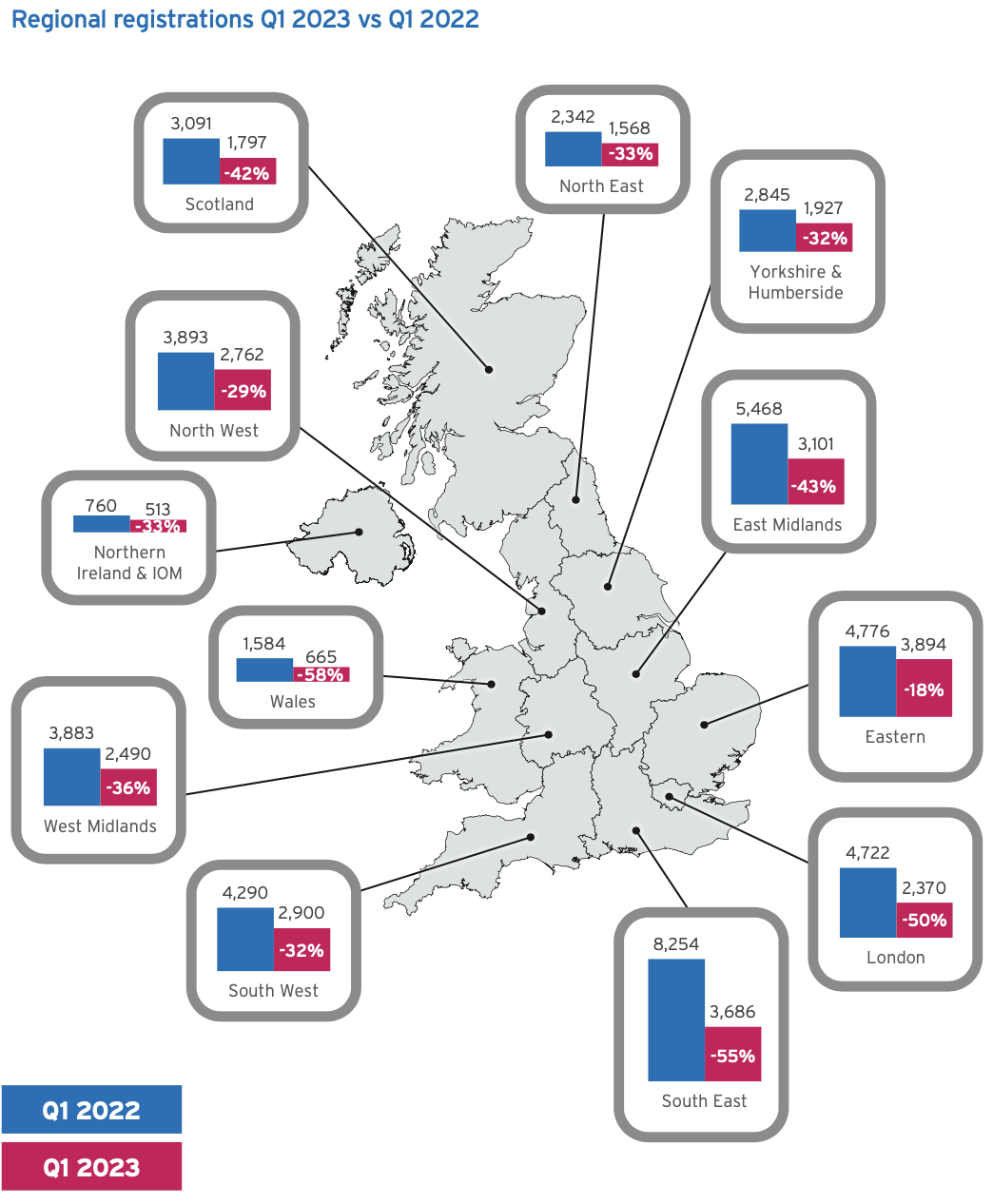

The devolved nations saw some of the most significant falls in the quarter, as did the South East and London.

Wales saw a 58% fall in registrations and Scotland a 42% fall, while in London and the South East volumes declined by 50% and 55% respectively, compared to the same period in 2022.

.gif)