The department is piloting a “seasonal model” which will direct self-assessment queries from the helpline to its digital services, including online guidance, digital assistant and webchat.

The helpline closed on June 12 and is not due to reopen until September 4.

The move has seen frustrated self-employed tradespeople contact specialist Hudson Contract to voice their concerns.

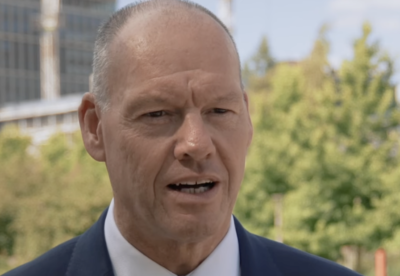

Managing director Ian Anfield said: “We know from experience the helpline is by far the easiest way for subbies to quickly resolve any issues with their self-assessment, especially if they are paying higher than necessary tax deductions under CIS.

“It is simply not practical for tradespeople to get online, register for digital services and then look out for HMRC messages when they are busy working on building sites.

“We would urge HMRC to reopen the helpline.

“Some self-employed people use refunds from their tax returns to fund holidays, newly registered people are faced with a registration deadline in early October and the last date for paper submissions falls at the end of October.

“The helpline being closed now will impact all of these groups and HMRC will struggle with the backlog when it reopens in September.”

An HMRC spokesperson said: “We continually review our services to see how they can best serve the public and we are taking steps to improve them. The changes we’re making to the SA and VAT registration helplines will make more of our expert advisers available where they are most needed.

“Our online services, including the HMRC app and digital assistant, are quick and easy to use and have been significantly improved. I urge customers to explore these fully before deciding to wait to speak to us on the phone.”

(300 x 250 px) (2).png)