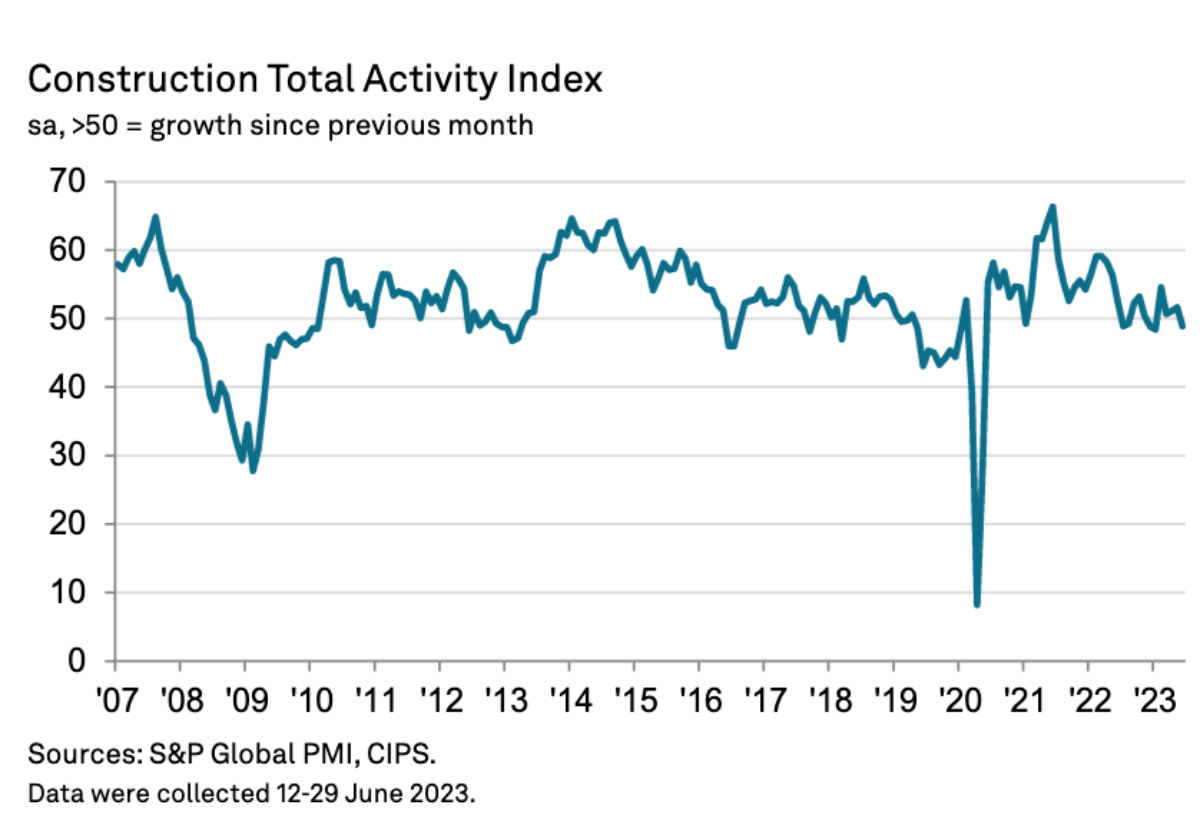

The bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index recorded 48.9 in June, down from 51.6 in May and below the neutral 50.0 threshold for the first time in five months.

The index was dragged down by a steep decline in residential work.

Housing work (index at 39.6) decreased at the steepest pace since May 2020. Aside from the lockdown-related fall in house building, the rate of contraction was the fastest since April 2009.

Survey respondents widely commented on weaker demand due to rising borrowing costs and a subdued outlook for the housing market.

Civil engineering was the best-performing segment (index at 53.1), with business activity rising at the second-fastest pace since June 2022 while commercial building also expanded at a solid pace in June (index at 53.0), although the rate of growth slipped to a three-month low.

June data also signalled a marginal decline in overall input prices across the construction sector – the first outright reduction in average cost burdens since January 2010.

Construction companies cited lower fuel, steel and timber prices, alongside more competitive market conditions in response to falling demand as subcontractor charges increased at the slowest pace for 31 months.

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The construction sector became rooted in contraction territory in June as interest rate rises and squeezed affordability rates impacted on residential building output which fell to its greatest extent since 2009 outside the pandemic years.

“Fewer houses being built meant the sector was dragged down overall because civil engineering and commercial building projects remained relatively buoyant with stronger pipelines of work.

“Delivery times for building materials were also the most improved since 2009. Input price inflation fell blow the no-change mark, meaning raw materials became less expensive and were more widely available for construction companies.

“Looking ahead, there were few reasons to be cheerful as optimism fell to its lowest since January. A large blot on the landscape was the fall in employment growth. With interest rates at the highest for 15 years and inflation four times over the Bank of England target, the sudden reduction in construction sector hiring is one of the red flags facing the UK economy at the moment.”

(300 x 250 px).jpg)

.gif)